Market Overview

The geopolitical tensions continue to calm down in eastern Ukraine as it appears as though Russian President Putin and Ukraine’s Poroshenko are set to meet next week. This potential improvement in relations is helping to improve the sentiment for investors. Wall Street continues to be the main beneficiary of this, with the S&P 500 adding a further 0.5% but the NASDAQ is now up at 14 year highs once again. However after a strong run, Asian markets took a bit of a breather overnight and closed broadly flat. European markets are also flat to slightly lower as investors move into wait and see mode ahead of the key minutes from the Bank of England and the Federal Reserve today.

The strength of the dollar has been remarkable in the last couple of days of forex trading as the dollar bulls have used a period of consolidation to renew their appetite for gains. Once more today we are seeing dollar strength across all the major currencies, with strength against the yen and the Kiwi dollar most prominent.

Traders will be now looking towards the release of the meeting minutes of both the Bank of England and the Federal Reserve. The BoE minutes are released at 09:30BST and they will be very interesting as they could contain the first breaking of ranks in the consensus which has seen a 9-0 vote to keep rates flat since mid-2011. The last voice to dissent was Martin Weale and it is expected that if anyone makes a move, it could be him. However the bank’s inflation report recently sounded rather dovish and the sterling bulls could again be disappointed. The Fed minutes are released at 19:00BST and are also likely to remain fairly dovish, however any hawkish leanings once again could give the dollar further strength late in the day.

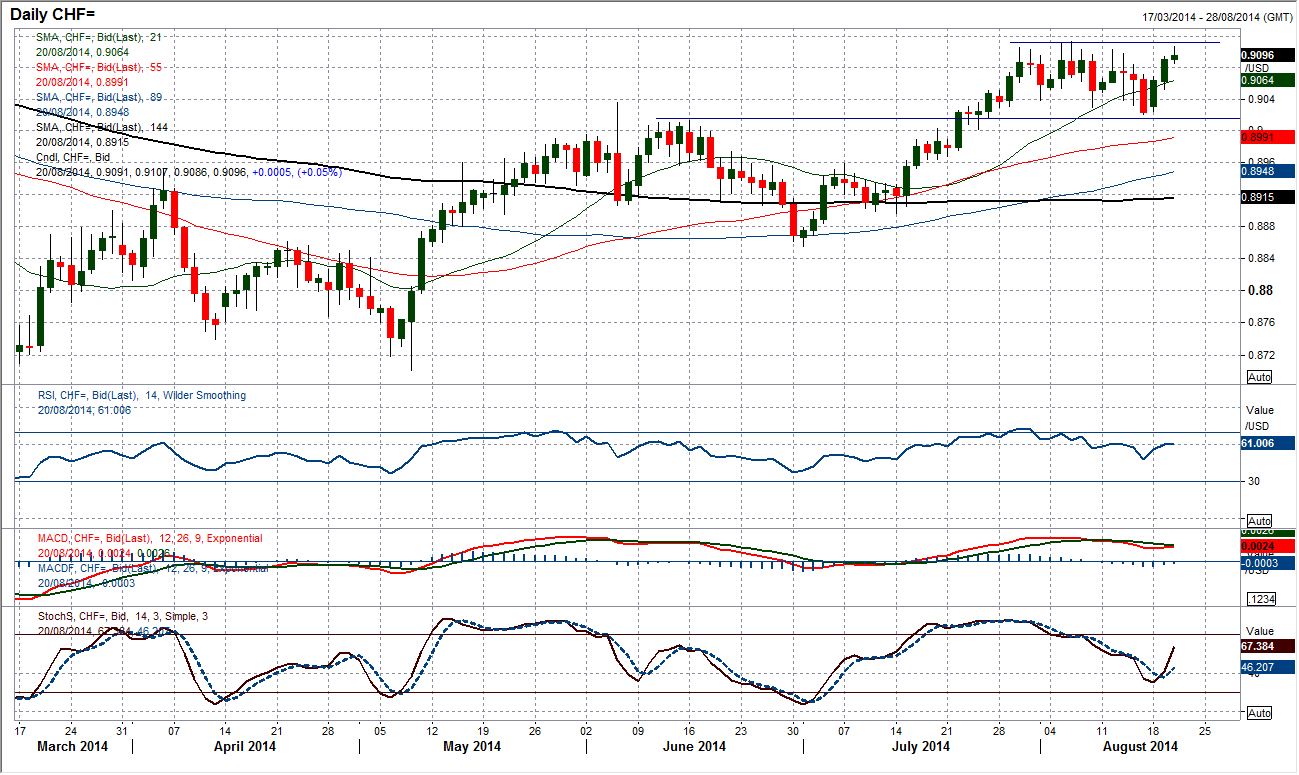

Chart of the Day – USD/CHF

The Swissy has been following the Euro for a while and with the breakdown yesterday on the Euro, it looks like there could be a breakout on USD/CHF. The pair has been trading in a range below 0.9114 for over three weeks, but the pressure is mounting on the resistance (suggesting dollar strength). A successful breakout would take the pair to a multi-month high and open an immediate test of the January high at 0.9156 above which lies the key November high at 0.9250. The momentum indicators are strong for further upside, with the RSI recently having unwound to neutral and having renewed upside potential. The intraday chart shows that there is support around 0.9090 and then 0.9060, whilst hourly moving averages and momentum indicators are all in positive configuration. The strength of the daily candlesticks in the past two days suggest an appetite for gains is increasing. Today could be the day for another upside breakout.

EUR/USD

Finally there has been a break of the consolidation. However the break has come against the indication of the improving euro momentum, and has been seen to the downside. The breach of $1.3330 has seen the key November low at $1.3295 almost immediately come under pressure as the dollar strength continues today. The support after the breakdown is fairly weak though, with a minor low from September at $1.3253 and then little until $1.3100. The only slight niggling doubt is that the move has come on incredibly light volume, however the selling pressure has at least been decisive. The old support at $1.3330 now becomes new near term resistance, with the intraday chart showing a band of resisatnce now between $1.3330/$1.3350. The bullish divergences on the daily chart have not yet been aborted which will give the bulls some hope, but for now the downside pressure is firmly back on again.

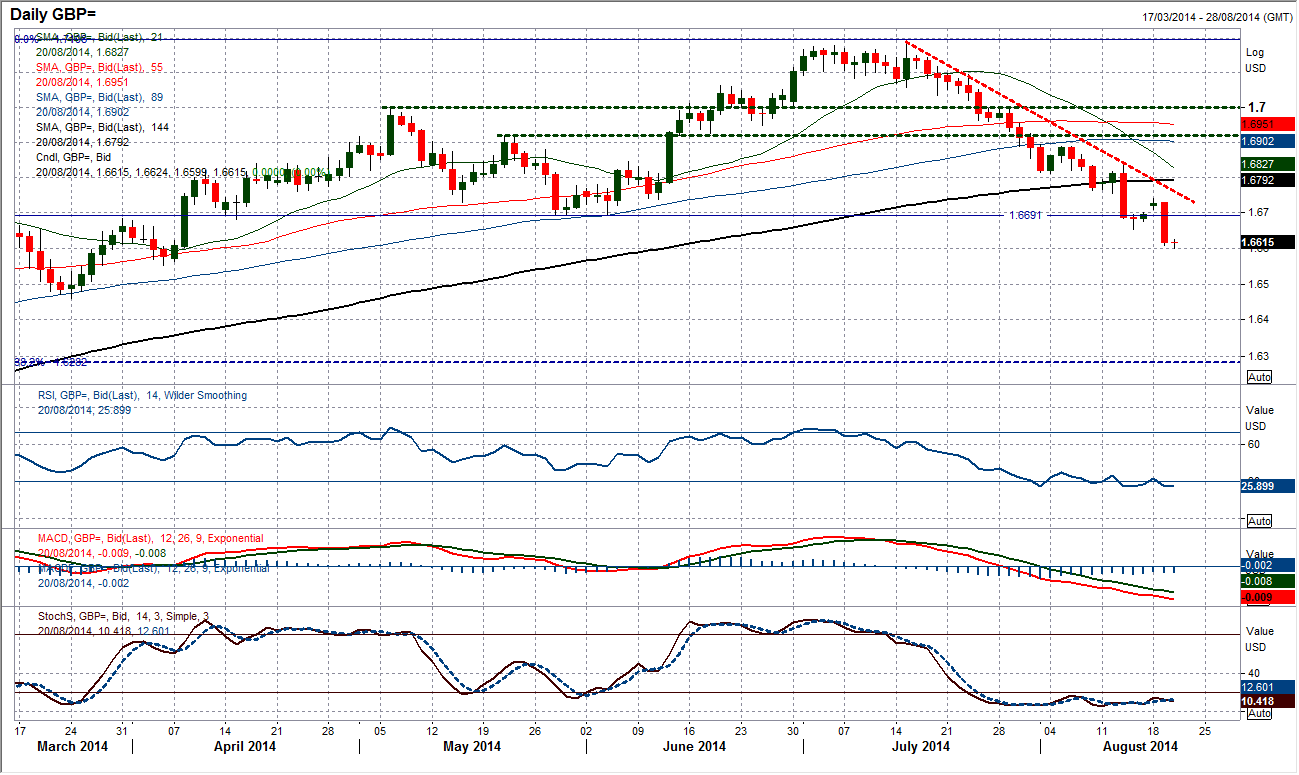

GBP/USD

I spoke yesterday about the continued downside pressure and that rallies were still simply being seen as a chance to sell. Another huge downside day for sterling has just reaffirmed this view. The weakness of the momentum indicators is a big concern now for sterling bulls. The RSI is consistently fluctuating around 30 which is indicative of a strong bear trend, whilst MACD and Stochastics are equally as negative. The next support that should come under threat is the April low at $1.6552 but it is the key March reaction low which is the real test at $1.6459. Once more, it would be best to possibly wait for a bounce to open new short positions, with the initial resistance at $1.6654. Volatility could be quite high today with the meeting minutes from both the Bank of England and the Fed, but any possible jump should be seen as a chance to sell.

USD/JPY

In the context of the recent price action that has been fairly solid gains for the dollar, the sharp acceleration in the push higher has been remarkable over the past 24 hours. Not only have we seen a close above 102.80 for the first time since 7th April but now that has been followed with an upside break early in the Asian session to a new 4 month intraday high too. This is the bulls really having a go at a breakout now. The momentum indicators are positive and if there can be a close above 103.00 today then that would confirm the positive intent. The RSI is now over 70 which may hold back immediate upside potential, however there seems to have been a change in attitude of the bulls recently. Could this finally be the end of this four month range? There is now support around 103.00 and 102.70.

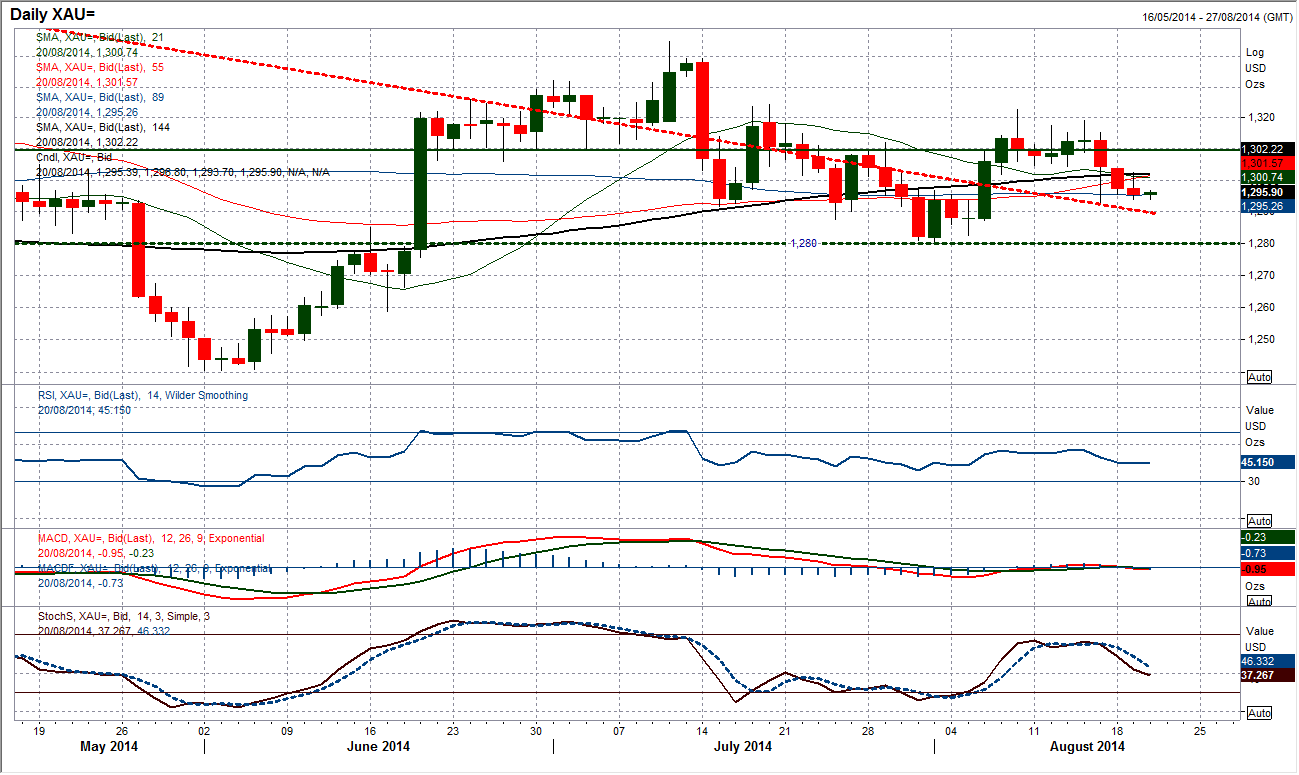

Gold

The drift lower seen in the gold price has continued as the slight corrective bias remains in play. The gold price is now struggling to push back above $1300 which is a sign that a move back towards the key support at $1280 is increasingly likely now. To all intents and purposes the moving averages are completely flat and the momentum indicators are neutral, so there is little that can decisively be obtained from them. The downside pressure is on because of the break below $1305 which gives an implied target of $1290. The intraday chart shows that since the volatility of the breakdown, there has been a stepped decline that has formed, whilst intraday momentum points to selling into strength. A move back above $1305 would now abate the selling pressure towards the key support at $1280.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.