Technical Bias: Neutral

Key Takeaways

Euro surged higher against the US dollar this past week, but the 1.2980 level is proving to a tough resistance.

Only a break and close above 1.3000 might call for more gains in the EURUSD pair.

EURUSD support seen at 1.2910 and resistance ahead at 1.3010.

The US dollar corrected lower against the Euro during this past week, but the bias remains bullish unless the Euro bulls manage to clear the 1.30 hurdle in the near term.

Technical Analysis

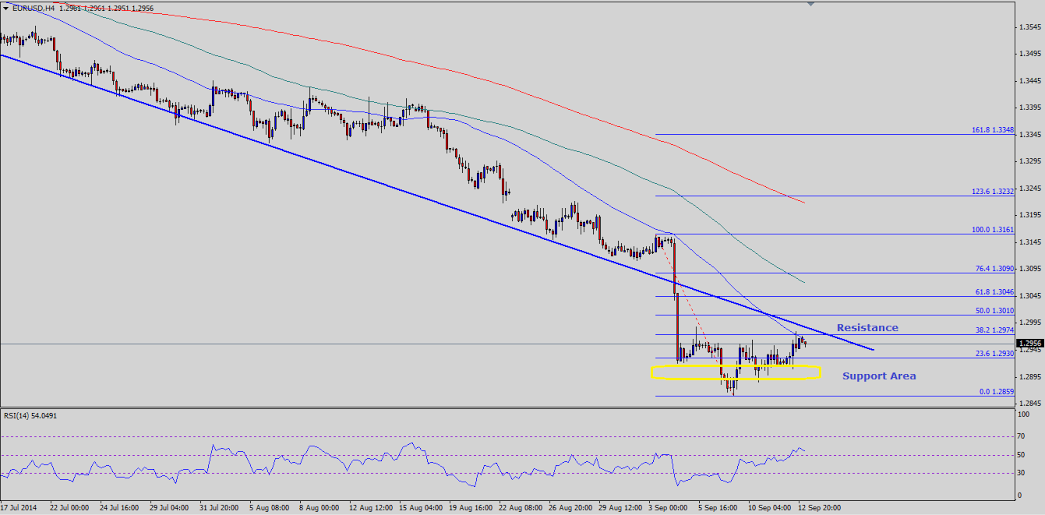

There was a major trend line on the 4 hour timeframe for the EURUSD pair, which was broken earlier and now acting as a hurdle for the pair. The pair traded as low as 1.2859, and now trying to correct higher. Currently, the pair is struggling to break the 38.2% Fibonacci retracement level of the last fall from the 1.3161 high to 1.2859 low, which also coincides with the broken bullish trend line. However, the 4H RSI has managed to close above the 50 mark, which is a positive sign in the near term. So, if the pair manages to clear the mentioned confluence resistance area, then there is a chance of a move towards the 100 simple moving average (SMA) – 4H, which is just sitting above the 61.8% fib retracement level.

On the other hand. If the pair moves lower, then support can be seen around the 1.2910 level. If the Euro sellers get aggressive and break the mentioned level, then a retest of the last low might be on the cards.

Euro Trade Balance Data

Later during the London session, the Euro zone trade balance data will be released by the Eurostat. If the outcome exceeds the market expectation of 15.9B euros, then the Euro might climb further in the near term.

Overall, buying dips might be considered as long as the EURUSD pair is trading above the 1.2910 level.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.