Technical Analysis

EUR/USD violates 1.2660

“The violence of this euro move has been fairly dramatic. We’re in this period of broad U.S. dollar strength. It’s fairly hard for almost any currency to strengthen in that kind of environment.”

- Bank of Nova Scotia (based on Bloomberg)

Pair’s Outlook

The support at 1.2660 did not withstand the selling pressure yesterday, thus exposing the 2012 low at 1.2040, namely the main long-term target. However, in the short run we may expect some bullish activity at the weekly pivots—at 1.26 and 1.2510 respectively, but the overall outlook should stay bearish. Additional demand area is around 1.24, where the weekly S3 coincides with the monthly S2 level.

Traders’ Sentiment

Although the price of the Euro is becoming more attractive, we observe a decline in the percentage of long positions open in the market. Since the previous report 24 hours ago, their share has fallen from 60 to 57%.

GBP/USD to preserve negative bias until 1.6050

“The dollar appreciation is broad-based. Our recommendation is to be long dollar.”

- Nomura (based on Bloomberg)

Pair’s Outlook

GBP/USD keeps moving away from the three-month down-trend, which is expected to lead the pair to this year’s minimum. The immediate support is at 1.6162, represented by the weekly S1, but it is highly unlikely to influence the major bearish trend. The demand at 1.6050 on the other hand poses a real threat to the bears—potentially it can send the price to 1.63 and in case of success there—to a neck-line of a double bottom pattern at 1.65.

Traders’ Sentiment

The difference between the amounts of bullish and bearish market participants is almost the same as yesterday—18 percentage points in favour of the former. Meanwhile, the portion of sell orders plummeted from 66 to 50%.

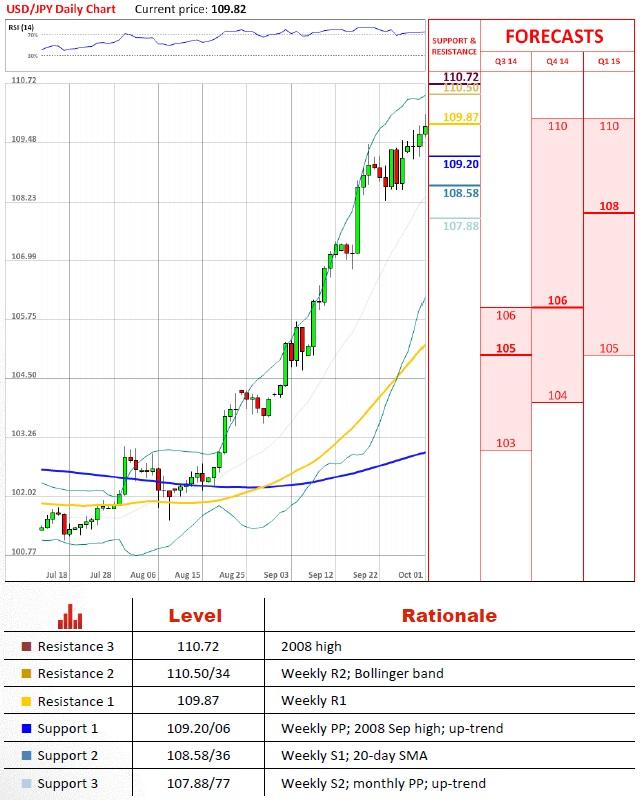

USD/JPY approaches 110.70

“While ¥110 seems close, the path there is still distant.”

- Mizuho Securities (based on MarketWatch)

Pair’s Outlook

After finding firm support at 109 USD/JPY was able to extend the gains to the weekly R1. The next milestone is the weekly R2 level at 110.34—the last hurdle before we see a test of the 2008 high at 110.72. In case of a strong sell-off from here, the pair may return to 108, where it will be expected to stabilise and resume the rally, since this area is created by the monthly PP, weekly S2 and a rising trend-line.

Traders’ Sentiment

Just as yesterday, the sentiment with respect to USD/JPY remains distinctly bearish—as many as 70% of open positions are short. But the share of orders to purchase the U.S. Dollar at the same time increased from 64 to 69%.

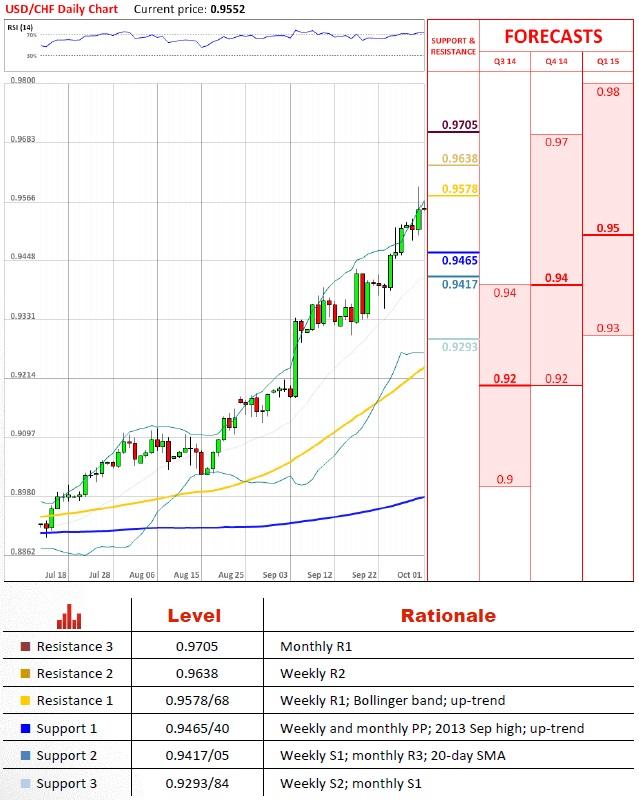

USD/CHF probes resistance at 0.96

“Friday's non-farm payrolls will be key, as it could raise rate hike expectations another notch.”

- Barclays (based on CNBC)

Pair’s Outlook

USD/CHF, after unimpressive performance on Monday, posted new highs yesterday, proving to retain bullish momentum. However, if the pair now retreats from 0.96 back to 0.9450, this will mean that the trading range is gradually narrowing and there is a significant probability of a break-out to the downside. This risk is also highlighted by the monthly technical indicators—five out of eight are pointing downwards.

Traders’ Sentiment

The traders seems to have been encouraged by USD/CHF’s latest rally, being that the percentage of long positions went up from 58 to 62%. As for the orders 100 pips from the spot price, the number of buy ones plunged from 76 to 59%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold retreated from record highs, maintains the upward bias

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, in an uneventful US session

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground while central bank officials fail to trigger some action ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.