Technical Bias: Short-term Bearish

Key Takeaways

US dollar was seen trading lower against a basket of currencies including the Euro, British pound and the Japanese yen.

US dollar index traded below an important support area.

US consumer price index might act as a catalyst for more downside in the near term.

The US dollar index pierced a critical level and opened the doors for downside acceleration. Moving ahead, more losses are possible if sellers remain in control.

Technical Analysis

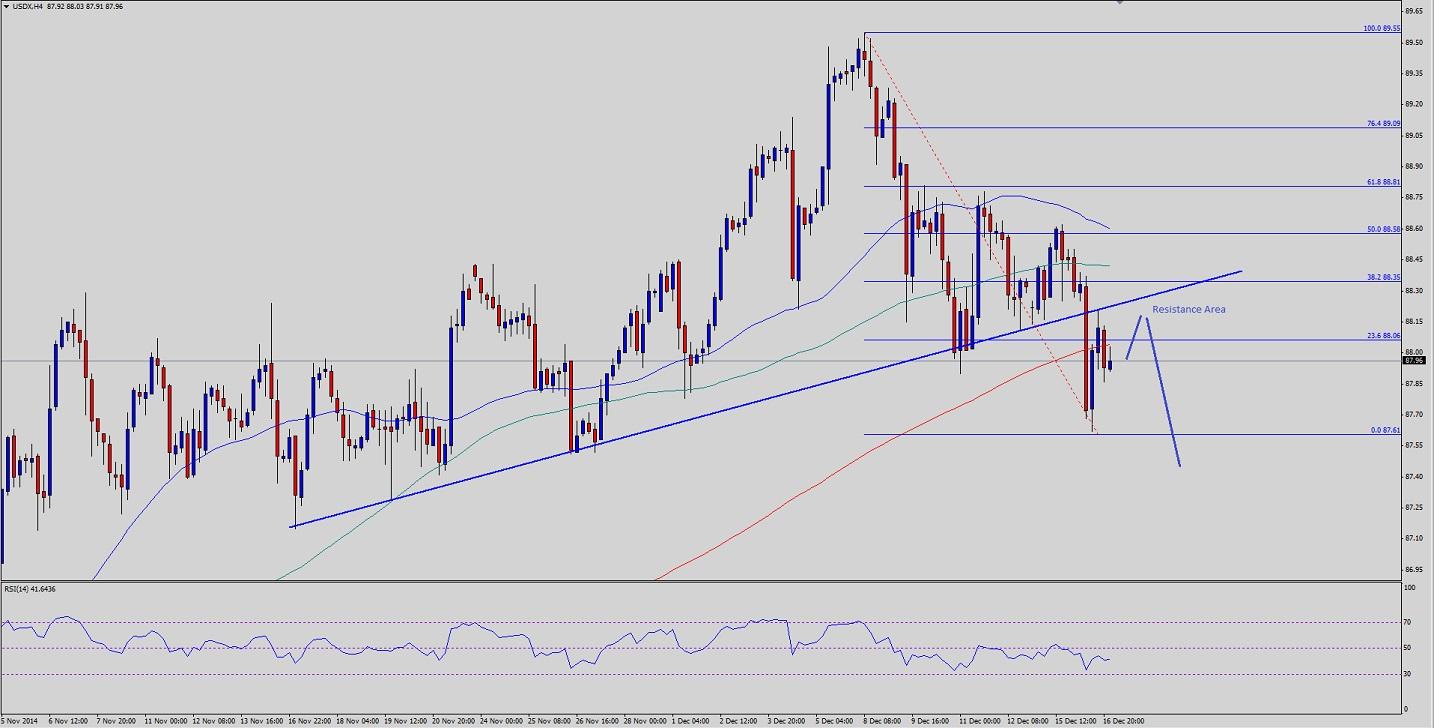

There was a monster bullish trend line formed on the 4 hour chart of the US dollar index, which was broken recently. The US dollar index also closed below the 100 and 50 simple moving average (SMA) – 4H, which is a strong bearish sign. There is a chance that the dollar index might move higher from the current levels to retest the broken trend line, which is now coinciding the 38.2% Fibonacci retracement level of the last leg from the 89.55 high to 87.61 low. The 100 SMA – 4H is also sitting around the highlighted resistance area. So, there is a major hurdle around the 88.30-40 level. If the dollar index climbs from the current or a bit lower levels, then it might find it difficult to break the stated area. The 4H RSI is well below the 50 level, which adds to the view that more downsides are likely moving ahead.

On the downside, the last swing low of 87.61 might act as a support in the short term. A break below the same could take the dollar index towards the 87.20 level.

US Consumer Price Index

Later during the NY session, the US Consumer Price Index will be released by the US Bureau of Labor Statistics. The forecast is slated of a minor decline of 0.1% in November 2014, compared with the preceding month. If the outcome misses the forecast, then the US dollar might come under pressure.

Recommended Content

Editors’ Picks

EUR/USD manages to hold above 200-hour SMA ahead of Eurozone CPI, FOMC

EUR/USD meets with some supply during the Asian session on Tuesday and erodes a part of the previous day's gains amid the emergence of fresh US Dollar buying. Spot prices, however, remain in a familiar range held over the past week or so and currently trade around the 1.0700 round-figure mark.

GBP/USD consolidates its gains above 1.2550, investors await Fed rate decision

GBP/USD consolidates its gains near 1.2560 after flirting with the key 200-day SMA and three-week highs in the 1.2550-1.2560 zone during the early Tuesday. Investors reduce their bets on BoE rate cuts, which support the Cable.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.