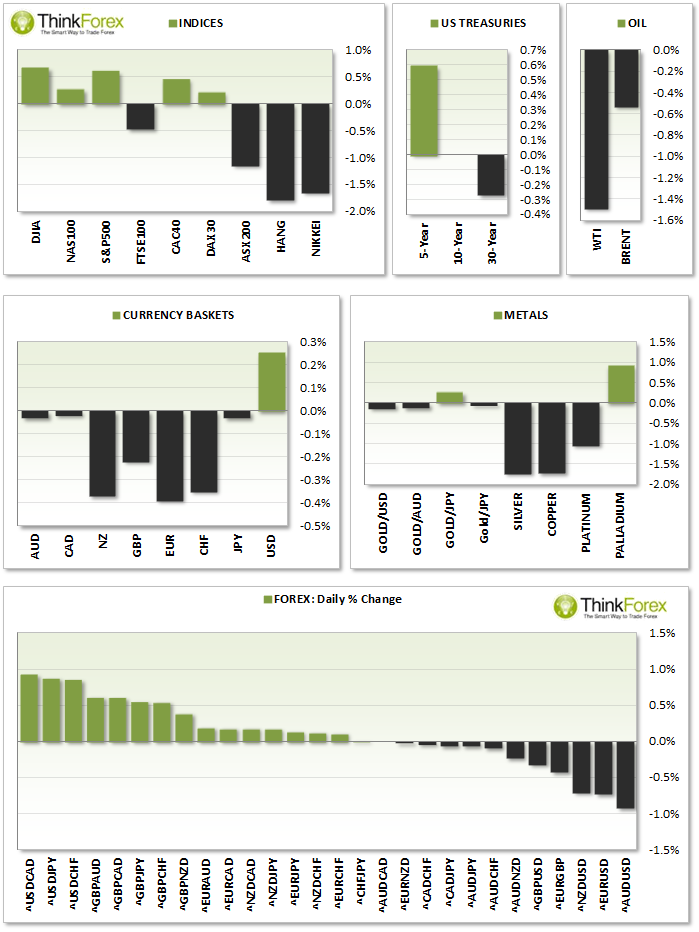

MARKET SNAPSHOT:

ASIA HANDOVER:

FX:

Whilst volume has been a little thinner due to the JPY bank holiday, the Aussie Dollar has seen the most action today gaining ground against all majors:

AUDNZD traded up to a 4-day high of 1.062; A break above 1.0625 confirms a double bottom pattern

AUDJPY traded to a 2-day high but technically trading sideways;

AUDCAD is within a bullish trend with 1.023 within its sights.

EURAUD edging lower to an intraday 10-day low. The daily charts still appear to be forming a head and shoulders reversal where a break below 1.50 confirms.

INDICES:

A day of tumbleweed aross Asian equities, all seemingly waiting for the weekend.

AUS200 caught within a 26-point range following yesterday's Riskshaw Man Doji

Nikkei 225 drifts higher, up just 0.2% at time of writing

Similar sotry with Hang Seng, down -1.5%

COMMODITIES:

Gold has traded up to yesterday's high and (so far) above the 200 day eMA. If it remains within the bullish channel then $1337 and $1350 are the next targets

Palladium trades higher following yesterday;s volatile bullish hammer to suggest a swing low has formed and continuation of the bullish trend

COMING UP:

CHARTS OF THE DAY:

USDCAD: Favours further upside & disappointing CPI

When I took a cursory glance at the CPI and the forecast of 0.5% I immediately noted the following:

It hasn’t been above 0.2% since last March

March must be a seasonal tendency for positive CPI

The CPI frequently falls short of the expectation

There is lots of weak data coming out of CAD so my 'guestimate' is to fall short on CPI.

In the event the seasonal tendency of good CPI comes to fruition, then (depending on how good) I would expect a retracement towards the broken neckline. At which point, going into next week, I would be seeking bullish setups once more.

NZDCAD: Potential bullish wedge forming ahead of CAD CPI

Whilst this is a pair I'd imagine to many would not tend to look at my justification is as follows:

NZD is one of the stronger G10 pairs

CAD is one of the weakest

I expect CPI to disappoint (hence CAD weakness)

We're clearly within an uptrend, within a bullish channel

The correction appears to be forming a bullish reversal pattern

Worst case scenario is CPI comes in much better than expected and you can forget the above. Price may well break below 0.9550 support zone and target 0.9520 and the lower bullish channel.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.