EUR/USD Current price: 1.1231

View Live Chart for the EUR/USD

Monday is proving to be quite dull, with the major pairs trading in limited ranges during the European session, as London is off. During Asian hours, the greenback came under limited selling pressure, as Chinese shares fell once again, although the movements have been shallow compared to last week ones. There were some positive news in Europe, as German Retail Sales surged 1.4% in July, beating expectations of 1.0%. The EU yearly inflation remained at 0.2% against 0.1% expected, but the market was hardly able to react to the news. Later on during the American session, the US will release its Chicago PMI for August, expected unchanged at 54.7.

Technically however, the EUR/USD pair remains stuck around the 1.1200 figure, with the 1 hour chart presenting a neutral technical stance, as the price hovers around a horizontal 20 SMA, whilst the technical indicators lack strength around their mid-lines. In the same chart, the 100 SMA has extended its decline above the current level, approaching the 200 SMA both in the 1.1320 region. In the 4 hours chart, the technical indicators aim slightly higher below their mid-lines, while the 20 SMA heads sharply lower above the current level, containing advances around the daily high. The pair has a strong resistance around 1.1280, the 61.8% retracement of its latest bullish run, and the upside seems quite limited as long as it remains below it.

Support levels: 1.1160 1.1120 1.1075

Resistance levels: 1.1245 1.1280 1.1330

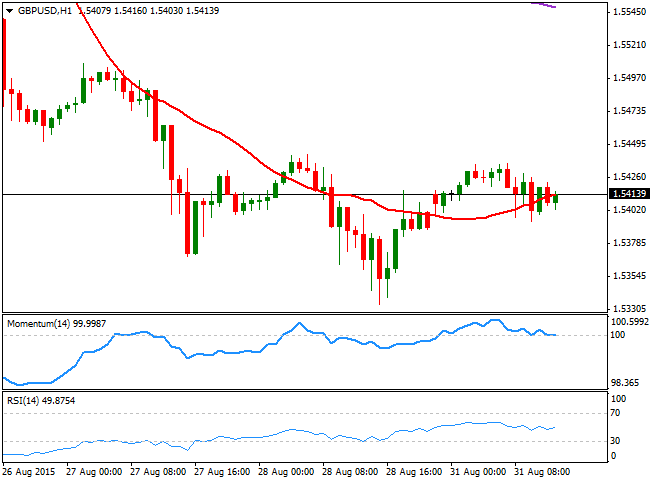

GBP/USD Current price: 1.5413

View Live Chart for the GPB/USD

The GBP/USD pair consolidates above the 1.5400 level, having been as high as 1.5436 during the Asian session, and showing little aims to move higher ahead of the US opening. The short term picture is neutral, with the price right below its 20 SMA and the technical indicators hovering around their mid-lines. In the 4 hours chart, the pair maintains its bearish longer term tone, with the price retreating from a strongly bearish 20 SMA , the Momentum indicator lacking directional strength below the 100 level, and the RSI indicator turning back south around 38. At this point, the price needs to break below 1.5370 to be able to retest last week lows around 1.5335.

Support levels: 1.5370 1.5335 1.5290

Resistance levels: 1.5430 1.5760 1.5710

USD/JPY Current price: 121.28

View Live Chart for the USD/JPY

Downward risk increases below 121.00. The USD/JPY pair eased some from its recent highs, falling down to 120.87 during the Asian session, as falling local share markets triggered demand for safe-haven yen. The pair however, managed to bounce some 50 pips from the level, and remains stuck around 121.30. Bulls are having a hard time to return, as poor inflation figures in Japan suggests the BOJ may need to add stimulus during the upcoming month, to reach its 2% inflation target. Technically, the short term picture is neutral, as the 1 hour chart shows that the price is hovering around its 200 SMA, whilst the technical indicators hover around their mid-lines. In the 4 hours chart the technical indicators also lack directional strength, but hold well above their mid-lines. In this last chart, the 100 SMA presents a tepid downward slope around 122.80. Daily basis, further recoveries are not yet confirmed, as despite the pair has recovered above its 200 DMA, around 121.00, the technical indicators have lost their upward strength and are now heading back south. A daily close below this last should be quite disappointing for bulls, and open doors for a retest of the 120.00 figure.

Support levels: 121.00 120.60 120.20

Resistance levels: 121.70 122.10 122.45

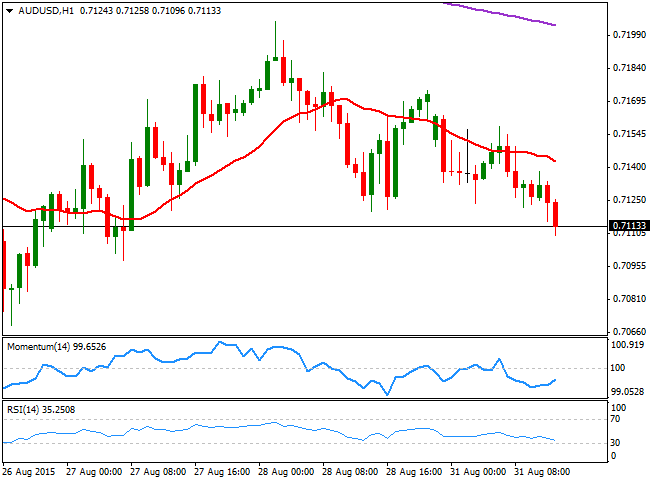

AUD/USD Current price: 0.7133

View Live Chart for the AUD/USD

The Australian dollar is once again being hit by Chinese turmoil, down against the greenback to a fresh daily low near 0.7100. The AUD/USD pair presents a short term bearish tone, with the price extending below its 20 SMA and the RSI indicator heading south around 34, anticipating additional declines. In the 4 hours chart, the downside is also favored, as the Momentum indicator turned sharply lower below the 100 level, whilst the RSI also heads south in negative territory, as the price accelerates below its 20 SMA.

Support levels: 0.7070 0.7030 0.6985

Resistance levels: 0.7140 0.7190 0.7240

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.