Gold prices moved to $1270 early today as noted in yesterday's daily report. Price action in gold is likely to form a near-term top which could see a much-needed correction start. Meanwhile, GBPUSD forms an inside bar at support which could see a short term momentum led breakout to the upside.

EURUSD Daily Analysis

EURUSD (1.13): EURUSD posted declines for 6 consecutive days with price closing at 1.1371 yesterday. However, the range (open/close) of the candlesticks has declinedto indicate a lack of momentum. This could potentially signal a near-term correction to the upside. Resistance is seen near 1.1470 while a close below yesterday's low at 1.1358 could signal further downside to 1.130. On the 4-hour chart, price action continues to consolidate near the support zone of 1.14 and 1.1380 and has formed a falling wedge pattern with a doji formed and the current 4-hour candlestick staying bullish. A bullish close here and preferably above the doji's high of 1.1381 could signal an upside breakout. While 1.1470 remains a key level to watch, EURUSD could rally to as high as 1.14975 to form a lower high.

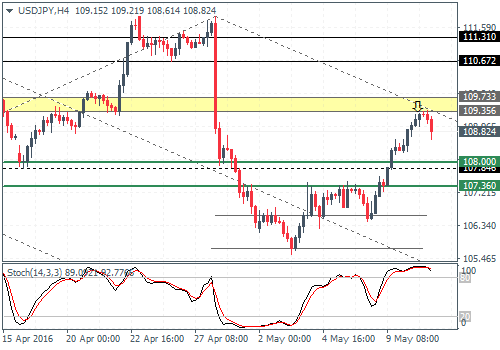

USDJPY Daily Analysis

USDJPY (108.8): USDJPY is currently bearish but price briefly opened higher. A bearish close today could signal a move to 107.955 - 107.70 support. Watch for a lower high in USDJPY which could signal a move to 111.0 in the near term. On th 4-hour chart, the hidden divergence is currently seeing prices falling lower after a brief test near 109.35 - 109.73 resistance. The downside is likely to be limited near 108 - 107.360, which could confirm the bottom being in place and could start a rally to the resistance of 109.73 - 109.35 and eventually to 111.0.

GBPUSD Daily Analysis

GBPUSD (1.44): GBPUSD formed an inside bar yesterday with prices closing bullish but within the Monday's high and low range. The inside bar comes near the 1.4425 support, which marks the previous resistance level which snapped, sending GBPUSD towards April 28th higher close at 1.4673. An upside breakout here could see another rally, but it is very likely that GBPUSD will form a lower high indicative of a move to the downside unless the resistance zone of 1.4743 - 1.4635 is broken. On the 4-hour chart, a descending wedge pattern confirms this view with price moving higher above 1.4425. Initial resistance is seen at 1.4535, which could be the likely target. In the medium term, a higher low near 1.4535 - 1.4585 could see GBPUSD correct lower to 1.43 support.

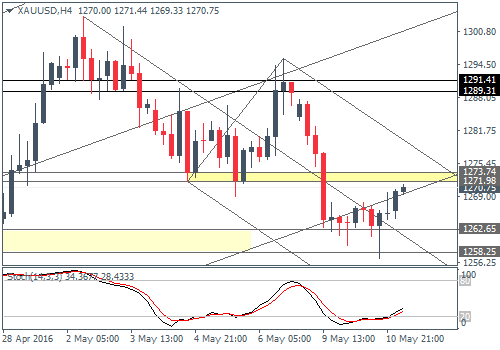

Gold Daily Analysis

XAUUSD (1270): Gold prices formed a doji yesterday after Monday's bearish declines. Price action is showing signs of fading momentum which could see a near term top being confirmed. As long as gold doesn't break above $1300, we suspect that a correction to 1200 will be likely, provided gold can manage to break 1230 support. On the 4-hour chart, the falling median line is showing a correction to retest the broken support at 1273 - 1271. Establishing resistance here could confirm a move lower, but there is a risk of a break higher. In this case, gold could consolidate between 1291 - 1289 resistance and 1273 - 1271 support.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Democrats to introduce bill targeting crypto mixing services

Rep. Sean Casten revealed in a House hearing on Tuesday that Democrats are planning to issue a bill this week that would target crypto-mixing protocols. Democrats and Republicans also clashed over the SEC's recent action against crypto companies.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.