Good morning from Hamburg and welcome to our latest Daily FX Report. The Syrian army advanced toward the Turkish border on Monday in a major offensive backed by Russia and Iran that rebels say now threatens the future of their nearly five-year-old insurrection against President Bashar al-Assad. Iranian backed-militias played a key role on the ground as Russian jets intensified what rebels call a scorched earth policy that has allowed the military back into the strategic northern area for the first time in more than two years. The Russian-backed Syrian government advance over recent days amounts to one of the biggest shifts in momentum of the war, helping to torpedo the first peace talks for two years, which collapsed last week before they had begun in earnest.

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

Stock indexes worldwide tumbled on Monday, led by banking stocks in Europe and technology stocks on Wall Street on persisting fears of a global economic slowdown. Wall Street continued Friday's technology-led selloff, with the benchmark S&P 500 stock index falling as much as 2.5 percent. The Dow Jones industrial average closed down 177.92 points, or 1.1 percent, at 16,027.05 and the Nasdaq Composite dropped 79.39 points, or 1.82 percent, to 4,283.75. U.S. crude prices fell after a meeting between Saudi Arabia and Venezuela failed to reassure investors of measures to bolster sagging prices. U.S. crude was last down 71 cents, or 2.3 percent, at $30.18 per barrel. The dollar fell to its lowest level against the yen since Nov. 2014 of 115.170 yen , partly on doubts about the effectiveness of the Bank of Japan's negative interest rate policy. Safe-haven spot gold XAU= reached a peak of $1,200.60 an ounce, its strongest since June 22. An increasingly important gauge of U.S. inflation tumbled last month to its lowest level since the Federal Reserve Bank of New York began the survey in mid-2013, in what could be taken as another warning bell for the U.S. central bank. The New York Fed's survey of consumers found expectations for inflation one and three years in the future fell as Americans were more cognizant of lower gasoline prices and costs of medical care and college. The Fed raised rates in December and aims to keep tightening. But a market selloff in January and worries over a global slowdown has some Fed officials worried that inflation, at 1.4 percent now according to their preferred measure, will not rebound as soon as desired.

Daily Technical Analysis

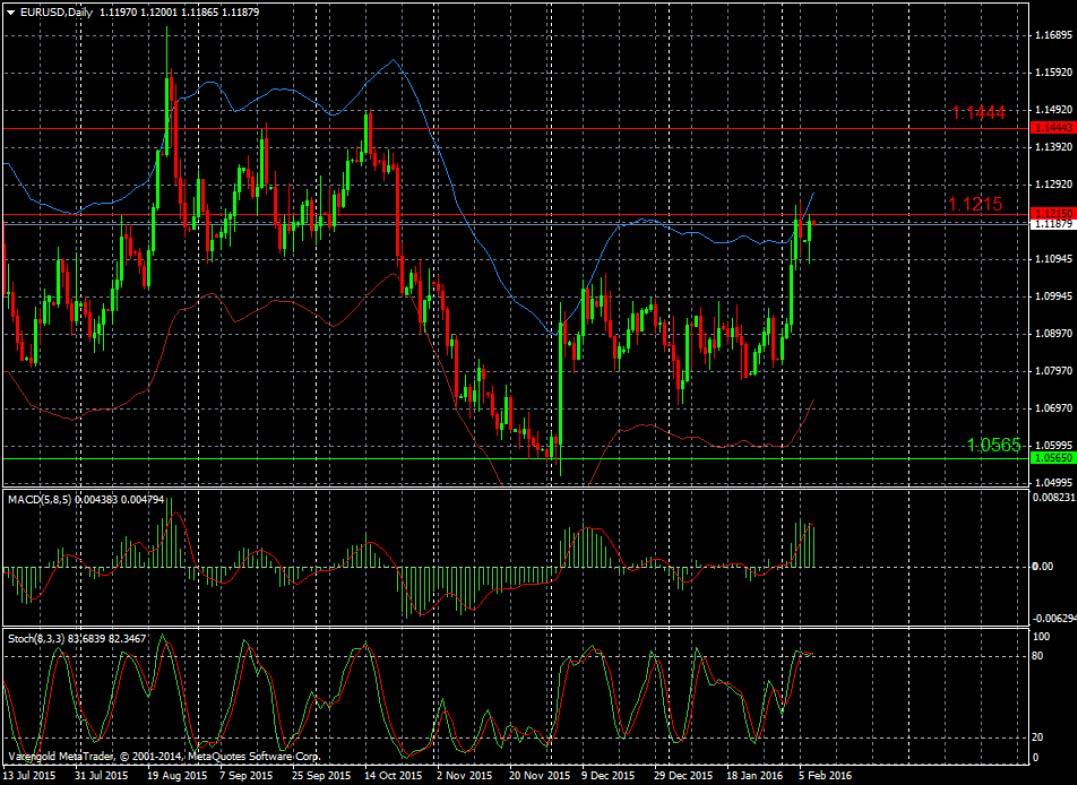

EUR/USD (Daily)

One of the most important currency pairs worldwide is held under control of the bears. It doesn’t seem to be a stable long term support line, as this pair is highly influenced by economic world data and now especially by the QE program from ECB and the Chinese worries. The current support level at 1.0565 could stop the fall. The price is moving upward now. Looking long term further losses might occur.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 1.0565 | 1.1215 |

| N/A | 1.1444 |

| N/A | N/A |

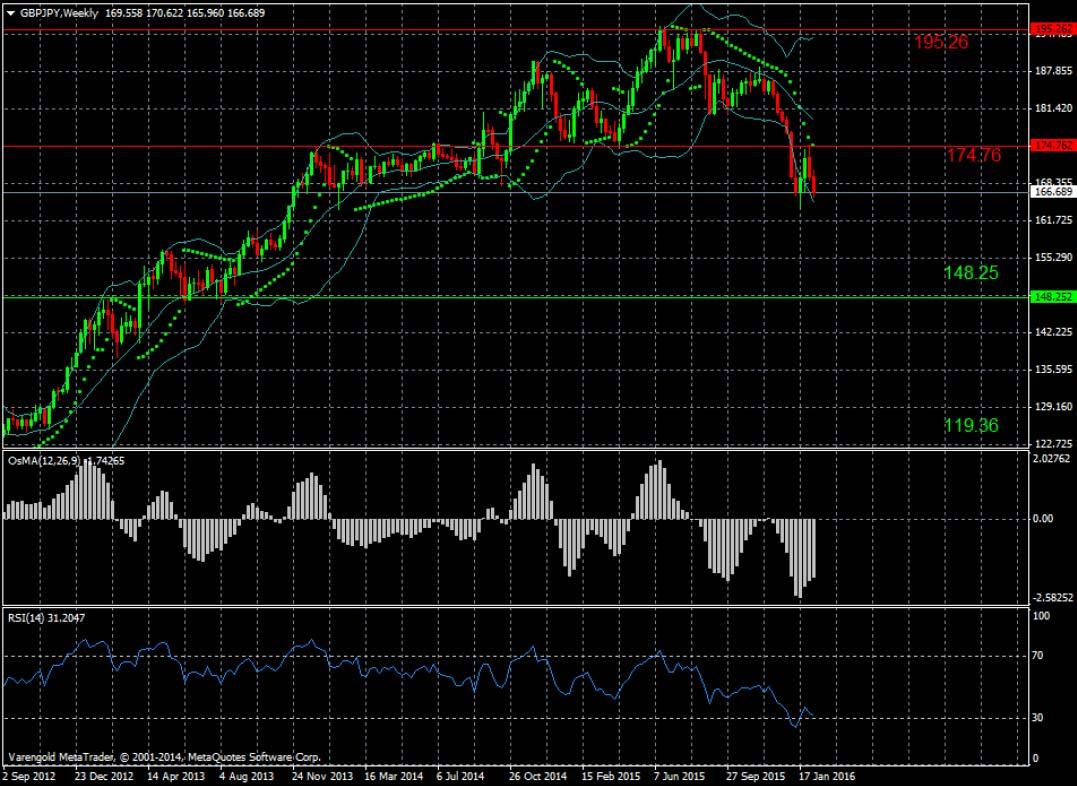

GBP/JPY (Weekly)

Looking long-term since 2012 the bulls have pushed this pair steadily upwards. The economic situation in Japan has weakened the JPY versus its major peers. Although the current situation with Crude Oil helps the JPY to gain some strength. The yen is seen now as a safe-haven currency. It could break the long term support at 169.24, so further losses might occur. The OsMA and the RSI are showing that the pair might be highly interesting for sellers.

Support & Resistance (Weekly)

| Support Levels around | Resistance Levels around |

| 148.25 | 174.76 |

| 119.36 | 195.26 |

| N/A | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.