Market Analysis

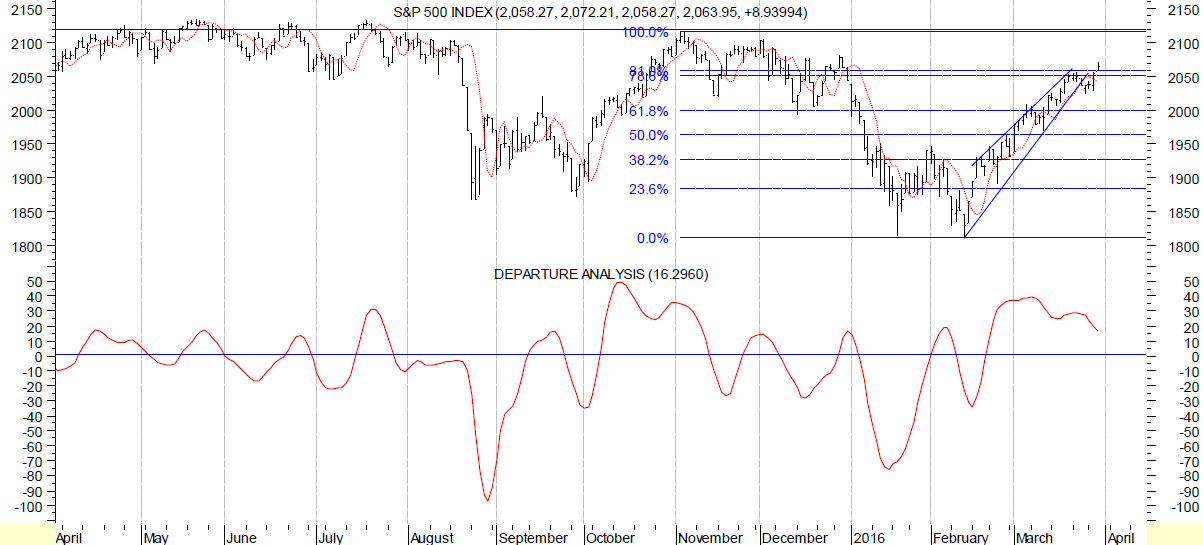

At this point, the actual market activity has been mostly in line with the cycle projections. Below, we see that the daily S&P has traced out a rising wedge from which it has begun to break down. A divergence between price and momentum can be detected. But the cycles still point up, so there has been little follow through on the downside.

The daily S&P surpassed both the critical 38% and 50% retracement levels. Price sits just above the ‘last stop’ 78.6% and 81% retracement levels. A run at the old highs is likely by mid-month.

Daily S&P 500

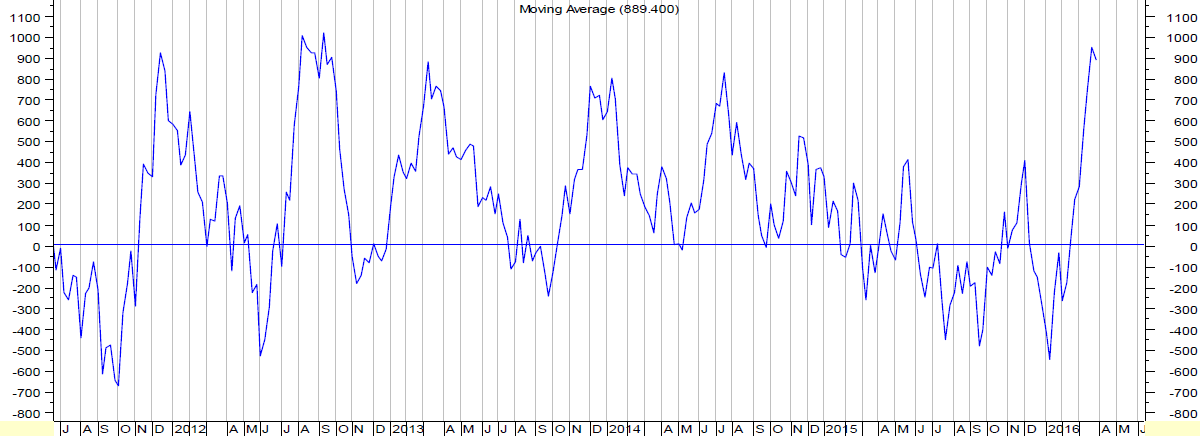

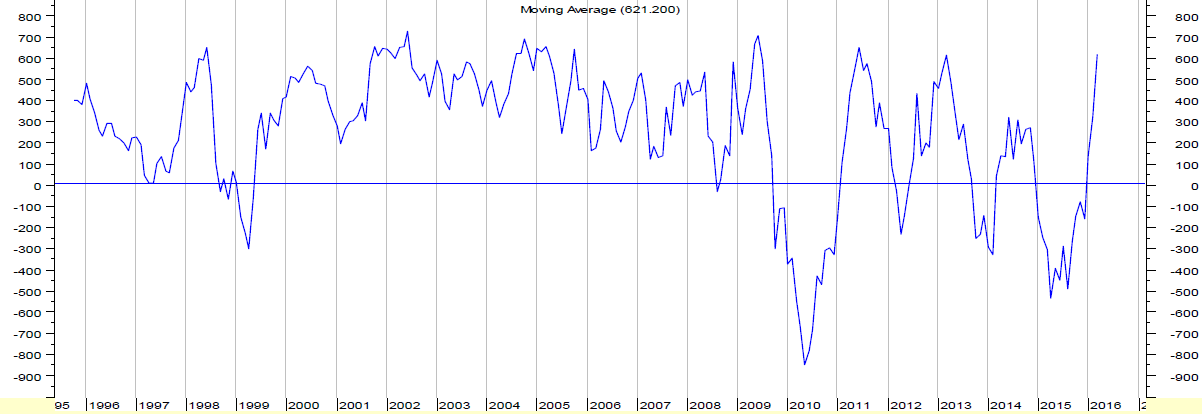

Below are weekly and monthly oscillators of advances less declines. Both are overbought.

Weekly NYSE Advances Less Declines (10-Period M.A.)

Monthly NYSE Advances Less Declines (10-Period M.A.)

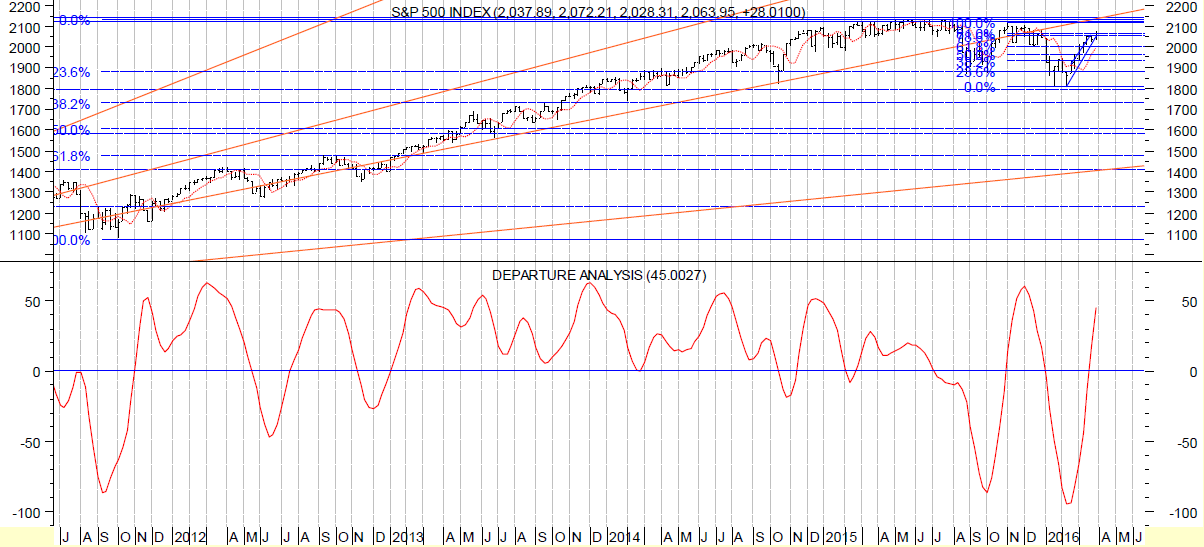

The weekly chart is now overbought.

Weekly S&P 500

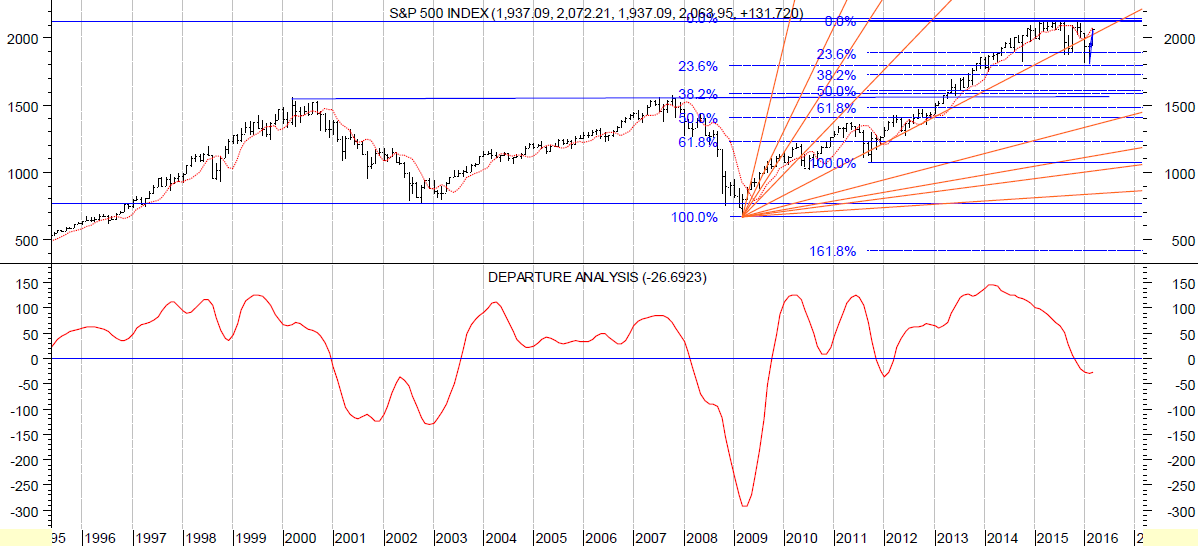

The monthly graph shows that the decline has hit the 23.6% retracement levels of 1 prior rally and the 38.2% retracement of another rally. The longer-term support and the projected lows are in the 1550-1600 range by the autumn.

This is an excerpt from the monthly Cycles Research Early Warning Service, a monthly e-mail report that analyzes the trends in the US stock market, the bond market, and the gold market. There are stock and ETF recommendations and high-probability S&P turning points.

Cycles Research Investments, LLC does not guarantee the accuracy and completeness of this report, nor is any liability assumed for any loss that may result from reliance by any person upon such information. The information and opinions contained herein are subject to change without notice and are for general information only. The data used for this report is from sources deemed to be reliable, but is not guaranteed for accuracy. Past performance is not a guide or guarantee of future performance. The information contained in this report may not be published, broadcast, re-written, or otherwise distributed without prior written consent.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.