Technical Bias: Bearish

Key Takeaways

German IFO business climate index will be released later during the London session, which is expected to decline one more time from 104.7 to 104.3.

Euro likely to face a tough resistance around the 1.2750 level.

Upside limited as the Euro sellers are still active.

Euro showed some signs of reversal at the start of the week, but it remains at risk of more losses as the market sentiment is still bearish.

Technical Analysis

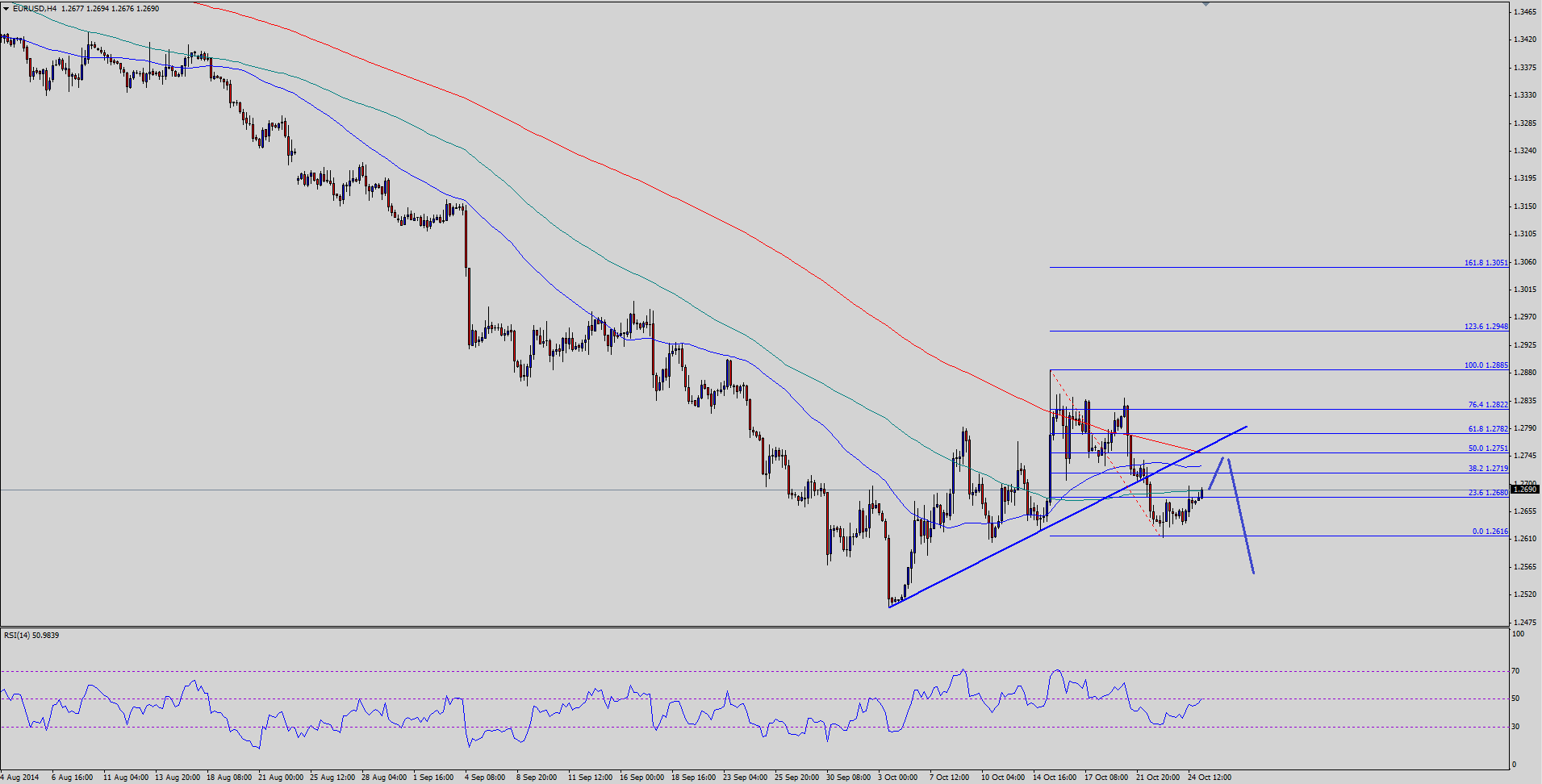

EURUSD crashed to 1.2616 recently where it managed to find buyers and climbed back higher. The mentioned level acted as a support on a number of occasions. However, the EURUSD pair broke an important bullish trend line on the 4 hour chart which is a solid bearish sign in the near term. The pair is under correction, which could lead it towards a critical confluence resistance area around the 1.2750 level. There is a confluence of 100 simple moving average, 200 simple moving average and the 50% fib retracement level of the last drop from the 1.2885 high to 1.2616 low. So, there is a chance that the Euro sellers might appear around the highlighted resistance area. If the pair manages to break higher and settle above the 1.2750 level, then it might encourage the Euro buyers in the short term. We need to see how the pair reacts around the mentioned level if it reaches there.

On the downside, the 1.2610-00 support area holds a lot of importance as it could continue to act as a monster hurdle for the Euro sellers. If they manage to pierce it, then the EURUSD pair might dive towards the 1.2500 support area.

German IFO Business Climate Index

There is an important economic release lined up during the London session today i.e. German IFO business climate index will be published. The forecast is slated for a decline of 0.4 points from 104.7 to 104.3.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.