Failure to hold on to the gains made in the early part of the week near the $1300 level has seen Gold prices continue to pull back following the doji pattern two days ago. A bearish continuation today could see further downside in Gold ahead of the US ADP payrolls report and Friday’s non-farm employment data.

EURUSD Daily Analysis

EURUSD (1.14): EURUSD tested the $1.160 handle yesterday but closed on a bearish note settling at 1.1496, indicating a near-term pullback to the upside. Support at 1.147 remains the immediate level of interest, a break below which could see EURUSD extend its declines to 1.130. The bearish divergence on the daily chart points to a deeper pullback that will see EURUSD test the 1.10 handle over the next few weeks.

USDJPY Daily Analysis

USDJPY (107.2): USDJPY closed yesterday on a modestly bullish note, pulling back from the lows of 105.550. A continued upside momentum could see the recovery push USDJPY towards 110.67 in the near term which marks a strong resistance level that was previously supporting prices. A break above 110.67 could see further bullish momentum in USDJPY for a test to 117 - 116.21 resistance. Minor support at 106.565 is likely to be tested ahead of further gains to the upside. However, a break below this support could see USDJPY either continue to consolidate below the support and the recent lows or extend declines lower.

GBPUSD Daily Analysis

GBPUSD (1.45): GBPUSD closed in a bearish engulfing pattern on the daily chart after a brief test to the resistance high near 1.4743. Engulfing the past two sessions, the downside momentum could see GBPUSD test the lower support at 1.4425. As long as this support holds, which was the resistance neckline of the inverse head and shoulders patterns, GBPUSD is poised to the upside with further gains likely only on a break above the current resistance near 1.4743 - 1.4635. Below the support at 1.4425, GBPUSD could slip towards 1.4312 - 1.430 support.

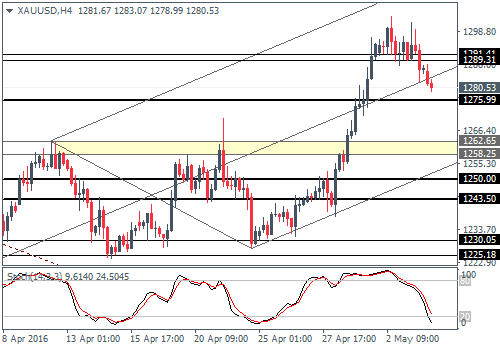

Gold Daily Analysis

XAUUSD (1280.5): Gold prices are into their second day of declines following the doji pattern that was formed at the top end of the rally to $1300. The downside could see Gold prices slip to 1275 support, but overall, gold remains well positioned to the upside above the 1200 handle. On the 4-hour chart, looking at the Stochastics, there is scope for 1275 - 1276 support likely to offer a short term bounce, but the upside is likely to be limited to the currently broken support at 1291 - 1289 which could be tested for resistance.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.