Good morning from beautiful Hamburg and welcome to our last Daily FX Report for this week. Ukraine, Russia and the European Union signed a deal on Thursday on the resumption of Russian natural gas supplies to Ukraine for winter after several months of delay during the conflict in Ukraine. European Commission President Jose Manuel Barroso, who witnessed the three-way signing ceremony in Brussels as he prepares to leave office on Friday, said: "There is now no reason for people in Europe to stay cold this winter."

Anyway, we wish you a successful trading day and a relaxing weekend!

Market Review – Fundamental Perspective

As the U.S. economy expanded more than forecasted in the thirs quarter to confirm the Federal Reserve`s decision to end its bond-buying program, the dollar touched a three-week high against its major counterparts. The dollar index climbed as far as 86.491 - a high last seen on Oct. 6 - after U.S. gross domestic product grew at an annual pace of 3.5 percent in the third quarter, beating forecasts for 3.0 percent. The index has since eased back to 86.174, but was still up 0.5 percent so far this week. Against the yen, the greenback bought 109.32, near a fourweek high of 109.47 reached overnight. The euro fell as low as $1.2545, but managed to recover to $1.2606. The GDP report should go some way in justifying the Fed's optimistic stance on the economy when it announced the end of its monthly bond buying stimulus program on Wednesday. The New Zealand dollar climbed to $0.7837, turning around from a slide to a fourweek low of $0.7765 on Thursday after the Reserve Bank of New Zealand softened its tightening bias. The Canadian dollar held steady against a stronger greenback on Thursday as investors limited their bets and mulled over the implications of the more hawkish tone adopted by the U.S. Federal Reserve and comments by the governor of the Bank of Canada. The Canadian dollar closed at C$1.1196 to the U.S. dollar, or 89.32 U.S. cents, little changed from Wednesday's finish of C$1.1191, or 89.36 U.S. cents. Both benchmark Brent and U.S. crude gained about 1 percent a day earlier as U.S. crude stockpiles rose less than expected last week, ending two weeks of builds that pressured the market. Brent crude for December delivery settled down 88 cents a barrel at $86.24, after falling to as low as $85.92. Front-month U.S. crude finished down $1.08 at $81.12, after a session low at $80.80.

Daily Technical Analysis

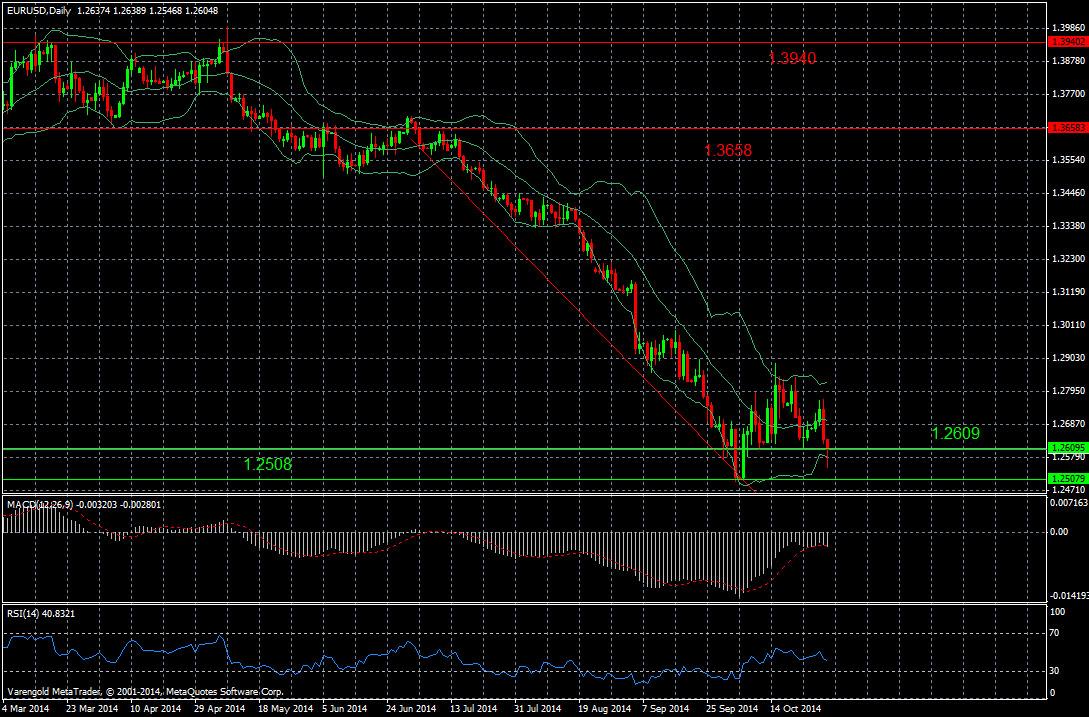

EUR/USD (Daily)

Since June the euro experienced a sharp decline versus the dollar until the currency pair dropped to the support level at 1.2508 where it rebounded. After that we observed a small recovery of the European shared currency in the last weeks, but the USD was able to regain its strength and forced the EUR to decline. At the moment the pair is traded slightly above the first support line and it remains to be seen whether this support will hold. The indicators support the thesis that we may see a sideward movement or even a tiny appreciation of the EUR against the USD in the near future.

Support & Resistance (Daily)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.