Market Overview

The bears appear to be starting the new week in control. This comes as several key fundamental events, such as the latest Fed meeting and the Scottish vote on independence approach in the next few days, whilst the cracks are beginning to appear in the ceasefire in eastern Ukraine. There is just a sense that safer haven assets are beginning to edge back into favour, with the Japanese yen hinting at some support and gold also off its lows in early trading. Furthermore, the disappointing close on Wall Street on Friday has filtered through to today’s trading in Asia which also shows weakness across the board. The sentiment was not helped as Chinese industrial output missed expectations and fell to the lowest level since 2008. The weakness has meant that European trading has begun the day under pressure.

Forex trading also reflects a sign of more concern in the markets. Although the dollar is showing strength today across many of the major currencies, the fact that it is weaker again the yen (and also gold) suggests that risk sentiment is not especially strong today. The only major piece of data that will be released today is the US Industrial Production which is announced at 14:15BST. The expectation is for 0.3% for the month of August, whilst the capacity utilization (which the Federal Reserve keeps an eye on) is expected to improve very slightly to 79.3 (previously 79.2).

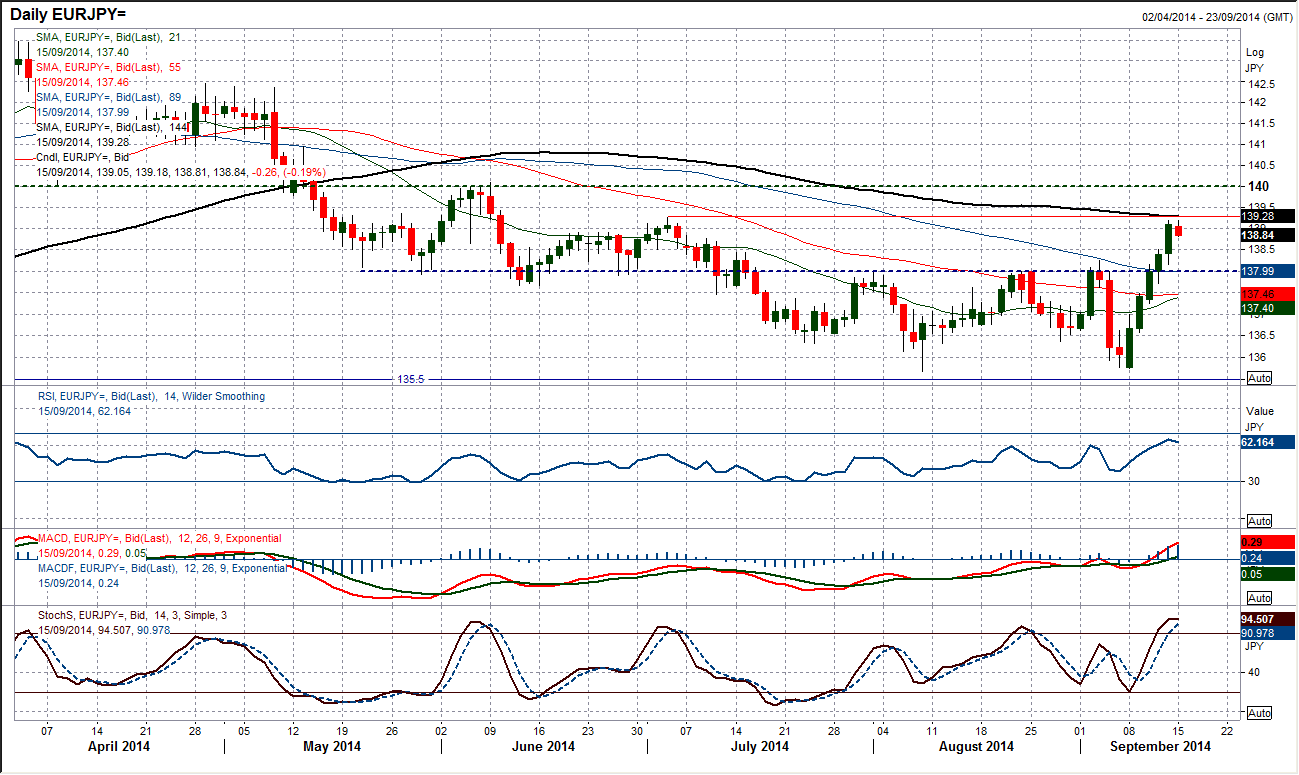

Chart of the Day – EUR/JPY

After 5 strong days of gains, the prospect of a correction is growing. However it could just be a near term move that gives another chance to buy. The sustained move above 138.00 has been key as this has been the resistance for almost two months. This now means that Euro/Yen is in a transition phase and it is a test of credentials of the bulls. If there can be a new basis of support formed above 138.00 then the outlook will have suggested a sustained improvement and that the newly positive configuration on the momentum indicators is not just blip. The intraday hourly chart shows support around 138.50 too. If the bulls can regain control and push above the key July reaction high at 139.27 then it would re-open the upside towards 140.00 which is the major medium term resistance.

EUR/USD

The euro bulls are fighting to engage the recovery as Friday’s price action continued the intraday sequence of higher lows and pushed towards the key near term resistance t $1.2986. If there can be a consistent move above $1.2986 and the psychological $1.3000 then there is very little resistance until the old support (turned new resistance) just above $1.3100. The daily momentum indicators are showing signs of life, but the RSI is still below 30 and the MACD line are yet to crossover. However, the Stochastics are showing signs of improvement, but in such a bearish medium term trend this is more the signal of a profit-trigger on short positions than an outright buy signal. However if the positive signals begin to mount up then perhaps there would be more conviction in a recovery. For now the next signal would be a breach of $1.2986. The intraday support levels come in at $1.2910 and $1.2880.

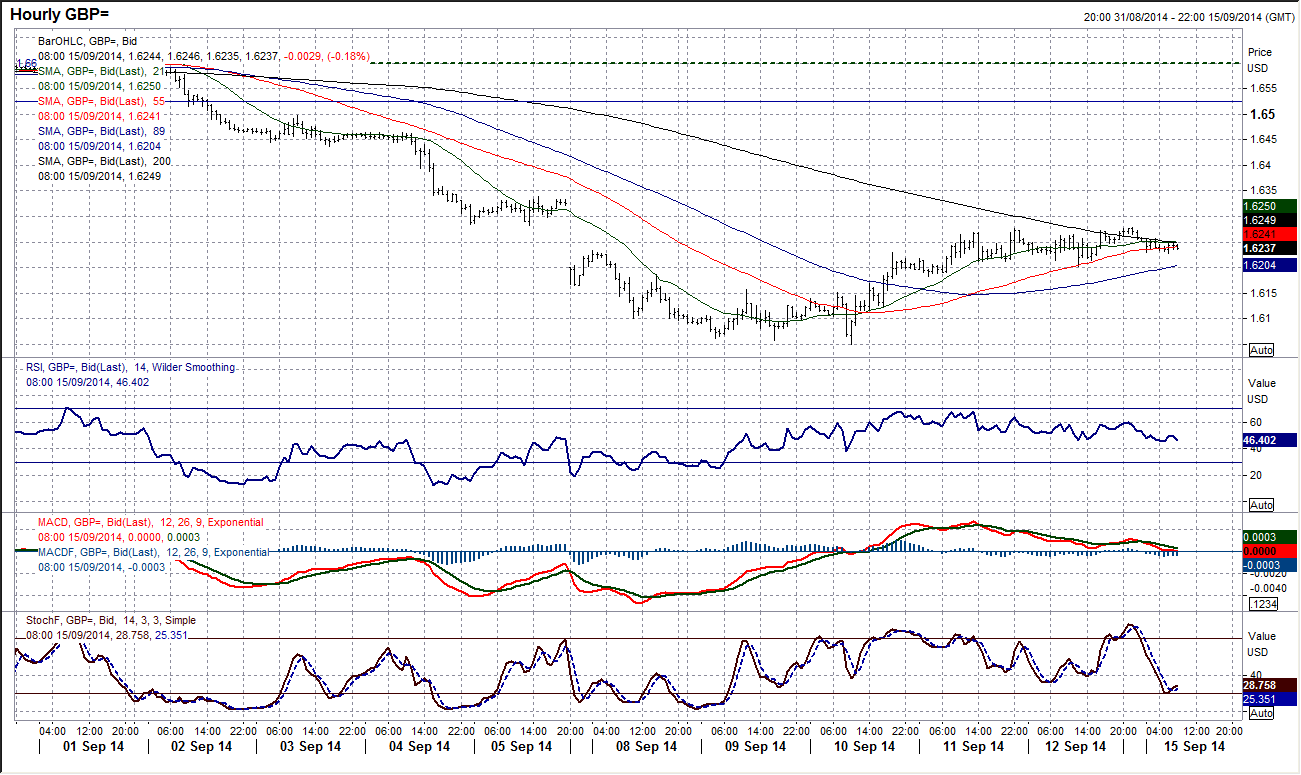

GBP/USD

The recovery bulls will be concerned that for three days now, the gap down from last week at $1.6282 remains unfilled (albeit now by just a few pips). Also the roll that the 38.2% Fibonacci retracement of last week’s sell-off $1.6644/$1.6050 has played at $1.6278.The overnight Asian session has shown Cable in slight retreat once more as the potential recovery is stalling. The momentum indicators are showing little sign of a rebound with any substance yet and unless this gap is filled soon the nerves may get the better of the bulls and the selling pressure may once again tell. The support at $1.6180 is key near term, but a failure of $1.6200 would also suggest that the downside impetus was growing once more. If the gap can be filled, the resistance comes in at $1.6350.

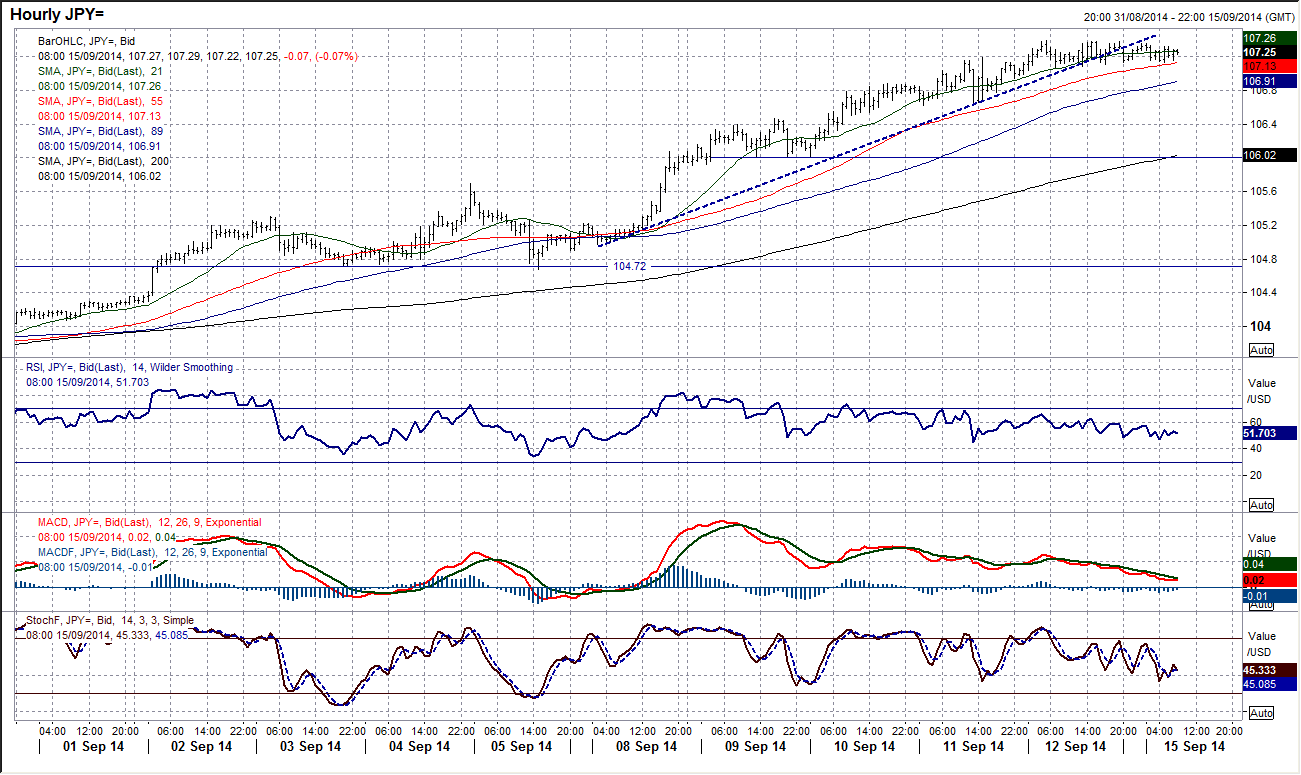

USD/JPY

The daily chart suggests that the uptrend remains strong as Dollar/Yen powers ever higher into multi-year high territory. There are though just a few signs on the intraday chart that the bulls are not as strong as they have been. The intraday hourly chart shows the uptrend formed over the past week has been breach following consolidation overnight. There also needs to be a move above 107.40 to continue a sequence of 11 consecutive sessions of higher daily highs. On the flip-side of this is that there has also not be a lower daily low in over a week, so watch out for support at 106.94. Dollar/Yen has seen consolidation previously in this bull run and it will be interesting to see the outcome of the latest pause for breath. The daily momentum indicators remain strong but look slightly stretched. If there is a correction, the support band 106.50 and down to 106.00 is ready to hold up the selling pressure. I would still view any corrections as a chance to buy again.

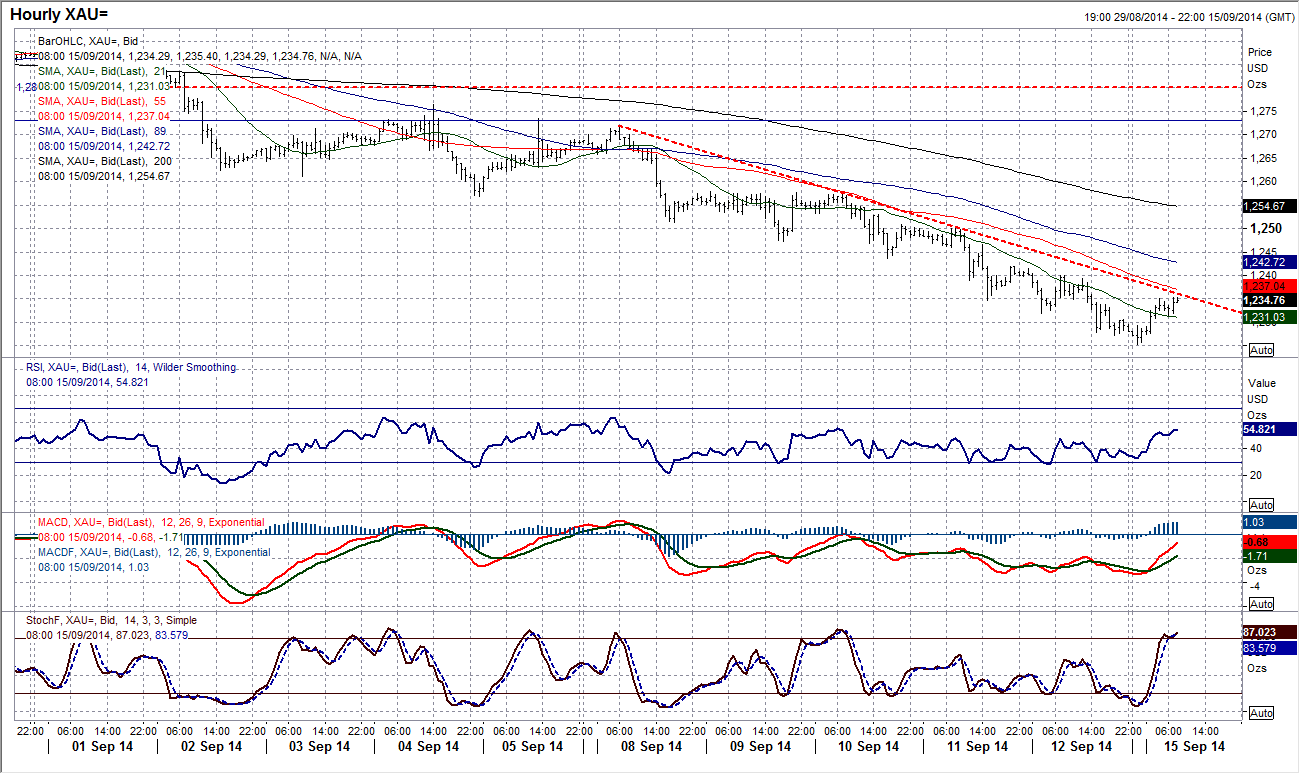

Gold

The overnight rebound viewed on the daily chart would suggest perhaps the first signs of a recovery. However, when shown intraday, it just looks as though the bounce is just another part of this bear trend that has given intraday opportunities throughout to sell once more. The one big difference this time around is that the RSI is in oversold territory on the daily chart, which is below 30. Perhaps a more cautious approach should be given therefore this time to selling. I would still be in a bearish mind-set on gold, however I am more cautious than I have been for a few days and suggest watching the intraday chart. A move above $1240 resistance would be a move above a lower high, something not seen on gold for several weeks. The daily chart would suggest that the old support of the downtrend channel, currently at $1248, is now a basis of resistance.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.