Market Overview

Labor Day in the US is often seen as the final throws of the summer break and after it is over, it is back to business. Or so traders must be hoping, after another pitiful day of volume in financial markets with little steer. In the absence of US traders, there was very little to shout about yesterday. However, Asian markets made gains overnight, with the Nikkei 225 around 1.5% higher amid selling pressure on the yen which is now at its lowest level since January. After a mixed day yesterday, European markets are showing slight gains today.

In forex trading, the greenback once more rules the roost as the US dollar makes strong gains against the major pairs. Notable moves have come against sterling, the yen and the Aussie dollar after the RBA maintained its rates at 2.5% overnight.

There are a few second tier economic releases this morning, with UK construction PMI at 09:30BST (61.5 exp) although after yesterday’s disappointing manufacturing PMI for the UK, the risk must surely be to the downside. Furthermore there is the Eurozone Producer Prices Index at 10:00BST which is expected to fall from 0.8% to 1.1% on the year-on-year figure. However, undoubtedly the main focus for the day will be the US ISM Manufacturing PMI which is released at 15:00BST. A reading of 57.0 is forecast (down from 57.1 last month) and after the European economies showed signs of deterioration yesterday, any figure that shows a stabilization would certainly be cheered today.

Chart of the Day – EUR/GBP

The prospects of a euro rally have now all but been all but scuppered as sterling strength has dragged EUR/GBP back below the neckline support at 0.7980 and now broken the reaction low at £0.7920. The concern is that the moving averages and momentum indicators are now back into their bearish configuration and that rallies now look to be an opportunity to sell. The last two weeks have seen a stepped decline which has left resistance now between £0.7920/60. The set up on the intraday momentum indicators suggest that a recent consolidation is likely to once more fall over and result in further weakness that should result in a retest of the July low at £0.7866. It would need a move above the old neckline again at £0.7980 to suggest the bulls are fighting back now.

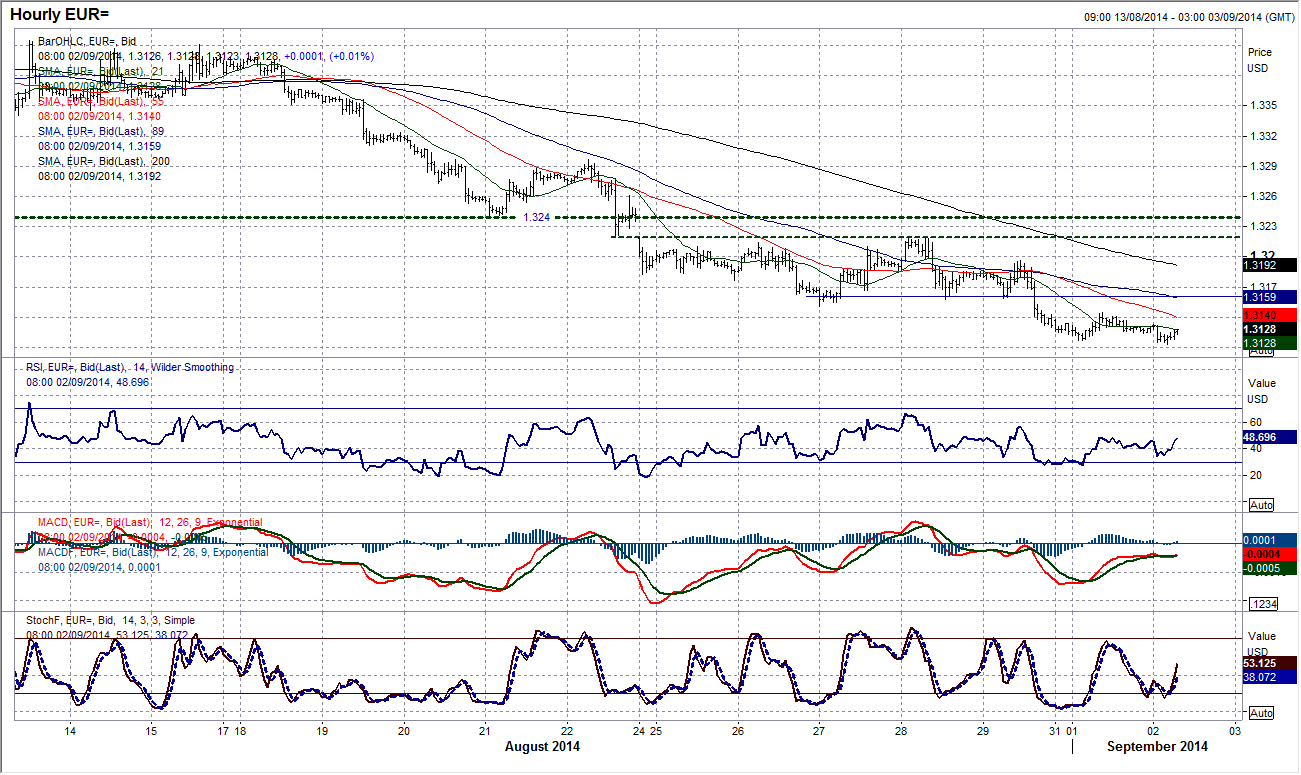

EUR/USD

In light of it being Labor Day yesterday in the US it was a predictably quiet day for the euro. However, with a full trading complement back in force today, the Euro/Dollar pair could see increased volatility. The outlook though remains extremely weak for the euro and it is difficult to see a viable strategy in anything other than continuing to use intraday rebounds as a chance to sell. Intraday rebounds tend to be anything up to 30 to 40 pips before the selling pressure resumes. The nagging feeling though is that with the recovery set up seen on Cable, there may be technical rally looming. However, if one does materialise then there is little sign of it on the technicals. The old support at $1.3150 has become the new resistance, with a band of supply then up towards $1.3200, with the real near term resistance in at $1.3220. The set up on the intraday chart simply suggests selling into strength remains the best option.

GBP/USD

The sterling bulls have got to fight hard for this rally and at the moment it could be slipping through their fingers. Having spent 8 sessions challenging the resistance at $1.6600, yesterday was almost a classic upside break and then pullback to find support at the breakout level. However this support subsided overnight and now if there is a break below $1.6560 today then the recovery pattern will have been aborted. So all is not lost yet, but it is a disappointing response. Cable has now mustered 4 straight days of gains, something that has not been seen since late June. Furthermore the daily momentum indicators are beginning to improve. A move back above $1.6600 today would help to improve the outlook again, amid a base pattern that implies $1.6675.

USD/JPY

What a move again we are seeing from Dollar/Yen. Having formed the support at 103.50, the consolidation has now ended with a burst through the resistance at 104.43 and having formed a bull flag pattern the rate is now testing the 2014 highs around 105.00. The implied target from the bull flag suggests that there will now be a test of the 105.44 multi-year high that was posted in December. Momentum indicators are strong with the RSI showing an incredibly bullish set up. The intraday hourly chart is a little overbought, but the strength of the move suggests the bulls are backing the move. Immediate support now comes at the breakout of 104.43.

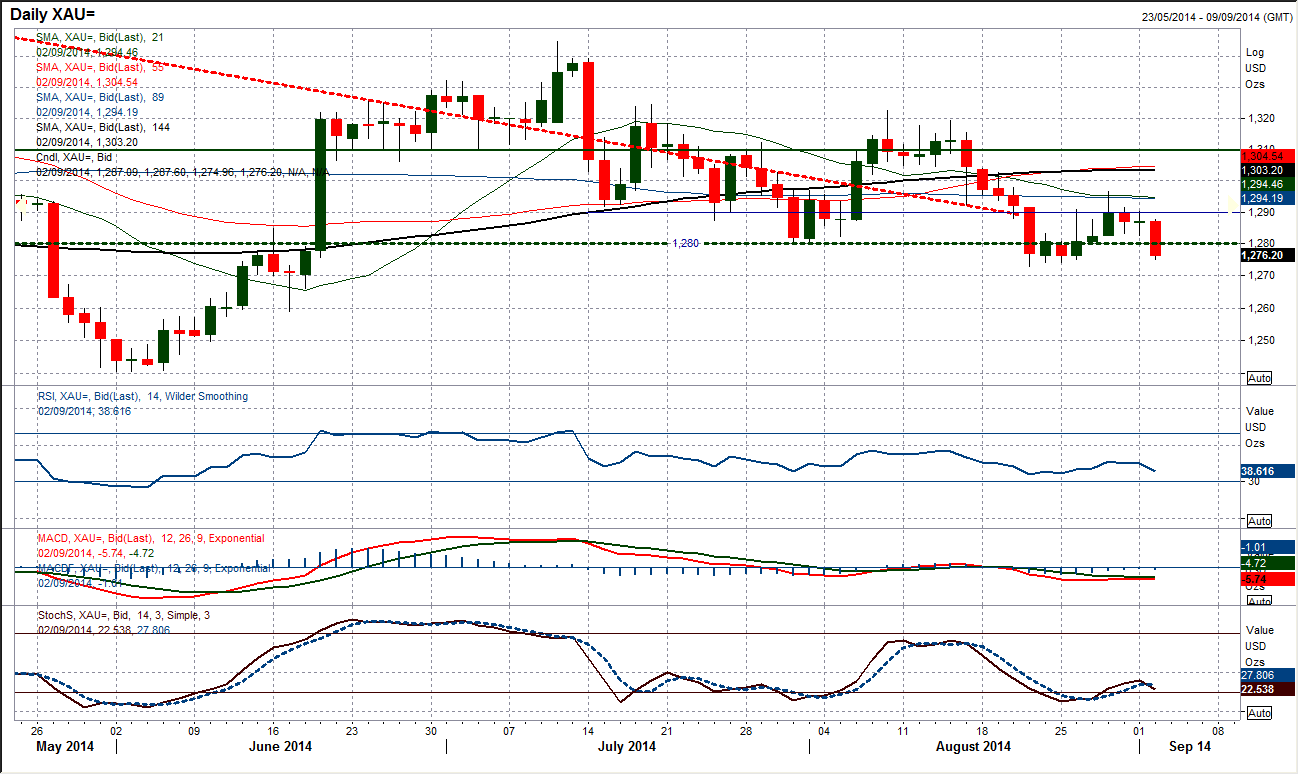

Gold

I have been looking for another lower high on gold to come maybe between $1300/$1305, however the way in which the price is now beginning to drift away once more, the high may have already been left at $1296.50. The last few days have formed a negative set-up on the candlesticks, which remain under all the moving averages and the momentum indicators are in negative configuration. It looks as though, once more, the technicals are dragging the price back towards a test of the recent low at $1273, below which opens $1258.85 again. It is likely that the sequence of lower highs and lower lows will continue and there will be further downside in due course. The caveat is still a geopolitical flare up in Ukraine, but for now the outlook remains negative on gold and rallies are seen as a chance to sell.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.