Today's Highlights

RBA has room for further Aussie interest rate cuts

NZ producer prices in sharp decline

UK could see 1st deflation in 50 years

FX Market Overview

You have to feel sympathy and admiration for Prince Charles who will meet Gerry Adams today. Adams claims to never have been a member of the IRA and we have to believe that don't we but the Prince's beloved uncle Lord Mountbatten was murdered by the IRA in 1979 and he will visit the scene of that crime today. Thank goodness Gerry Adams wasn't involved or today's meeting could have been awkward.

Monday was a very quiet day on the data front. With little to focus on, traders loitered near the news wires talking about Greece and the Euro gently lost ground as a result. Greek ministers are trying to get funds out of a reticent Europe but the Greek Finance Minister seems to believe a deal is near. I am not sure the markets are convinced, judging by the weakness in the euro this morning. We will see Eurozone inflation data this morning and another flat or marginally negative figure is expected. New Zealand's output producer prices were far lower than expected in Quarter 1. The Q4 contraction of 0.1% was dwarfed by the 0.9% drop in Q1. However, the fall in input prices of 1.1% was even more dramatic. It doesn't shriek of impending inflation so it may give the RBNZ another reason to think about another interest rate cut. As you might suspect, the NZ Dollar weakened on the news and is back at last week's highs of NZ$ 2.13 against the Pound as I write.

The minutes from the last Reserve Bank of Australia meeting were published overnight and they revealed the RBA committee thought long and hard about delaying any interest rate cut but ultimately decided to go ahead in advance of, what is expected to be a contractionary budget statement. The Australian Dollar traded in tight ranges as it became clear that the RBA has plenty of scope and a little ambition to lower rates again if needs be.

Today starts with UK inflation data. Forecasts are mixed but there is a real possibility we will see contraction for the first time in more than 50 years. Falling energy prices can be blamed for some of that although I have noticed pump prices are gently rising again. But oil companies don't make any money out of the retail end of their business.....definitely not. Or so they say. As well as the inflation data we will see UK input and output prices at the production level and these are firmly in negative territory.

This afternoon brings US housing starts and building permits data and positive numbers are expected. The US Dollar could have a better afternoon so beware if you need to buy any.

And you have to feel sorry for the soldier who thought whe was getting the word 'strength' tattood on his arm in 2" high letters. The ink was noticed by a chap who could read Hebrew when the soldier was out shopp9ing. When the chap asked him whether he knew what it meant, the soldier proudly said, "yes it means Strength". "No it doesn't", said the other guy, "it says matzoh". That's a biscuit usually eaten by Jewish people when they celebrate Passover. Fancy walking around with the equivalent of 'minced pie' on your arm in massive letters!

Currency - GBP/Australian Dollar

Uncertainty over the plans by the Reserve Bank of Australia are keeping the Australian Dollar is relatively tight ranges. However, the fact that the Sterling – Aussie Dollar rate is hanging at the lower end of its trading range in spite of the Pound's general strength, would suggest there are a number of AUD buyers hanging around in the wings picking up Aussie Dollars on any spikes. It would also suggest that if the Chinese authorities start to stimulate their economy as has been very heavily hinted, the AUD would strengthen rather rapidly. Above $1.92, this is still in an upward channel. Below that level, A$1.90 and A$1.86 would be the targets.

Currency - GBP/Canadian Dollar

The Sterling - Canadian Dollar exchange rate is in an undisturbed upward trend which finds Sterling buyers around the C$1.82 level and Sterling sellers at the top of the range C$1.95. That red top line has topped the market since 2010, so it is pretty solid. It would be a brave trader who bet against it capping the market again.

Currency - GBP/Euro

After the spike to €1.42 in March, the Sterling – Euro exchange rate has been correcting. It has created a short term downward channel between 1.33 and 1.39 and we have been testing the top of that range this week. The UK economy is though in better shape than the Eurozone and the Greece story just refuses to lie down. So there is plenty of scope for further Sterling strength if traders can just overcome their fears of €1.40 levels. From the UK side of things, the new government is in its honeymoon period but that will be over before we know it. I still tend to favour further euro weakness and, whilst we may see a drop to 1.36, that may be the last gasp for the euro before a more substantial Sterling advance.

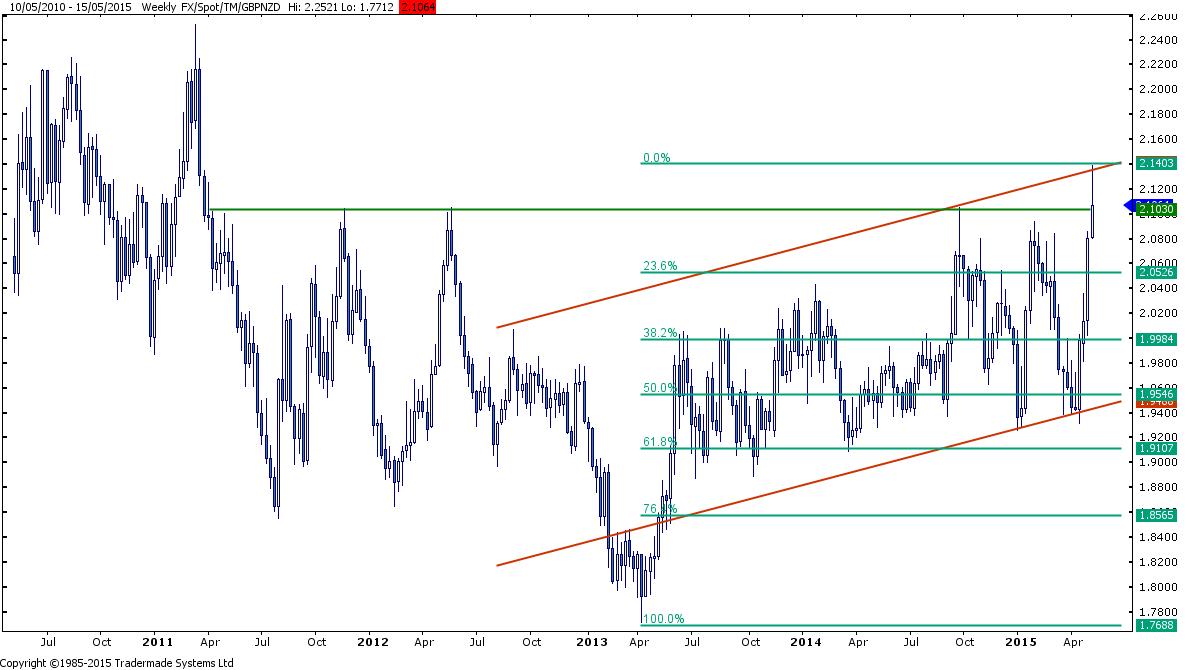

Currency - GBP/New Zealand Dollar

The New Zealand dollar has been hit by suggestions from the Reserve Bank of New Zealand that interest rates may have to fall further and some of the NZ economic data has supported that view. Hence the rally in the Sterling – NZ Dollar rate from 41.93 to 2.14 in just 4 weeks. That took this pair to the highest level we have seen since early 2011 and NZD buyers had a field day. So we are not surprised to see some correction of that rally but NZD buyers who missed the absolute top of the market are still able to access NZD at 2.09 or thereabouts. 4 weeks ago we would have given our right arms for such a rate, hence I am typing with my left hand. Just kidding.

Currency - GBP/South African Rand

The Sterling – South African Rand exchange rate is at levels not seen since the height of the financial crisis in 2008. As you can see from the chart above, this top 'resistance' line has capped this pair ever since the height of the dot.com bubble in 2002. It goes without saying that this is an excellent time to be buying Rand. This rally is partly due to Sterling's strength and partly due to the drop in commodity markets which have such a direct impact on South African exports.

Currency - GBP/US Dollar

April marked a turning point in the Sterling – US Dollar exchange rate. This pair had been in a downward trajectory for 10 months but the recovery in the value of the Pound started in the lead up to the UK general election, the Pound dipped just before the election day itself and the Sterling pushed on again once the majority government was confirmed. On the other side of the Atlantic, some poor US data and hints of delayed US interest rate hikes have hampered the US Dollar. Cable, as the GBPUSD rate is known, is heading towards $1.59; the 50% retracement of the fall from July 2014 to April 2015. Beyond there, the upside could take us to $1.62 but if the Pound stalls, we could fall all the way back to $1.52 without trying.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.