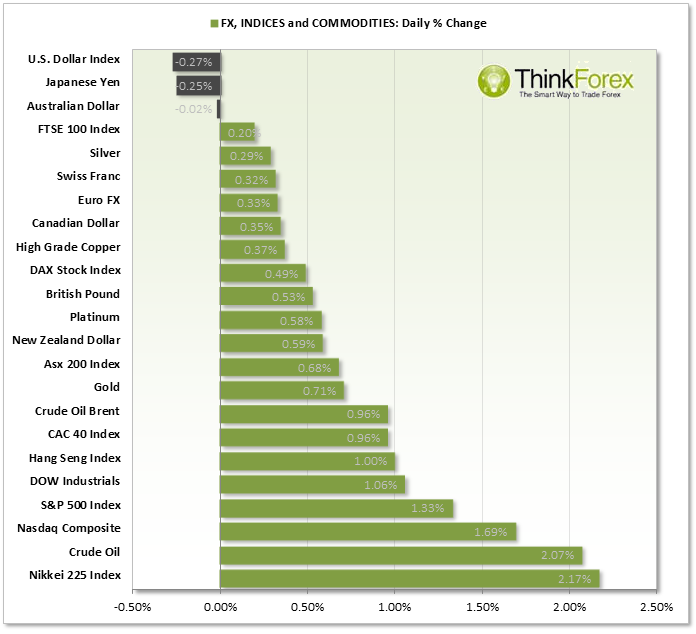

MARKET SNAPSHOT:

CHARTS OF THE DAY:

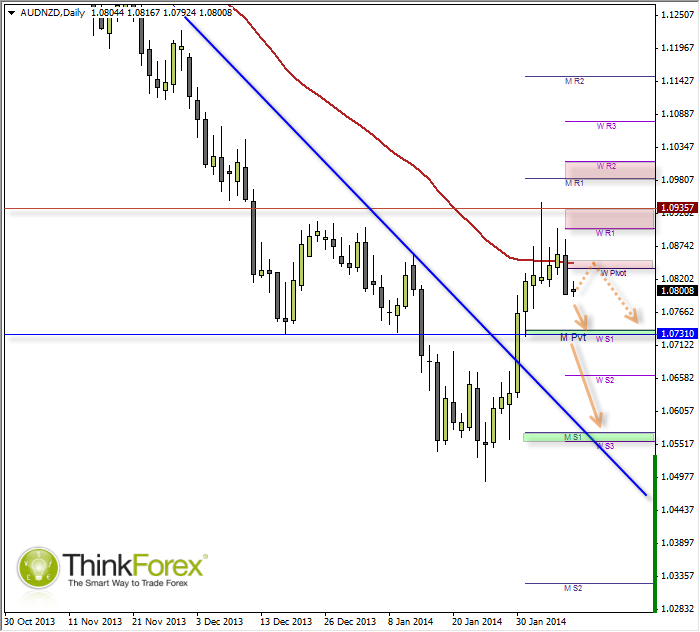

AUDNZD: Swing high formed?

This trade was highlighted last week and whilst it may have taken a little longer than anticipated to show signs of weakness, I do have more confidence we will begin to see losses soon.

The Bearish Pinbar which formed last Tuesday was the first clue, as the high if the wick was a pivotal S/R level. Another clue was provided on Thursday with an inside bar which is also a high-test Doji, which was followed by a bearish candle on Friday.

This bearish close helped produced the Shooting Star reversal candle on the Weekly chart to suggest further losses.

At time of writing we are beneath the 50eMA and weekly pivot which may cap any gains. A retracement within this area may provide further opportunity to enter short and target 1.073.

How price reacts here is crucial as it is the monthly pivot and has held has support previously. Any break below this level opens up 1.056.

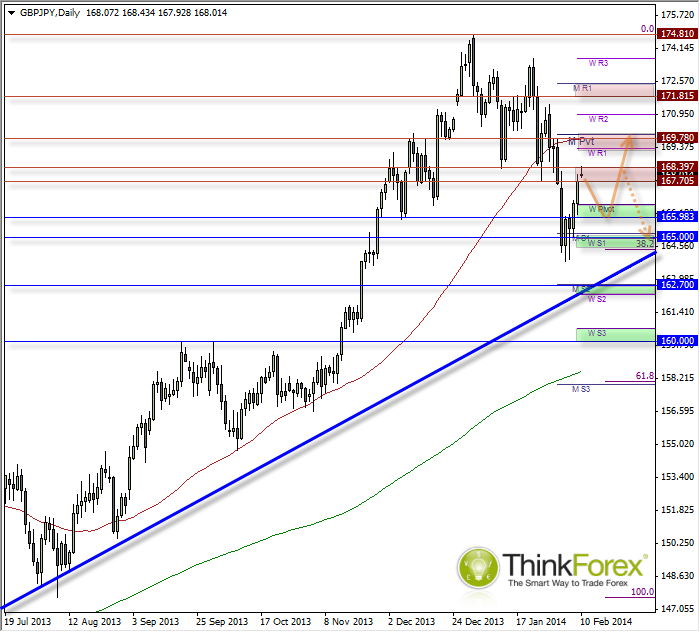

GBPJPY: Bullish Pinbar on Weekly suggests continued Gains

Please refer to Friday's post of GBPJPY for a bigger picture view.

We did see the bullish pinbar at the close of Friday to suggest a pivotal swing low and a return to the dominant bullish trend. However we closed the week at a resistance zone which (so far) has continued to do its job. So the preference is for a pullback before another leg higher to 169.80 and 172.

In the event we see losses below 165.80 then preference is for a retest of the bullish trendline around 165.00

BRENT: Targeting 110.50

Brent enjoyed its most bullish day since end of November and took full advantage of the USD weakness on Friday. WTI had indeed provided the heads-up of a pending bullish breakout above 108.50 and seems to be on target for 110.50.

However I do favour a pullback towards 108.50 support zone prior to another leg up.

A break below the support zone opens up the lower trendline around 106.50.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.