Technical Bias: Neutral

Key Takeaways

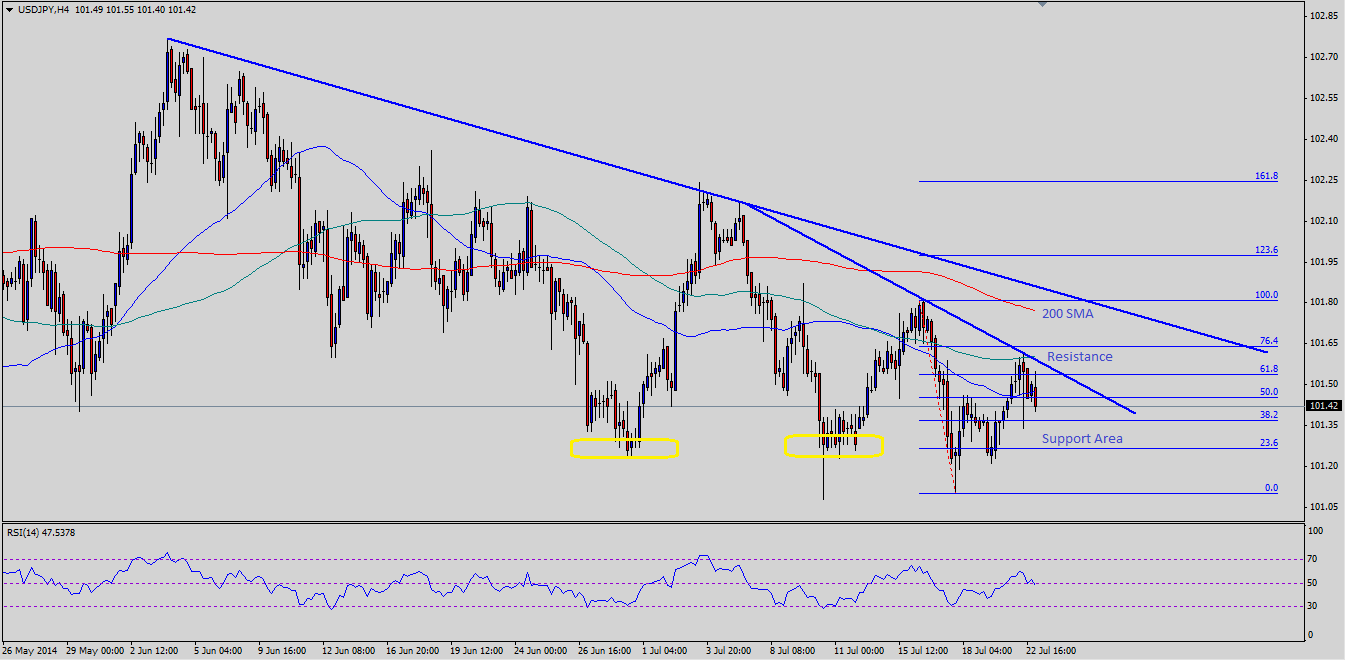

US dollar traded close to a major bearish trend line and failed to gain momentum Intraday.

USDJPY pair faces a tough resistance around the 101.65 level, which can be considered as a short-term breakout level.

USDJPY support seen at 101.20 and resistance ahead at 101.65.

The Japanese yen traded lower against the US dollar yesterday post the US inflation figures were published, but the dollar buyers failed to gain traction above an important resistance level at 101.60-65.

Fundamentals

The US economic data continues to impress the market, as the latest consumer price index figures registered in line with forecast readings. The report published by the US Bureau of Labor Statistics - Department of Labor mentions that the Consumer Price Index increased by 0.3% in June 2014, which was as expected. The US dollar traded higher after the data release, and the USDJPY pair jumped towards the 101.60-65 resistance area.

Technicals

There are two bearish trend lines formed on the 4 hour timeframe for the USDJPY pair. The recent failure occurred just around the first bearish trend line, which was also coinciding with the 100 simple moving average (SMA) – 4H at 101.62. It is important to note that most major pairs, including EURUSD and GBPUSD are trading lower, but the USDJPY pair has lost most of its post CPI gains. This has more to do with the Japanese yen strength and less with the US dollar strength. Currently, the pair is flirting around the 50 SMA (4H), and there are several support levels on the way down for the pair. The most important one is around the 101.20 level, which acted as a pivot area for the pair numerous times.

There is a possibility that the pair might trade lower from the current levels and retest the mentioned support level. If buyers appear and push the pair higher again, then there is a chance that the pair might break the first bearish trend line to test the second one.

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price remains on the defensive on a firmer US Dollar

Gold price attracts some sellers on the firmer US Dollar during the Asian trading hours on Wednesday. The hawkish remarks from Federal Reserve officials dampen hopes for potential interest rate cuts in 2024 despite weaker-than-expected US employment reports in April.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.