Market Overview

Investor sentiment remains restrained by events in Ukraine where there is a lack of clarity over the reasons behind Russia sending in humanitarian aid into Ukraine. The Ukrainian government also appears to be unsure over how to treat the aid, which all makes for uncertain markets. With a lack of driving factors, such as limited US corporate announcements and a summer lull in volume are also resulting in rather subdued markets. Wall Street had one of its quietest days in weeks which resulted in minor losses. The Asian markets were mixed after the release of Q2 Japanese GDP which showed an annualised -6.7% decline as the economy reacted to the imposition of a hike in the sales tax from 5% to 8%. The impact was damped due to the fact that this beat the estimate of a 7.1% decline. European markets are taking all this on board today and are also trading mixed to slightly weaker.

The cautious seen in equity markets is also occurring today in forex trading, as the major pairs have shown very little appetite for any direction. The notable exceptions have been with Cable which is just showing some strength ahead of a big day for sterling, and also the slight bout of strength in the Aussie dollar which has been bolstered by an improvement in business confidence.

Sterling traders will be focused on UK unemployment at 09:30BST where a further decline in the headline rate to 6.4% is expected. However more importantly will be the Bank of England’s Quarterly Inflation Report. Governor Mark Carney will set out the Bank’s renewed targets on inflation and growth. Any serious upgrades to forecasts will have traders speculating on an earlier than expected rate rise which would strengthen sterling. Into the afternoon, US Retail Sales are expected to show a 0.2% climb in July on the announcement at 13:30BST.

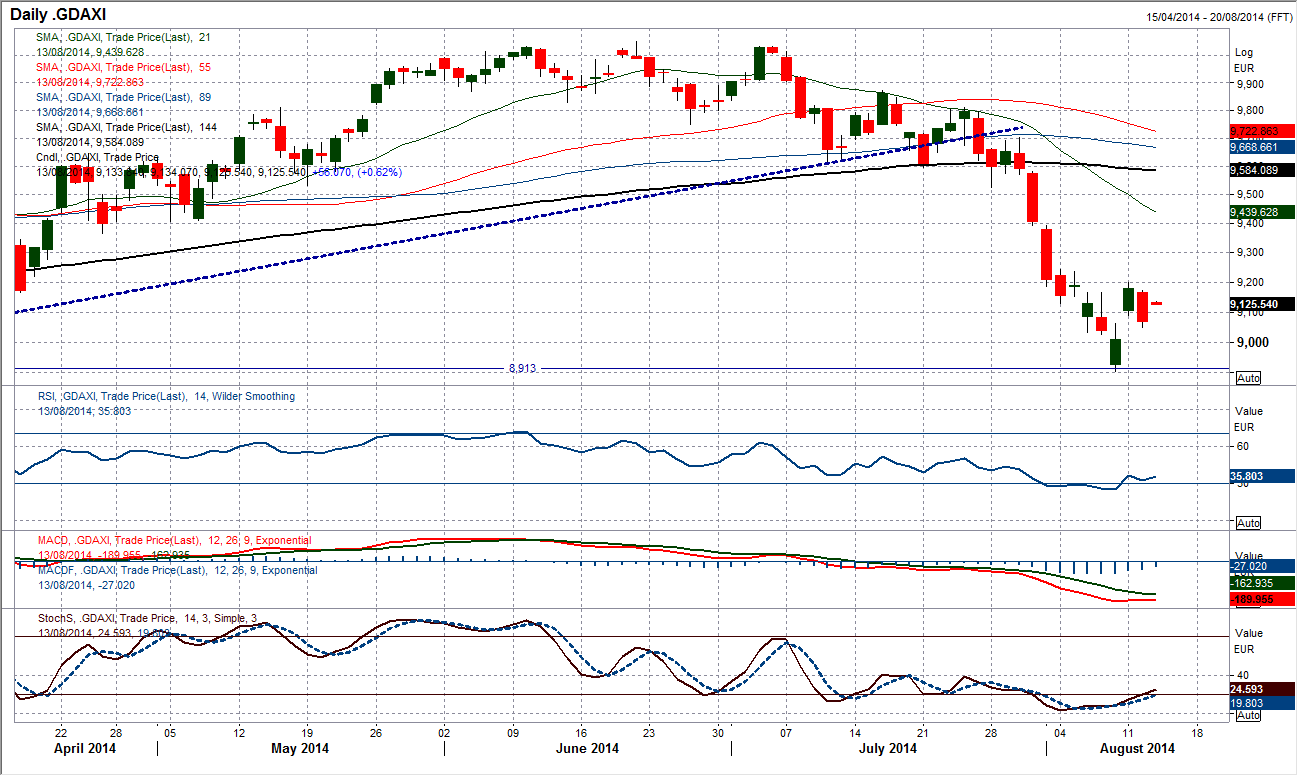

Chart of the Day – DAX Xetra

The DAX remains under severe pressure. A day where the German index fell well over 1% whilst the FTSE 100 was flat is evidence that investors are fearful. However there is one positive to come out of yesterday’s session. The gap higher at 9061, that was created following Monday’s sharp move higher has now been filled and not closed. Filling a gap can often be seen as a positive, whilst the correction of yesterday was not as great as the bounce higher from Monday, so there is still a net gain on the week (albeit very early still). The support on Friday came in around the key March low at 8913 and momentum indicators are in a stretched configuration. There could still be a retest of the key March low once more, but despite yesterday’s selling pressure, not all is as bad as it might seem.

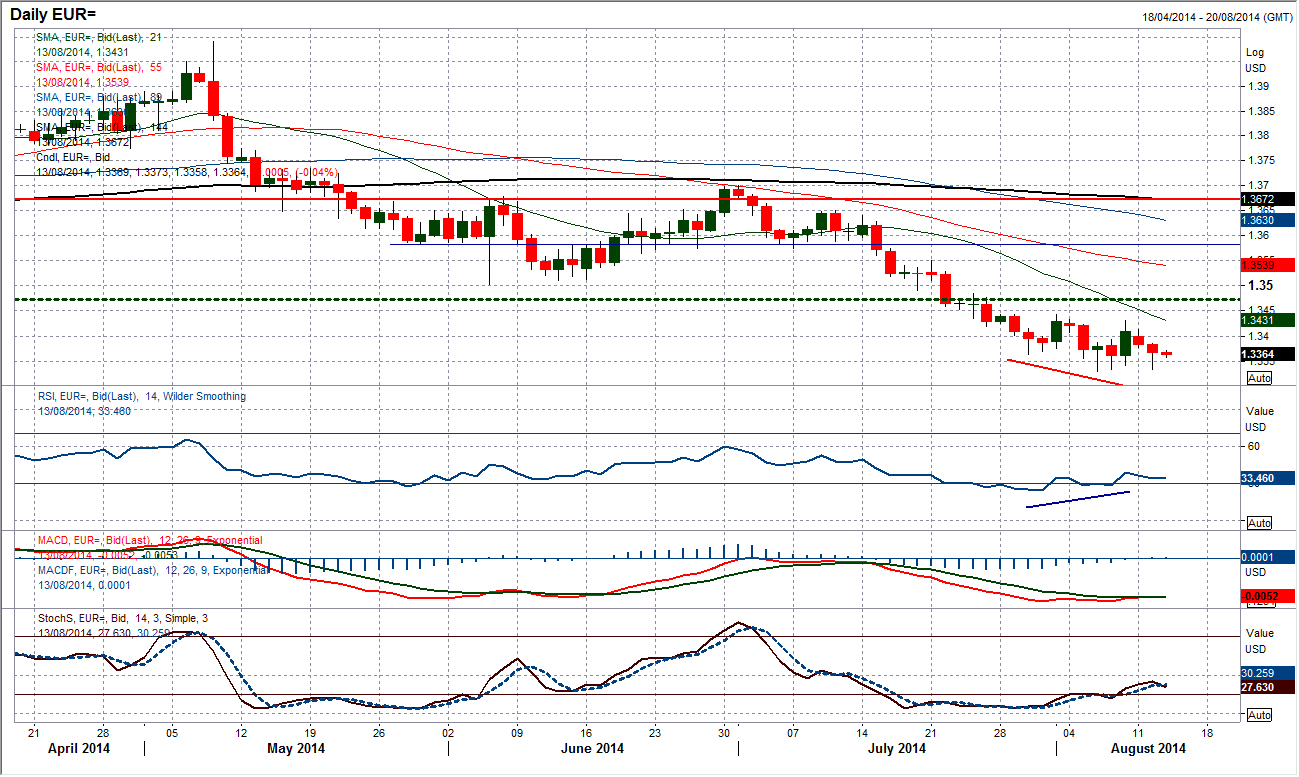

EUR/USD

The euro remains weighed down as the potential for a recovery begin to fade. Despite yesterday’s weakness, all is not yet lost though as the momentum indicators (RSI and Stochastics) retain their bullish divergences. Also the low that was posted last week at $1.3331 remains intact. I am still of the opinion that a technical rally will come through on the euro in due course and that the current configuration of the momentum indicators are testament to that. However it could be a slow building rally. We are not seeing any significant selling pressure on the euro as we have seen in recent weeks and this current consolidation above the key November low at $1.3295 and latterly above $1.3331 is part of that. The phrase “the trend is your friend” is always a nagging doubt in situations such as these, but I still think there is something in the prospects of a rally. The two key overhead resistance levels are at $1.3400 and $1.3445.

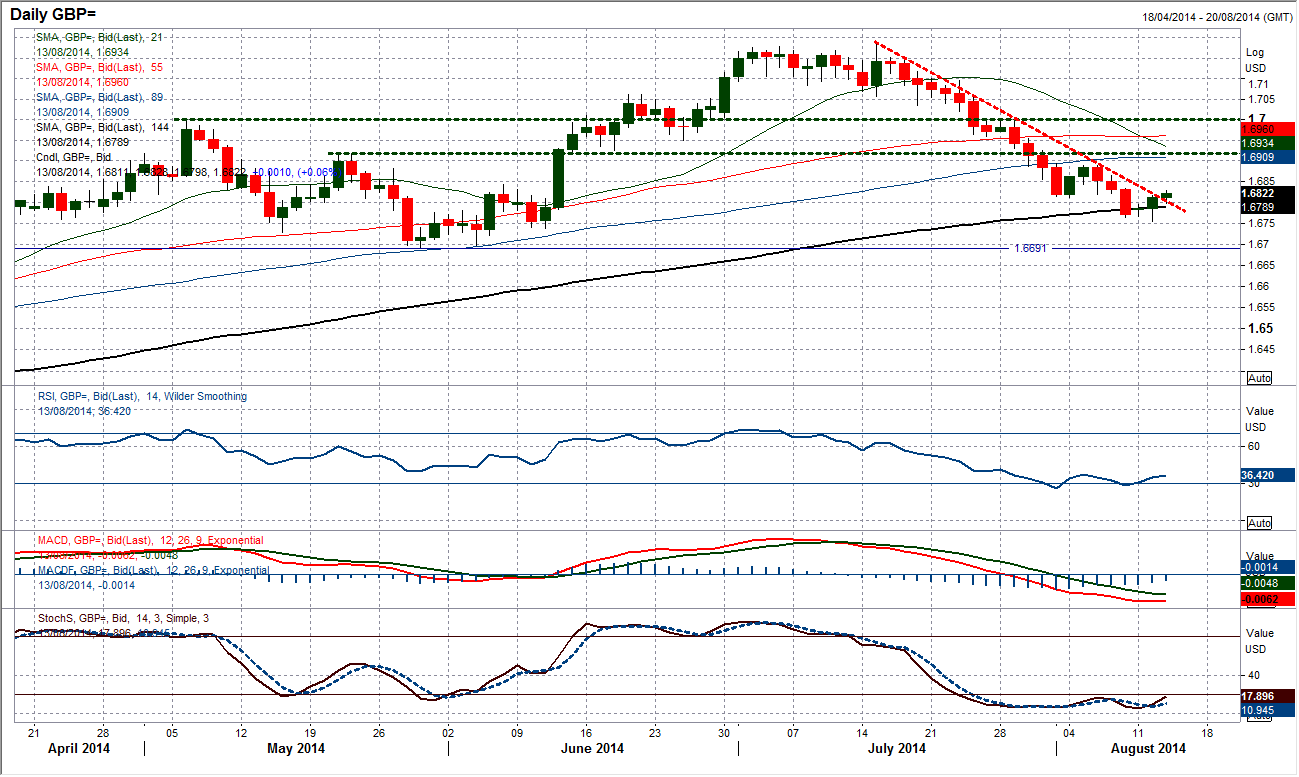

GBP/USD

After yesterday’s strong reaction to the upside which left a near term key low at $1.6754, Cable is now seriously challenging the resistance of the 4 week downtrend. Could this be the beginning of the consolidation phase that I see Cable moving into? With the long term bulls having lost control I see a choppy period of trading, and coming above the support around $1.6700, breaking the downtrend around now would fit in with this outlook. Not only did we see a “doji” candle (signalling indecision within the prevailing trend), a bullish key one day reversal yesterday adds to the argument that the support is ready to return. There would need to be a move above $1.6790 for any serious prospects of a bullish move, but the outlook is improving now. The downtrend currently comes in around $1.6800. The intraday hourly chart is also beginning to improve but shows that there needs to be a move above resistance at $1.6815 which would then open the next band of resistance at $1.6860.

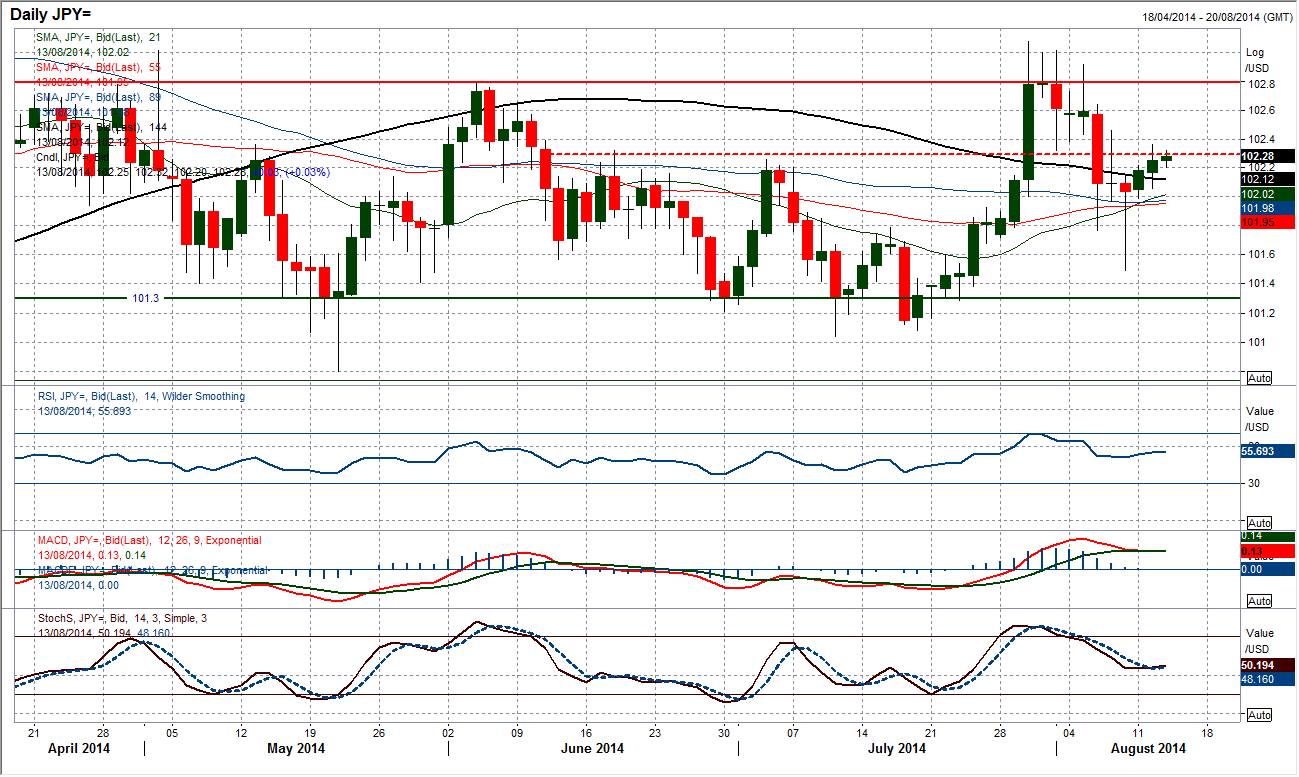

USD/JPY

The slow drift of dollar strength continues to drag Dollar/Yen higher. The volatile trading days of recent weeks now seems to have passed (at least for now) which has tended to result in a slow bout of dollar strength. There is an immediate test of 102.30 now underway and if this can be overcome then there will be a move higher towards the 1.2.80/103.00 resistance. There is a very slight positive bias on the momentum indicators but nothing too significant. Trading above the moving averages which have just all converged to turn positive in bullish sequence also adds to a tendency for a positive outlook now. The intraday hourly chart shows the near term importance of the 102.30 resistance area. There is support at 102.00 which needs to now hold for the positive outlook within the range to continue.

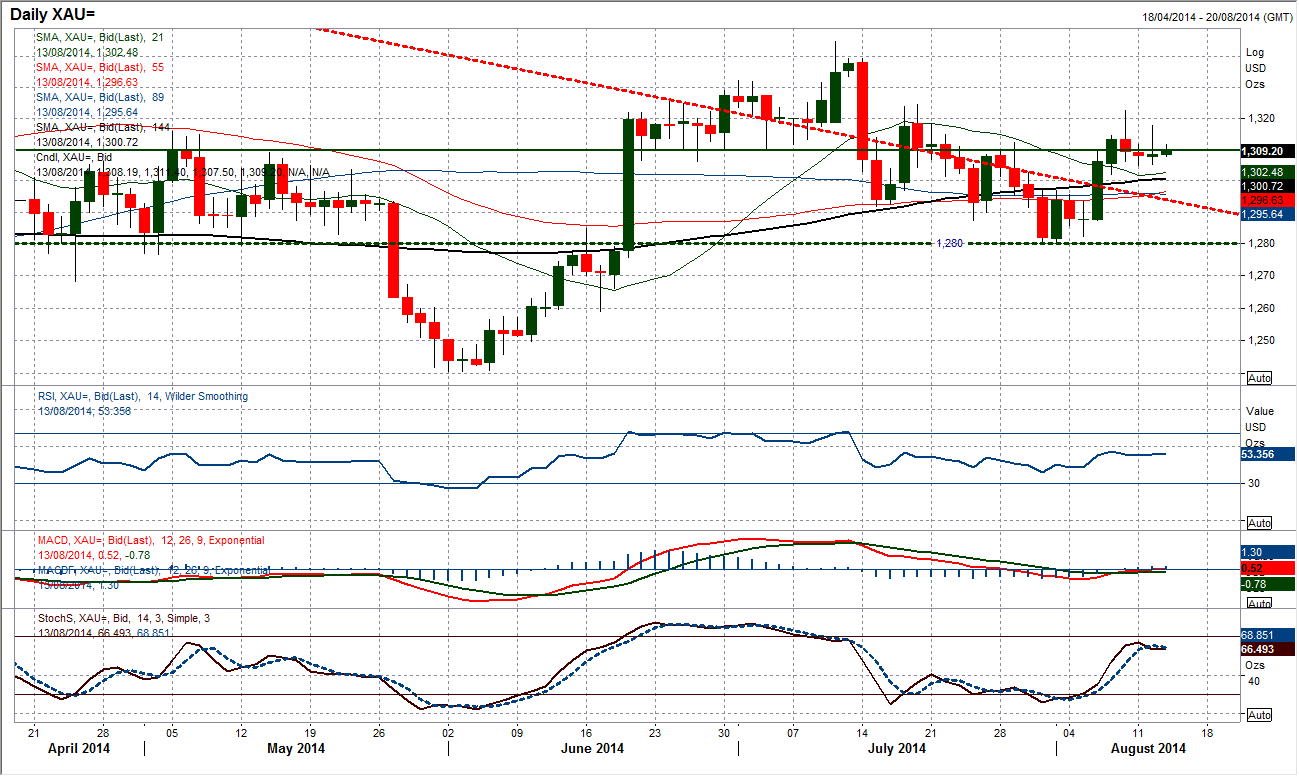

Gold

Yesterday’s price action could almost be used to sum up the outlook over the past few weeks. An attempted push higher which was then retraced to find a level back around where it had been previously trading. There is a slightly positive bias on gold with the price trading above the moving averages and above the $1300 psychological support, with the key $1280 support also intact. However the bulls are struggling to gain control. There needs to be a break and close above resistance at $1324.44 which was a key reaction high within the previous bearish drift in July. Until this is seen the gold price will retain a very messy outlook. There is still a near term support which comes in around $1305.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.