The Dollar

The dollar's daily cycle peaked on day 13. The dollar then formed a swing high the next day, lost the 50 day MA as it begin to decline into its daily cycle low.

This past week the dollar back test the 200 MA before breaking lower. The dollar printed its lowest point on Friday, which was day 25. That places the dollar late in its timing band for a daily cycle low. Friday's bullish reversal has eased the parameters for forming a swing low. A break above 95.19 will form a swing low and likely signal a new daily cycle and, as we will discuss on the weekly chart, quite possibly a new intermediate cycle.

The intermediate dollar cycle peaked in November, which was week 14. It went on to print its lowest point in early February. The February low was week 24, placing the dollar in its timing band to print an intermediate cycle low. But by breaking below the previous daily cycle low, the dollar extended its intermediate cycle decline which makes this week 29. At 29 weeks the dollar is deep in its timing band to print an intermediate cycle low. The odds are quite good that once a new daily cycle forms, it will also signal a new intermediate cycle as well.

Stocks

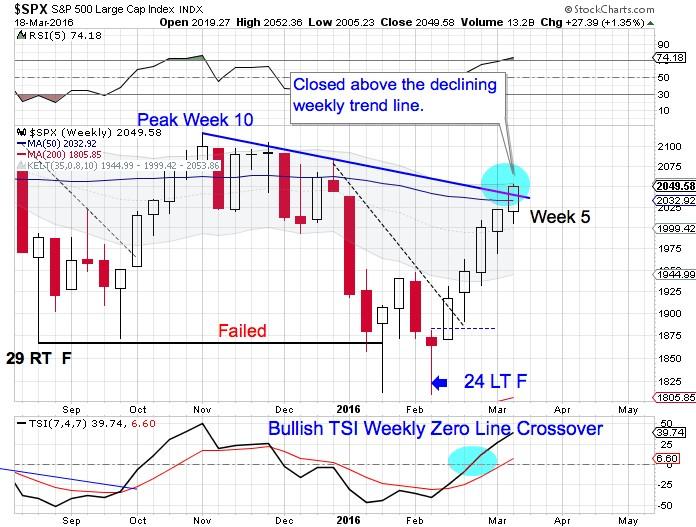

After a brief pause at the 200 MA, stocks powered higher through Friday.

The new high on Friday, on day 25, assures us of a right translated cycle formation and further verifies that 2/11 hosted an intermediate cycle low. Stocks continue to close above the upper daily cycle band, indicating that stocks remain in a daily uptrend.

This is week 5 for the new intermediate cycle and stocks closed above the declining weekly trend line. If stocks can close above the upper weekly cycle band that would indicate that February also was the yearly cycle low.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD rises to daily tops past 1.0800 post-NFP

The selling bias in the Greenback gathers extra pace on Friday after the US economy created fewer jobs than initially estimated in April, lifting EUR/USD to the area of fresh peaks above 1.0800.

GBP/USD surpasses 1.2600 after disheartening US Payrolls

The resumption of the downward pressure in the US Dollar motivates GBP/USD to extend its earlier advance to the area beyond 1.2600 the figure in the wake of the release of US NFP.

Gold climbs to new highs above $2,300 on poor NFP prints

The precious metal maintains its bullish stance and breaks above the $2,300 barrier on Friday after US Nonfarm Payrolls showed the economy added fewer jobs than expected during last month.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.