Market Overview

With a weekend to have considered the ramifications to investor appetite for risk following the awful events that continue to play out in eastern Ukraine, and the escalating conflict in Gaza, investors are starting the week on a fairly solid footing. After Wall Street closed with positive gains on Friday, Asian markets have been mixed, although the Japanese equities were closed due to public holiday. European markets are trading slightly higher in early exchanges.

The is a slight movement away from the US dollar in early forex trading as the euro continues to rebound following on from the selling pressure seen late last week. Aside from a few corporate earnings in the US there is very little for traders to focus on today other than geopolitical events. There are no major economic announcements scheduled so talk of further economic sanctions on Russia may be a driving force today.

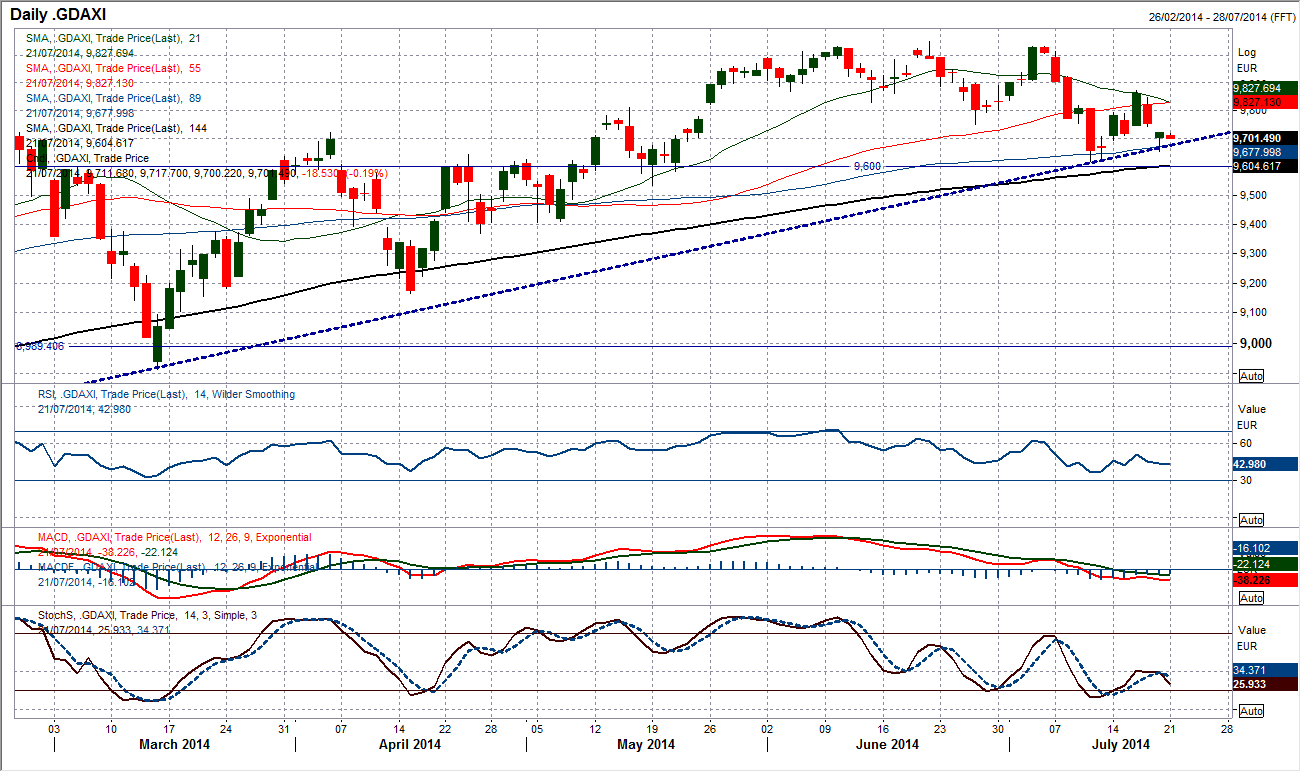

Chart of the Day – DAX Xetra

The primary uptrend on the DAX has now been tested for a second time in just over a week. This could be seen as a warning signal, however, as yet the trend remains strong and supportive currently around 9675. Friday’s trading saw a gap lower at the open which as yet remains unfilled at 9744, and with momentum indicators now fully unwound this all could be just the next longer term buying opportunity. The MACD lines tend to unwind back to turn higher from just below the neutral point for the next leg higher, and although there is no sign of a buy signal yet, they are now sufficiently unwound. Since April, the DAX has looked at the support around 9600 to provide the basis of where the buyers have tended to return too. The first hurdle the bulls need to negotiate is a close above the gap resistance at 9744 which would signal its closure and then open the resistance at 9872.

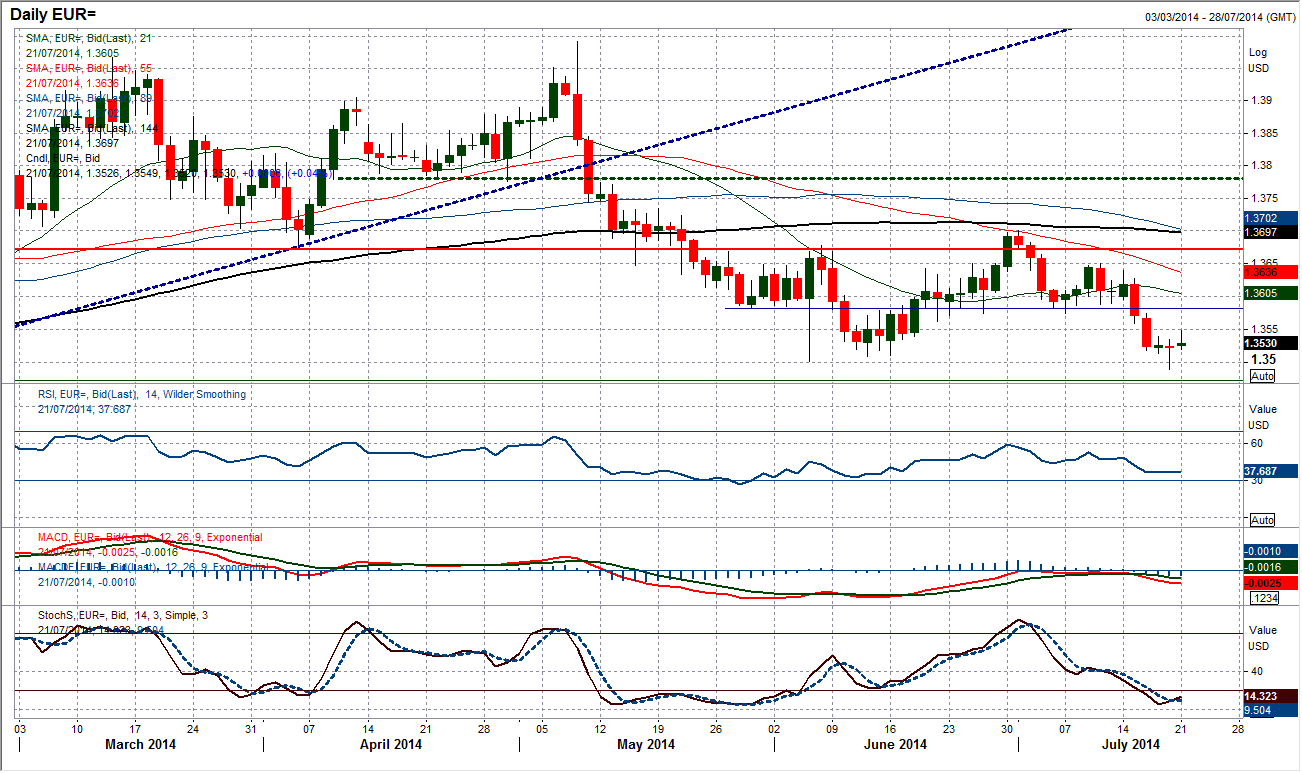

EUR/USD

Friday saw some interesting price action on the euro as a breach of the support around $1.3500 subsequently found some buying to support at $1.3490. The formation of a long-legged (to the downside) doji pattern is a potential reversal sign and the reaction early today has been positive. This may now mean a period of a potential rebound to the upside. The overhead resistance in the band $1.3575/$1.3600 should ensure that this rebound is likely to be short-lived and I expect this to be used as a chance to sell. Momentum indicators have the room to unwind slightly but remain in negative configuration. The moving averages are al falling in bearish sequence with the 55 dma the basis of near to medium term resistance at $1.3636.

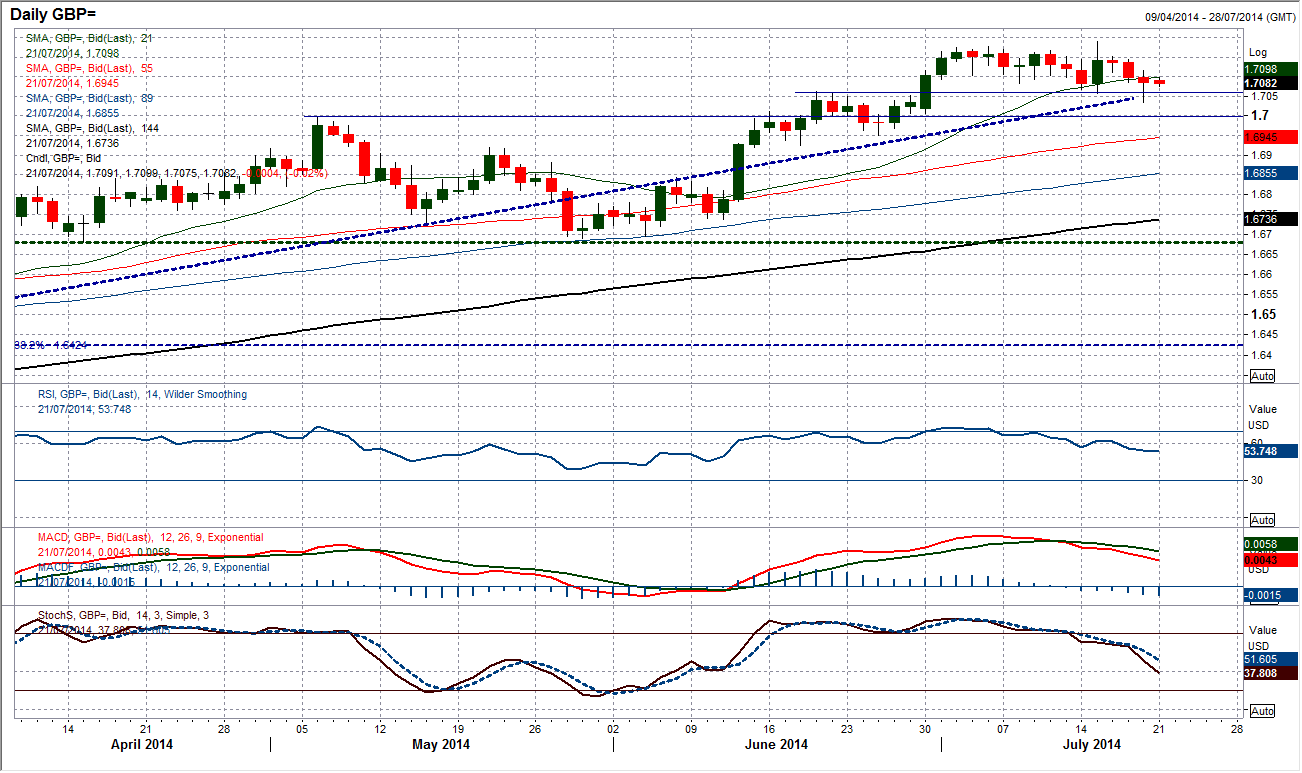

GBP/USD

Cable still has an element of a consolidation drift to it. There is no really strong desire for selling pressure to pull the rate lower, and for now the bulls appear happy to sit back and wait. This continues to allow the technical indicators to unwind without any real damage being done to the longer term outlook. The fact that the RSI is now back into the mid-50s may start to look interesting again from a long perspective, however there is still room for further unwinding still. Friday saw another poke below the $1.7060 support which was quickly seen as a chance to buy again. I think that Cable in the $1.7000/$1.7060 will continue to be seen as a chance to buy. The current outlook would suggest the bulls would only really have cause for disappointment on a breach of $1.6950, but even then the 89 day ma is the longer term basis of support at $1.6855. I still expect this consolidation to be resolved with a breakout above $1.7191 to further multi-year highs.

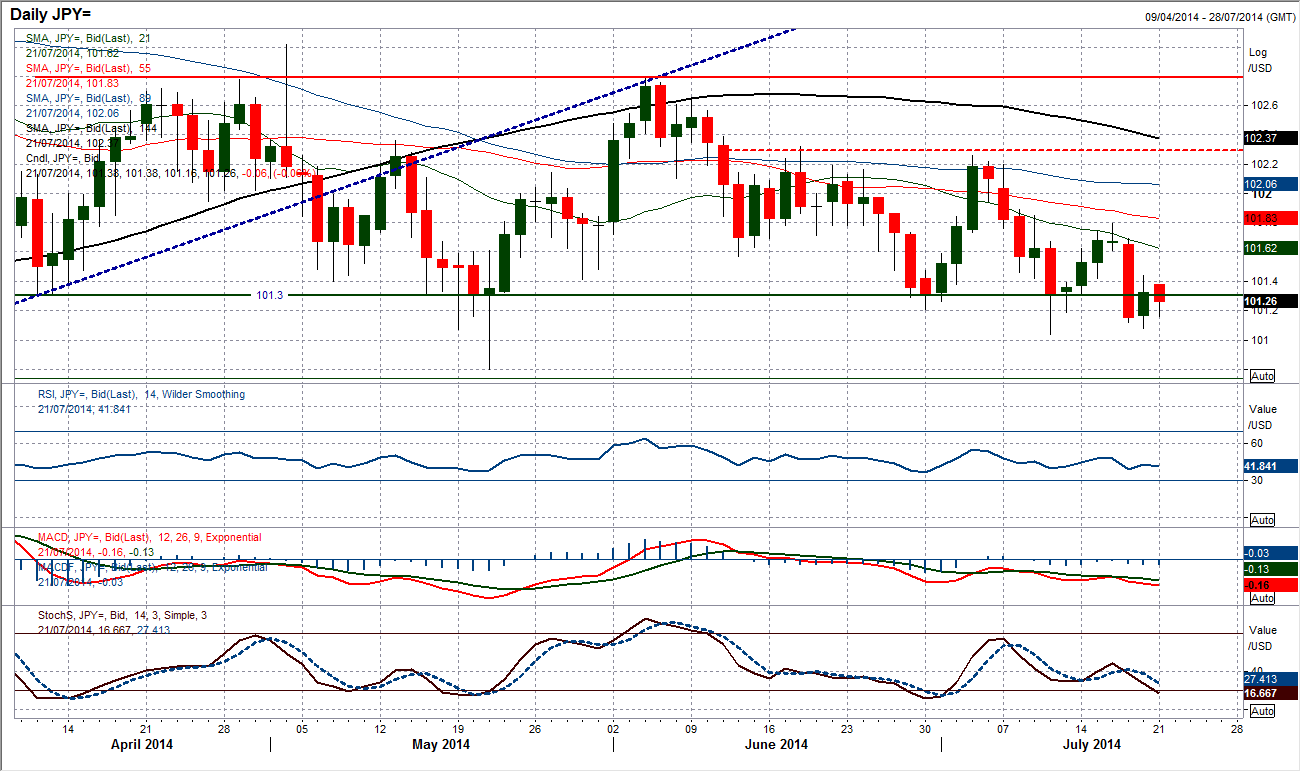

USD/JPY

Only the second close below 101.30 this year serves as further warning that the yen is strengthening on a medium to longer term basis. The immediate outlook for the currency pair that is viewed by some as a gauge for investor sentiment is being influenced by a flight to safety (re. Ukraine and Gaza) but the chart would certainly suggest that a trend is increasingly being formed. The moving averages which had been mixed throughout June are now all falling in bearish sequence, whilst the momentum indicators which had been largely neutral throughout June have also turned negative. This all suggests that rallies will be sold into and downside pressure will continue towards a test of the February low at 100.74. The intraday chart shows a small rally is already running out of steam and has seemingly failed around 101.40. There is also further resistance at 101.60 and more significantly at 101.80.

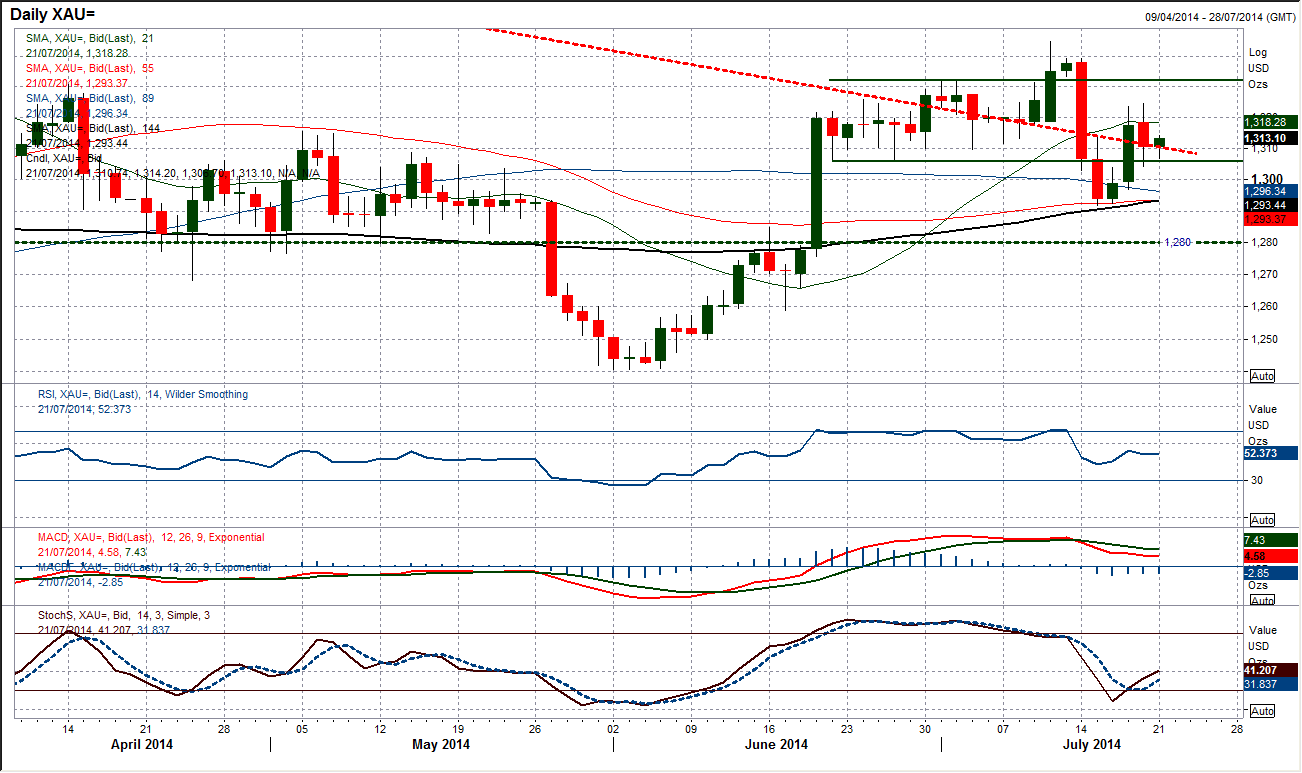

Gold

The past week has been very difficult and choppy trading for gold after a range of macro events have driven the trading. Taking a slight step back though, the support at the 144 day moving average has yet again acted as an excellent gauge (currently 1293.45). The price is once again trading back above $1300 and is beginning to settle down, whilst momentum indicators have also unwound. After such a hectic period of trading it is quite possible that gold may be ready to take a breather for a short while traders re-assess all the conflicting newsflow. Initial resistance comes at Friday’s high of $1324.44 and then $1332; whilst support arrives in the band $11300/$1304 and then the recent key low at $1291.70.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.