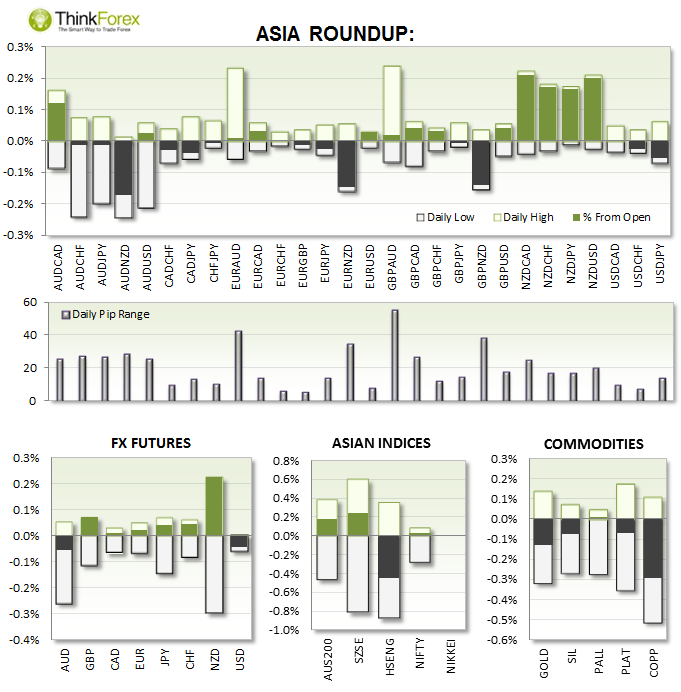

Australian building approvals contracted for a 4th time over the past 5 month to suggest a peak has been seen in the housing sector. The A$ was already fragile after strong US GDP data last night, with today;s data keepin it near 8-week lows. View today's post for details

Japan average cash earning y/y fall short at 0.4% vs 0.7% expected.

China Growth: CitiGroup upgrade their China growth forecast to 7.5% from 7.3% for 2014

UP NEXT:

European data takes the helm tonight with CPI flash estimates expected to be steady at 0.5%. With yesterday's bullish hammer on higher volume forming there is a technical argument for a bullish retracement. If we come in at 0.5% or more then we should see EURUSD retreat from the lows towards 1.3445 resistance.

Canadian GDP could provide further fuel to the bullish USDCAD if it falls short of 0.3% tonight. GDP has been expanding (slowly) for the past 4-month with the rate of acceleration declining. A positive number could see some profit taking and retracement on USDCAD but the trend remains increasingly bullish.

US jobless data may add a little volatility for those who cannot wait for tomorrow's NFP, but really the markets await tomorrow's employment data. If we fall short it may spur some profit taking from USD bulls.

TECHNICAL ANALYSIS:

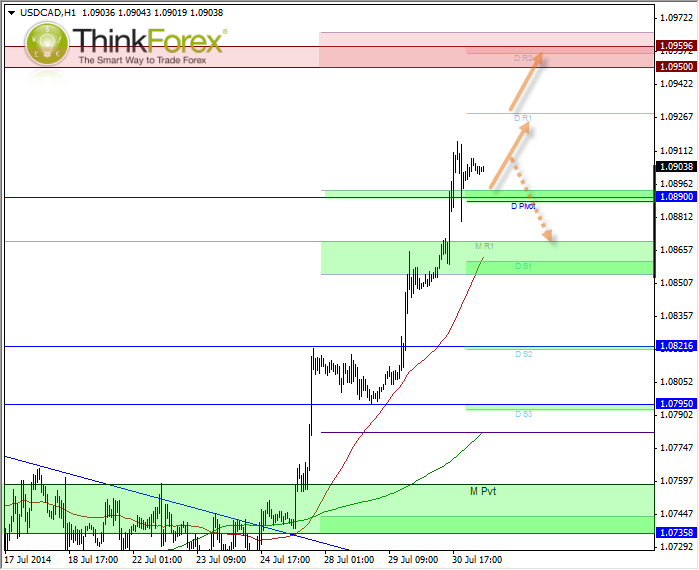

USDCAD: Seeking buy setups above 1.089

The Daily pivot is an obvious buy zone as this coincides with several other technical levels between 1.089-90. With US and CAD data out tonight (and I am favouring disappointing GDP from Canada) then I see no reason to buck the clearly bullish trend just yet.

​That said, poor data from US and good GDP data from Canada should see a quick reversal but I would only want to consider short positions below 1.089 (and not outstay my welcome).

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.