Good morning from beautiful Hamburg and welcome to our latest Daily FX Report for this week. Volkswagen AG’s lavish parties typically featured a surprise guest, from the Pet Shop Boys to Robbie Williams to Justin Timberlake. Now the music is about to stop. The parade of global pop stars was part of a culture of spending at the world’s biggest carmaker. Confronted with billions in repairs and fines from an engine-rigging scandal, Chief Executive Officer Matthias Mueller vowed on Tuesday to put everything that’s not absolutely vital on hold. Addressing 20,000 workers at Volkswagen’s main Wolfsburg factory in Germany, Mueller prepared the crowd for “massive savings,” in what would “not be a painless process.”

Anyway, we wish you a successful trading day!

Market Review – Fundamental Perspective

The dollar is mired in its longest slide since the market turmoil of August as traders look to speeches from policy makers this week for hints the Federal Reserve may be losing confidence the U.S. economy can withstand an interest- rate increase this year. The greenback dropped versus the euro, pound and Swiss franc before scheduled remarks from Fed officials, including Esther George, John Williams and James Bullard. Their speeches follow Friday’s jobs report, which showed the U.S. labor market was weaker last month than most economists forecast. The data led traders to bet that Fed officials will wait until 2016 to lift rates. While economic data have trailed expectations, the U.S. is still outperforming its counterparts and policy divergence will limit the dollar’s losses, he said. The U.S. currency fell 0.8 percent to $1.1272 per euro as of 5 p.m. in New York. It slipped 0.2 percent to 120.23 yen. Bloomberg’s Dollar Spot Index, which tracks the currency versus 10 major peers, declined for a fourth day. That’s the lengthiest stretch since Aug. 19-24, when financial markets were being whipsawed in the wake of China’s devaluation. After holding rates near zero last month amid overseas volatility, Fed officials have emphasized the strength of the U.S. economy and indicated they still expect to raise interest rates this year for the first time since 2006. The jobs report casts doubt on that assessment. Employers added 142K workers in September, below the lowest estimate of economists surveyed by Bloomberg. The Canadian dollar gained for a fifth day, the longest streak since June, rebounding after last week’s plunge to an 11-year low. The currency’s 0.3 % gain to C$1.3048 versus its U.S. counterpart coincided with a 4.2 % advance in Brent crude oil as of 11:23 a.m. in New York.

Daily Technical Analysis

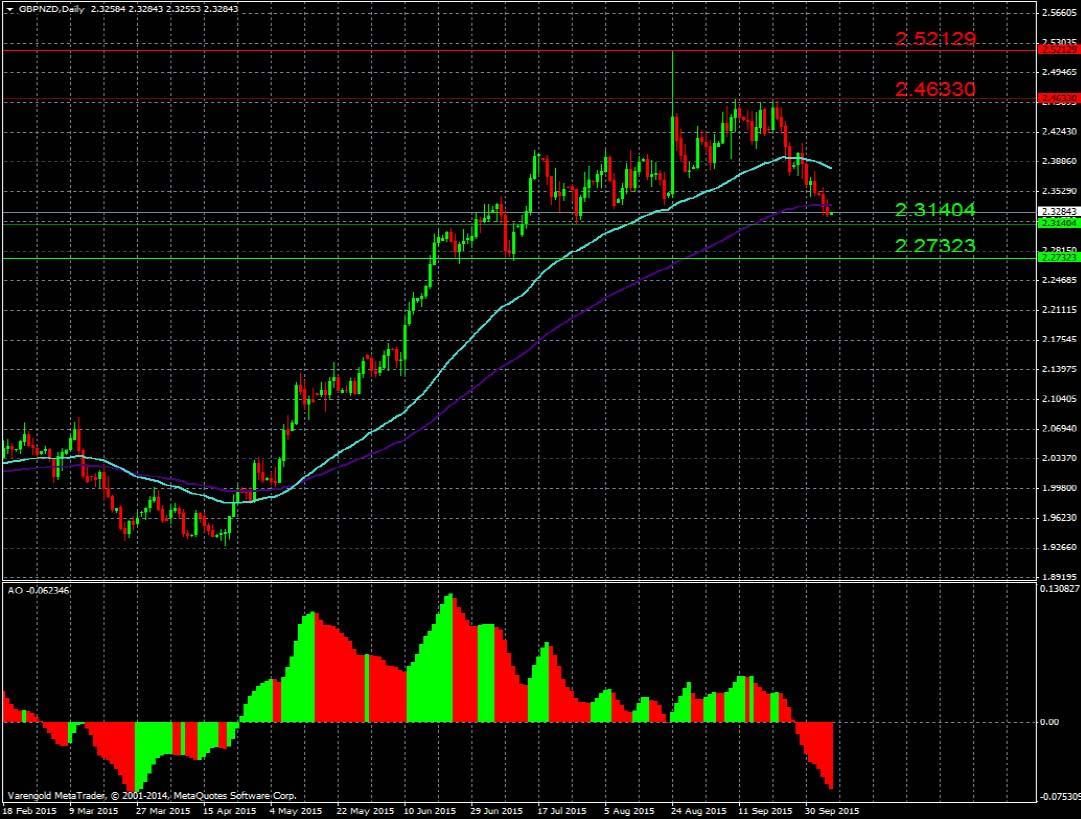

GBP/NZD (Daily)

The British Pound strengthened against the New Zealand Dollar since May. Last week the price felt below the first Exponential Moving Average 50 and a correction started. Current price candles maybe reached now fair value at the second EMA 100. It might be possible that bulls are able to start a pullback in short term.

Support & Resistance (Daily)

| Support Levels around | Resistance Levels around |

| 2.31404 | 2.46330 |

| 2.27323 | 2.52129 |

| N/A | N/A |

EUREX.FGBL (H1)

Bund future performed very bullish last days and touched the upward trend line yesterday. It seems to be possible that increasing value continues, if momentum appears. For those Traders, who wants to speculate on higher prices, they should consider next support levels to protect their positions. It should be await for the first minutes after the opening at 6 a.m. (GMT).

Support & Resistance (H1)

| Support Levels around | Resistance Levels around |

| 155.91 | 157.65 |

| 155.13 | N/A |

| N/A | N/A |

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.