Good morning from beautiful Hamburg and welcome to our last Daily FX Report for this week. U.S. stocks eased on Thursday as mixed messages about Greece's debt talks kept investor uncertainty high along with a sharp drop in Chinese shares after brokers tightened margin rules. Seven of the 10 major S&P 500 sectors were lower, with the industrials sector falling the most, 0.4 percent, a day after the Nasdaq closed at a record high. International Monetary Fund Managing Director Christine Lagarde said there was still a lot of work to do before Greece and its international lenders could clinch a cash-for-reforms deal. Greece's government said it aims to reach an agreement with lenders by Sunday. A euro zone official said Greece will not be able to get the money still available under its current bailout plan if it does not agree to the outline of a such a deal by the end of the week.

Anyway, we wish you a successful trading day and a relaxing weekend!

Market Review – Fundamental Perspective

The dollar climbed to a 12-1/2-year high against the yen on Thursday before pulling back as investors bet that U.S. interest rates will rise later this year while Japan's monetary policy remains ultra-loose. The latest data on U.S. jobless claims and pending home sales supported expectations that the Federal Reserve is moving toward raising rates by year-end. The USD was last up 0.2 percent at 123.915 yen after touching 124.46 yen on the EBS trading system earlier. Year to date, the dollar has gained 3.8 percent against the yen. In contrast, the USD weakened against the euro even in the absence of a deal between Greece and its lenders, although hopes persisted that the cash-strapped nation will soon secure more money to avert a default. The euro was up 0.4 percent at $1.09485, erasing earlier losses tied to encouraging U.S. jobless claims and pending home sales data. The dollar index fell 0.5 percent after rising 1.4 percent in the previous two sessions. The biggest mover on other major currencies was the AUD, which shed 1 percent against the USD. Commodity currencies came under pressure across the board, with the Aussie hitting a six-week low of $0.7618 and New Zealand's dollar shedding over 1 percent to trade at $0.7130 , its weakest in over four years. Front-month Brent rose 1.4 percent to $62.91 a barrel and U.S. crude futures rose 0.8 percent to $57.97. Gold was little changed near $1,188 an ounce, spot silver dipped less than 0.1 percent on the day and copper rose 0.2 percent.

Daily Technical Analysis

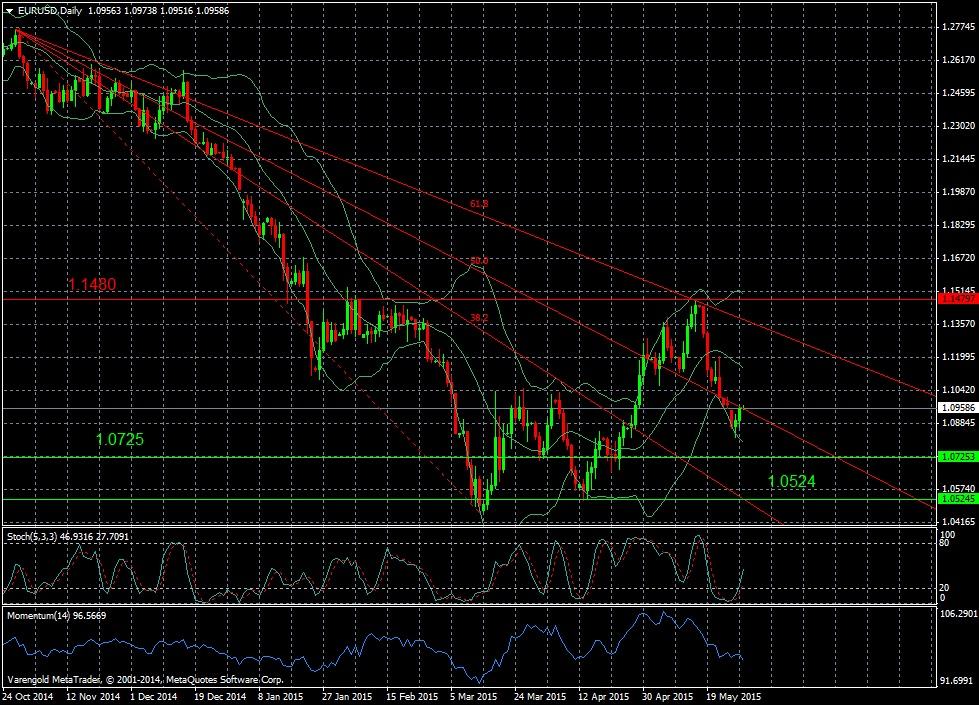

EUR/USD (Daily)

Since June the bears took control over this currency pair and the euro experienced a sharp decline versus the USD and even reached its lowest level for more than 10 years. After experiencing this decline to a level of around $1.04, the EUR was able to regain a bit and is now traded at around $1.095. After a pretty sharp decline over the last weeks the EUR could recover a bit. According to the indicators further gains may be possible. The decision about Greece`s debt repayment will clearly influence the direction of the pair.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

US Nonfarm Payrolls surprised to the downside in April, showing a gain of 175K jobs – LIVE

The job creation in the US economy seems to have slowed its pace after Nonfarm Payrolls figures reported an increase of 175K jobs in April, coming in short of consensus for a 243K gain.

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.