EUR/USD Current price: 1.1066

View Live Chart for the EUR/USD

The dollar reverted all of its latest gains and aims to return to its weekly lows against most of its rivals, following the release of US employment cost data for the second quarter of 2015. Wages rose 0.2% against expectations of a 0.6% advance, the smallest gain on records since 1982. The number does not bode well for those betting on a September rate hike, as poor wages is the Achilles heel in the employment sector. Dollar bulls rushed to take profits out of the table, and the EUR/USD jumped over 100 pips in the first 10 minutes, trading above the 1.1050 level now and poised to continue advancing in the short term, as the 1 hour chart shows that the price accelerated through its 100 and 200 SMA, whilst the technical indicators head north above their mid-lines. Nevertheless, the price needs to hold now above the 1.1050 figure after the dust settles to be able to continue gaining today. In the 4 hours chart, the technical picture also favors the upside, with the next critical level now at 1.1120. A weekly close above it should put the dollar under strong selling pressure during the first half of next week.

Support levels: 1.1045 1.1000 1.0960

Resistance levels: 1.1080 1.1120 1.1160

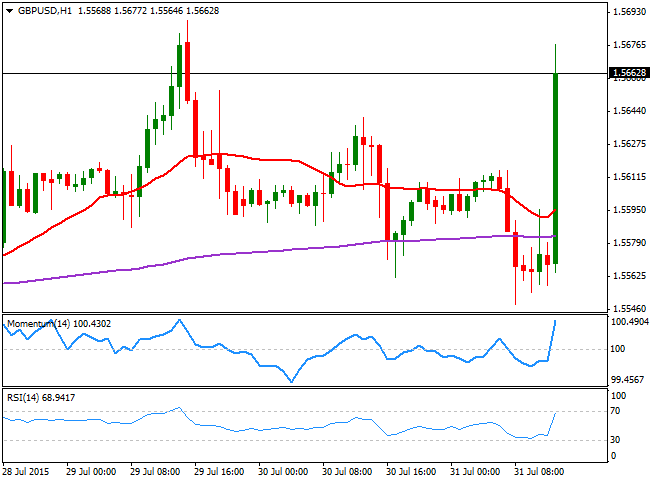

GBP/USD Current price: 1.5664

View Live Chart for the GPB/USD

The GBP/USD pair soared to 1.5677 on the back of US poor wages data, stalling however around the selling level that contained the advance for most of this July. The retracement so far has been quite shallow, with the pair holding near the highs, and the 1 hour chart showing that the technical indicators present a strong upward momentum. In the 4 hours chart, the technical indicators have turned sharply higher above their mid-lines, whilst an early dip found support around a horizontal 200 EMA. At this point, the pair needs to hold above 1.5635 to be able to sustain the bullish tone, and extend beyond the 1.5700 level.

Support levels: 1.5635 1.5600 1.5560

Resistance levels: 1.5680 1.5730 1.5770

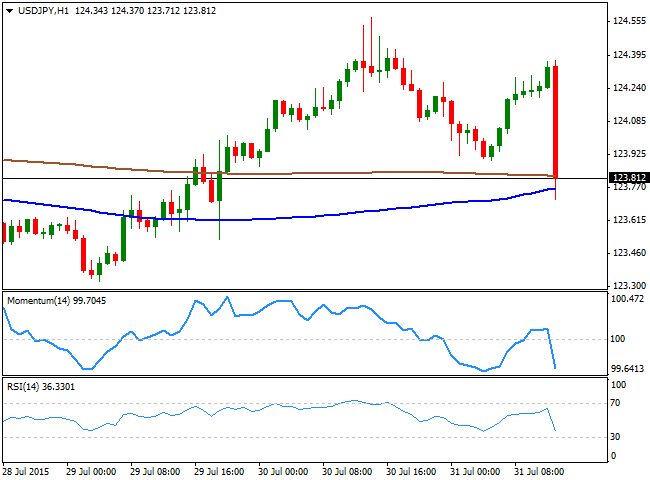

USD/JPY Current price: 123.79

View Live Chart for the USD/JPY

Eyeing 123.30 now. Market did not need much of a reason to sell the USD/JPY above the 124.00 level, and latest US data accelerated the decline, with the pair down over 50 pips in a few minutes. Weak wages in the US and month-end profit taking weigh on the USD, and the USD/JPY seems poised to extend its decline, particularly on renewed selling interest below 123.70, the immediate support. The 1 hour chart shows that the price is struggling around its 100 and 200 SMAs, both in the 123.70/80 region and horizontal, providing a limited support area, whilst the technical indicators followed price's decline and head sharply lower. In the 4 hours chart, the downward potential is more limited, as the technical indicators turned lower but remain above their mid-lines, whilst the 100 SMA continues to head higher below the current level.

Support levels: 123.70 123.30 122.90

Resistance levels: 124.10 124.60 125.00

AUD/USD Current price: 0.7314

View Live Chart for the AUD/USD

The AUD/USD bounced sharply higher from a fresh multi-year low set at 0.7233, now having trouble to continue advancing beyond the 0.7300 level, as the background bearish trend prevails. Short term, the 1 hour chart presents a bullish stance, with the indicators heading higher above their mid-lines and the price above its 20 SMA, although in the 4 hours chart, the upward potential seems more limited, as the price is struggling around a horizontal 20 SMA whilst the technical indicators aim higher but remain below their mid-lines.

Support levels: 0.7250 0.7220 0.7185

Resistance levels: 0.7320 0.7350 0.7390

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.