Technical Bias: Bearish

Key Takeaways

- Australian dollar struggled to hold ground against the US dollar, as the market looks past employment report.

- Australian home loans report came as a relief for buyers.

- AUDUSD support seen at 0.9370 and resistance ahead at 0.9405.

The US dollar gained heavily against the Australian dollar recently, as the AUDUSD pair broke an important support area to encourage sellers in the short term.

Technical Analysis

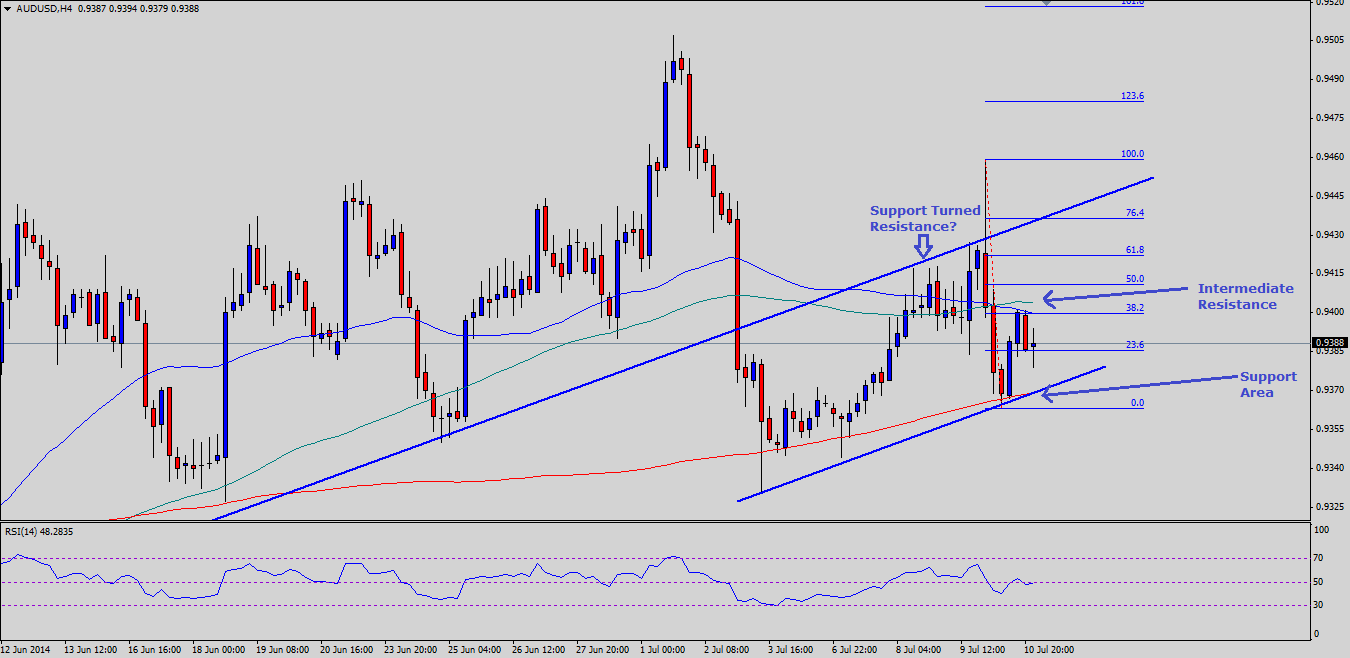

AUDUSD rose yesterday, easing some by the end of the US session on recovering Australian dollar. Earlier, the pair extended down to 0.9363 where it found the 200 simple moving average on the 4 hour timeframe, which held the downside in the pair. The 4 hours chart shows indicators correcting higher from somewhat oversold readings, but price seems unable to follow, as it looks shallow and corrective in nature. It is important to note that there was a bullish trend line that acted as a catalyst for the pair many times, which was breached earlier sduring this week. Currently, the mentioned trend line is acting as a resistance for the pair and it might continue to do so. On the downside, the 200 SMA (4 hours) is holding the downside along with a short-term bullish trend line. This looks like a consolidation pattern, which might give its way for more losses in the near term.

On the upside, an immediate resistance can be seen around a critical confluence area of 100 and 50 SMA (4 hours), which is also coinciding with the 38.2% Fibonacci retracement level of the last drop from the 0.9459 high to 0.9363 low.

Australian Home Sales Data

The Australian home loans report was published by the Australian Bureau of Statistics earlier during the Asian session. The Forecast was slated for a 1% decline in the home loans. However, the outcome was somewhat better than expected, as it registered a reading of 0%. Moreover, the report mentioned that investment housing commitments rose 0.3% and owner occupied housing commitments rose 0.2% in May 2014.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Democrats to introduce bill targeting crypto mixing services

Rep. Sean Casten revealed in a House hearing on Tuesday that Democrats are planning to issue a bill this week that would target crypto-mixing protocols. Democrats and Republicans also clashed over the SEC's recent action against crypto companies.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.