AUDUSD buyers seem to be enjoyingthe recent rise towards key resistance zone at around 0.9300. There were threeattempts so far to settle above 0.9300, but buyers struggled to take the pairhigher. Australia’s employment report islined up during this week, which could act as a catalyst for the pair.

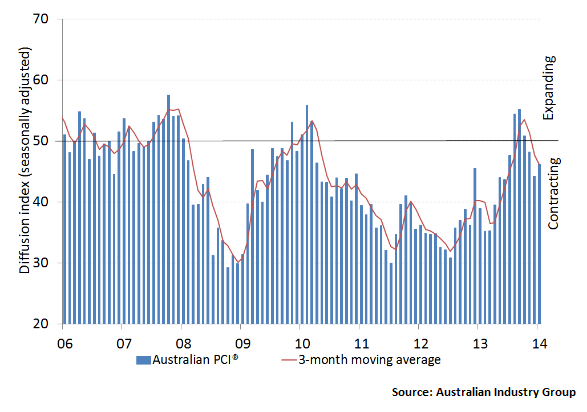

AIG Performance ofConstruction Index

During Asian session, Australian Performance of Construction Indexwas published by Australian Industry Group and the Housing Industry Association.The report suggested that the national construction industry continued todecline in March, as Australian Performance of Construction Index registeredanother contraction with a reading of 46.2 points. This is the thirdconsecutive month of a reading below 50 points due to slower declines in bothnew orders and activity. The outcome is disappointing, but the impact onAustralian dollar was neutral.

Australian Employment report

On Thursday at GMT 01:30 AM, Australia’s employment report will bepublished. Many banks and economists believe that there is evidence of improvementsin the Australia's job market.Recently, job ads in the newspapers have been trending higher, which isa positive sign. If the outcome on Thursday exceeds expectations, then AUDUSDcould trade higher.

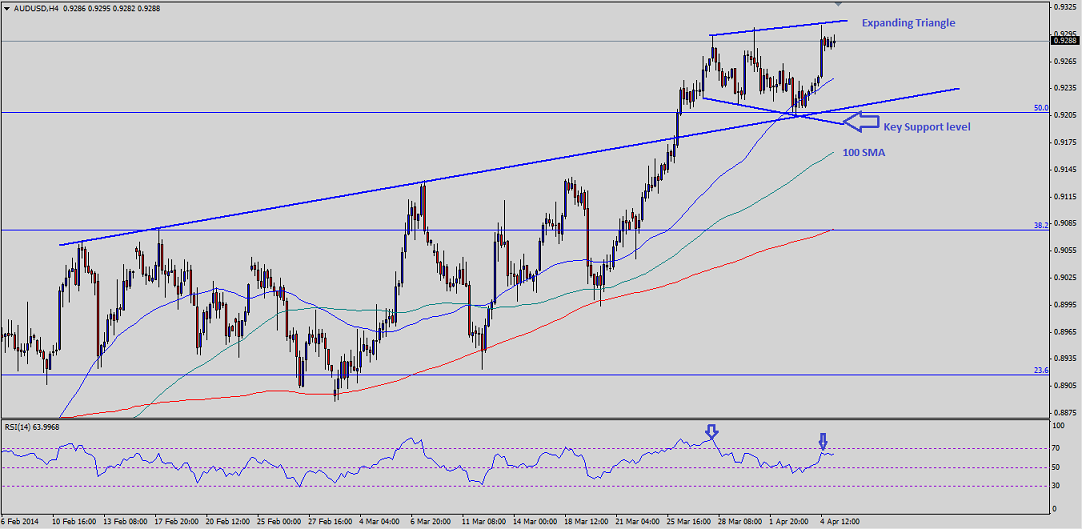

Technical Analysis

AUDUSD buyers struggling to pierce 0.9300 resistance zone, which hasacted as a barrier a number of times in the past. There is an expandingtriangle forming on 4 hour timeframe with resistance around the same zone. Duringlast week, AUDUSD sellers failed to defend a trend line, which is not acting asa support for the pair around 0.9200 level. If pair breaks higher and settlesabove triangle, then it might open the doors for further gains in the days tocome.

AUDUSD is trading above all three key moving averages (200,100 and 50). There is a divergence noted on the RSI, which could result in apullback in short term. Current price is 0.9280, with resistance ahead at 0.9308(Triangle resistance), 0.9340 (61.8% Fib of last leg lower from 0.9757 to0.8655) and 0.9380 (Swing high). Next support to the downside can be found at 0.9250(4H 50 SMA), 0.9210 (TL support) and 0.9180 (Triangle support).

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.