Good morning from Hamburg and welcome to our last Daily FX Report of this week. The search for EgyptAir Flight 804 is continuing after reports that the plane's wreckage had been found turned out to be false. When searchers got close to debris found in the Mediterranean Sea they realized it didn't come from the missing airliner, EgyptAir's Vice Chairman Ahmed Adel told CNN. The Airbus A320, which had 66 people on board, disappeared early Thursday as it flew from Paris to Cairo.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

EUR/USD fell slightly on Thursday, sliding below 1.12 for the first time in more than a month, as foreign exchange traders parsed the minutes from recent meetings by the Federal Reserve and the European Central Bank for signals of further divergence between the top two central banks in the world. The currency pair traded in a broad range between 1.118 and 1.1230 before settling at 1.1201, down 0.0019 or 0.14% on the session. It came one day after the euro suffered one of its worst one-day declines versus the dollar in two months, as the Federal Open Market Committee sent broad indications that it will raise interest rates in June if the U.S. economy continues to show improvement over the next several weeks.

The euro has closed lower against its American counterpart in 11 of the last 13 sessions, dropping more than 2.5% during the span. On Thursday morning, New York Fed president William Dudley noted that it could be appropriate to raise interest rates in June or July Fed’s Dudley says June hike in the cards, though Brexit is a risk. Fed Watch tool placed the probability of a June rate hike at 26.3% on Thursday, while leaving the odds for a July rate increase relatively unchanged at 42.1%. By comparison, the CME Group said there was a 15% chance of a July rate hike last month. The CME Group also increased the probability the Fed will complete two rate hikes by December to 25.8%, up from 12.1% last month. Also in June, the FOMC will issue its quarterly long-term projections on the path of the Federal Funds Rate, PCE Inflation, changes in Real GDP and the Unemployment Rate. Any rate hikes by the Fed this year are viewed as bullish for the dollar as foreign investors pile into the greenback in order to capitalize on higher yields.

Daily Technical Analysis

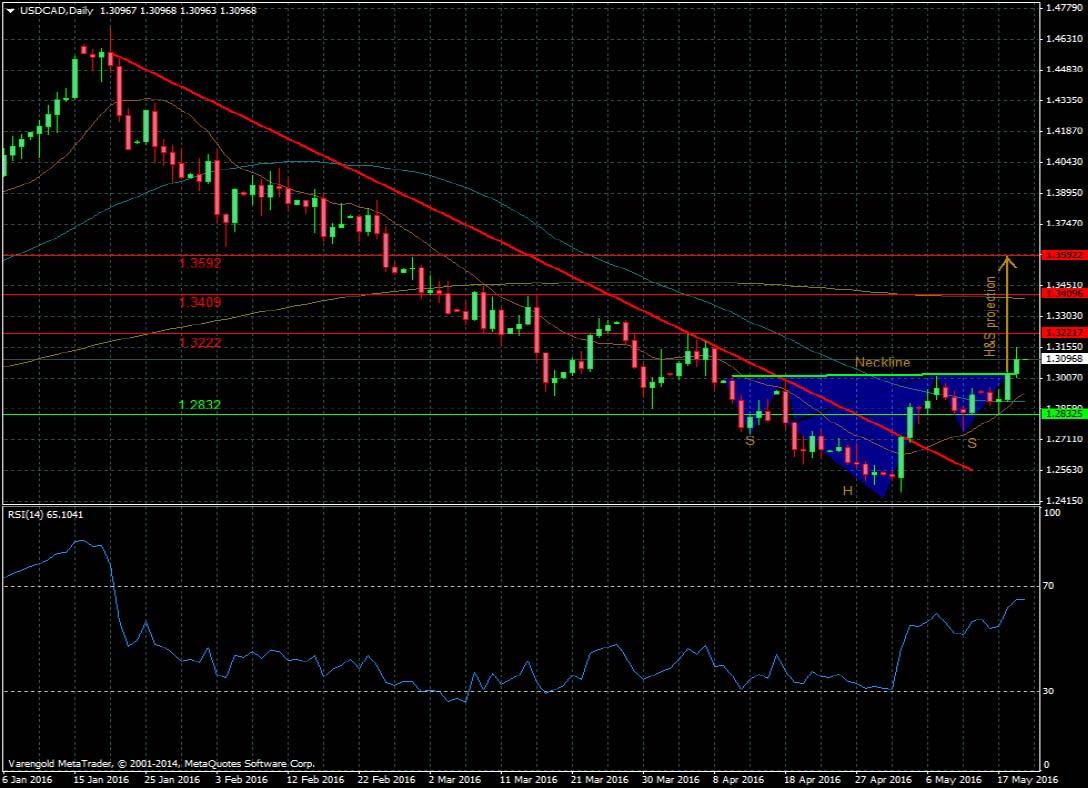

USD/CAD (Daily)

Technically, USD/CAD is confirming an inverted Head & Shoulders by breaking the neckline of this bullish pattern. At the same time, the price crossed the psycological level of 1.3000 which was also the 61.8% Fibonacci retracement of the last bearish trend. As a consequence, USD/CAD could potentially have further to rise, with 1.352 as main target coinciding with the H&S projection.

| Support Levels around | Resistance Levels around |

| 1.2832 | 1.3222 |

| N/A | 1.3409 |

| N/A | 1.3592 |

CBOT.YM (Daily)

According to the chart below, it seems the Dow Jones future is initiating a bearish trend, once the American index was unable to cross the long term resistance around 18000 points. If we believe in additional declines as the most probable scenario, we identify 17038 as the first support to consider, coinciding with the 61.8% fibonacci retracement of all the previous bullish movement, initiated in January 2016.

| Support Levels around | Resistance Levels around |

| 17038 | 18077 |

| 16720 | N/A |

| 16400 | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.