Today's Highlights

Euro largely unmoved by Draghi comments

Sterling steady ahead of inflation data

Chinese GDP will affect Aussie and Kiwi Dollars

FX Market Overview

It seems such a long time since we've had a warm day in the UK. I noticed men in shorts made a very early appearance in my neck of the woods. Pasty white hairy legs are just the thing to greet the summer. I hope it hasn't frightened the sun away.

Our own Charlie Horsley was in shorts running in the London Marathon; his first marathon I might add. Well done to him for finishing. Unsurprisingly, he isn't in the office today but when he is back in tomorrow, if you speak to him, please don't expect him to collect anything from the printer. It is a 12 foot walk away for goodness sake.

In the financial markets, we start the week with the words of ECB president Mario Draghi ringing in our ears. After a weekend which saw French protestors marching against austerity measures, Mr Draghi spoke of the potential for further monetary stimulus as the euro remains strong. Whether that would come in the form of lower interest rates or even negative interest rates or whether that is a matter of further monetary easing through the quantity of funds in circulation is unclear. However, there is then room for the euro to weaken against the likes of the Pound and US Dollar when the UK and US central banks are making their plans to reduce liquidity. The IMF agrees that he needs to make plans to stave off the threat of deflation. There isn't a lot of European data due for release this week but the industrial production, inflation and business sentiment indices will be closely followed.

Sterling starts the week with a 7.3% rise in house prices as reported by Rightmove and is braced for consumer and producer price inflation data. With the Pound hovering below the top end of its 2014 ranges, there is scope for both higher and lower levels so beware.

The big news for the Australasian markets this week will actually be the Chinese economic growth data. Strength in these figures leads to strength in the Australian and New Zealand dollars. The forecasts though are for a small scale decline. That would clearly have the opposite effect. Be prepared.

And no wonder it is hard to get to the truth on the Ukrainian crisis. One man has appeared on Russian TV claiming to be an injured Pro-Russian protestor and on Ukrainian TV claiming to be pro-Ukraine. He did the decent thing and changed his name for each report but how strange that news reporters would offer misleading information.

Currency - GBP/Australian Dollar

With stronger than expected employment data released this week, the Australian Dollar was in good shape to strengthen; and it did to some extent. That strength was tempered by poor Chinese import and export data and by nervousness over the potential for the US and Chinese economies as a whole. Nonetheless, the Sterling – Australian Dollar exchange rate has completed the first part of its correction from the January high and the pound is finding support at the 1.7780 level we highlighted in recent reports. If this holds, we will see a test of the 1.8550 level before we know whether the longer term trajectory is higher or lower. If 1.7780 breaks, then the next logical target for traders is the 1.7134 projection level.

Currency - GBP/Canadian Dollar

The ousting of Quebec separatists meant the Canadian Dollar started this week with a spring in its step. We saw the loonie strengthen against all-comers on Monday and Tuesday but that ran out of steam as the week progressed. Next week brings the Bank of Canada's interest rate decision and, whilst few are expecting any change, there is the outside chance of an interest rate cut from the BOC in response to the flagging Canadian economy. Technically speaking, the Sterling – Canadian Dollar exchange rate could easily fall to 1.7842; the first retracement level after a rally which took this pair from 1.5250 on the 1st quarter of 2013 to the 5 year high of 1.8643 last month. Those with a short to medium term need to buy Canadian Dollars may want to protect against that risk and maybe even more of a correction.

Currency - GBP/Euro

Since the middle of March, the Sterling – Euro exchange rate has traded between 1.19 and 1.2150 and is currently sitting right in the middle of that range. Data on both sides of The Channel is sporadic to say the least but the European data is probably a little less encouraging. That is definitely true of the data we received over the last couple of days. Improvements in inflation figures are counteracted by another rise in Greek unemployment and credit agency, Fitch updating Portugal's outlook is counterbalanced by a fall in manufacturing activity. All in all, there are few reasons to expect the Sterling – Euro exchange rate to break out of its current malaise but never say never.

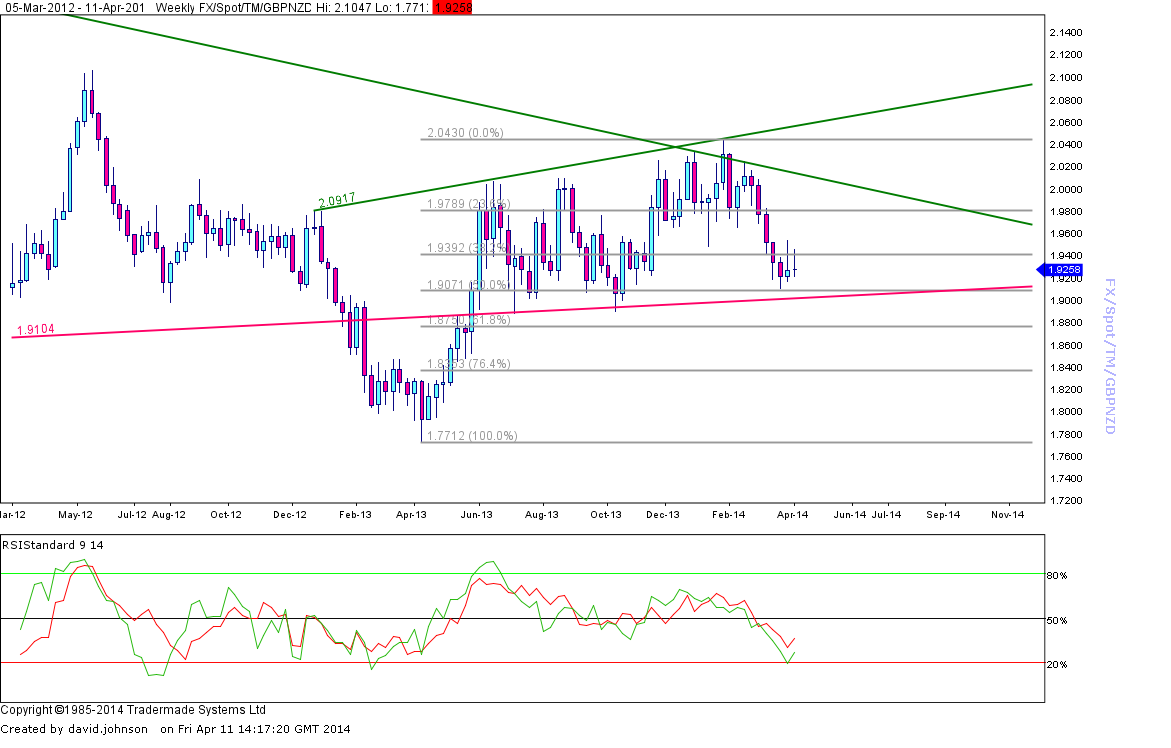

Currency - GBP/New Zealand Dollar

There is an increasing likelihood that the next move in New Zealand Interest rates will be to the upside. That has given the NZ dollar a real boost and we can see that in the move against the Pound from NZ$2.04 to NZ$1.90 over the last 6 weeks. However, the data in the UK is also picking up and that has caused there to be enough GBP buyers in the market to stop the decline on or around the long term trendline (red on this chart) and the 50% retracement of the move from the 2013 low to the 2014 high. In essence, with UK inflation coming up next week and a smattering of other data, we ought to see some more Sterling strength in this pair but there is a caveat. If the Pound falls below 1.9000 we will see it drop to 1.8750 and perhaps 1.8360. There is a very strong argument for protection just below that 1.90 level for NZD buyers. If you are unsure about how to do that, speak to your Halo Financial consultant about a Stop loss order.

Currency - GBP/US Dollar

The Pound has tried once again to break through the $1.68 level against the US Dollar and once again, traders have run out of bravery before the USD has fully capitulated. On this medium term chart, this does look like a currency pair which has run out of steam and a correction back to at least 1.6350 and perhaps 1.6050 look very likely. But there are disparate messages here as well. The Relative Strength Index at the bottom of this chart would suggest the Pound is finding support and that we may have yet another pop at that 1.68 level and that may well be the case but US Dollar buyers ought to be either locking in here or placing some form of protection in place to combat the potential for a substantial decline.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.