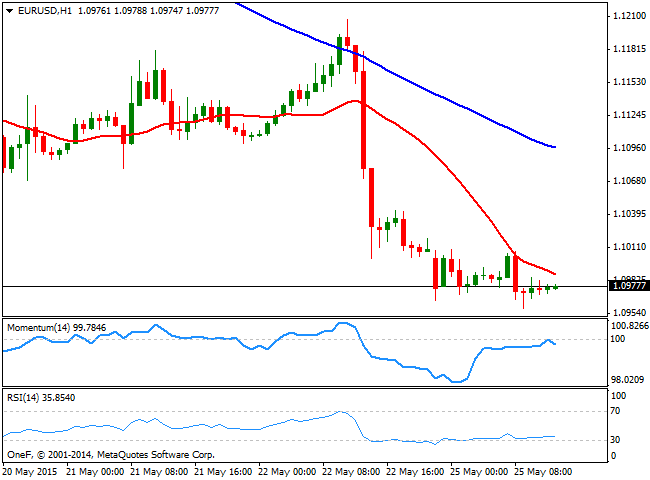

EUR/USD Current price: 1.0977

View Live Chart for the EUR/USD

The holidays in Europe and the US are keeping the FX board subdued, with majors consolidating in quite limited ranges this Monday. The EUR/USD pair has fell down to 1.0958, breaking below the 1.1000 level for the first time this May, amid doom Greek headlines, anticipating the country won't be able to meet its due payments to the IMF in June. The dollar surged on Friday, as higher inflation in the US boosted hopes of a soon rate hike in the country. Technically, the EUR/USD 1 hour chart maintains a negative tone, with the price a few pips above the mentioned level, and the technical indicators in negative territory, albeit lacking directional momentum amid the lack of volume. In the 4 hours chart the bias is also lower as the Momentum indicator heads south below 100 whilst the 20 SMA maintains is bearish slope above the current price.

Support levels: 1.0960 1.0910 1.0870

Resistance levels: 1.1000 1.1050 1.1100

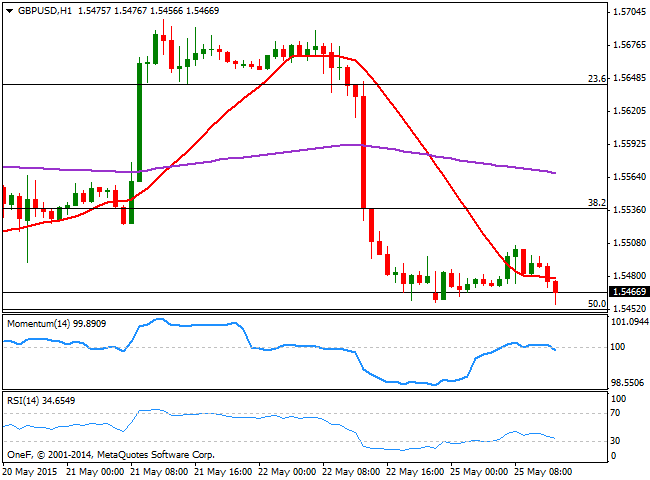

GBP/USD Current price: 1.5467

View Live Chart for the GBP/USD

The GBP/USD pair failed to regain the 1.5500 level, as an early spike to 1.5506 resulted in a retracement down to fresh daily lows of 1.5456. Trading with a limited bearish tone, the 1 hour chart shows that the price is now below its 20 SMA, whilst the Momentum indicator turned lower around 100 and the RSI indicator maintains a bearish slope near oversold levels. In the 4 hours chart the price is approaching a critical support area at 1.5440, 50% retracement of its latest bullish run, and last week low, whilst the technical readings present a bearish tone that supports additional declines on a break below the mentioned Fibonacci level.

Support levels: 1.5440 1.5400 1.5340

Resistance levels: 1.5495 1.5535 1.5580

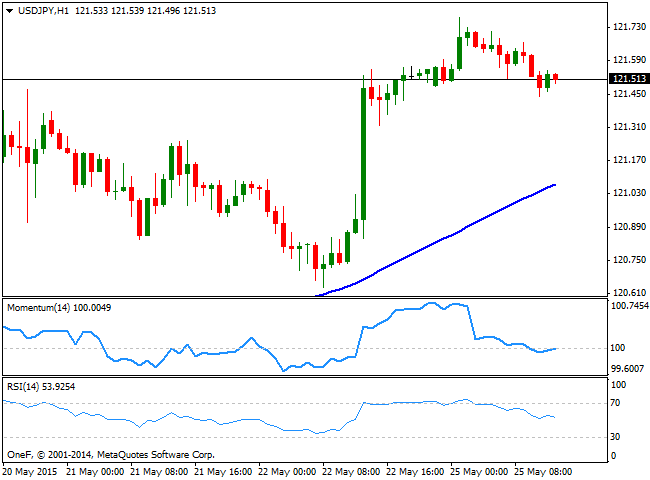

USD/JPY Current price: 121.51

View Live Chart for the USD/JPY

The USD/JPY extended its advance up to 121.77 during the Asian session, but gave up its intraday gains and hovers around its daily opening in the 121.50 price zone. Nevertheless, the 1 hour chart shows that the price stands well above a strongly bullish 100 SMA around 121.10, whilst the Momentum indicator aims to regain the upside around the 100 level and the RSI indicator hovers around 53. In the 4 hour chart, the technical indicators remain well into positive territory and aiming higher, supporting the ongoing bullish trend despite the lack of upward momentum.

Support levels: 121.10 120.85 120.45

Resistance levels: 121.60 122.10 122.50

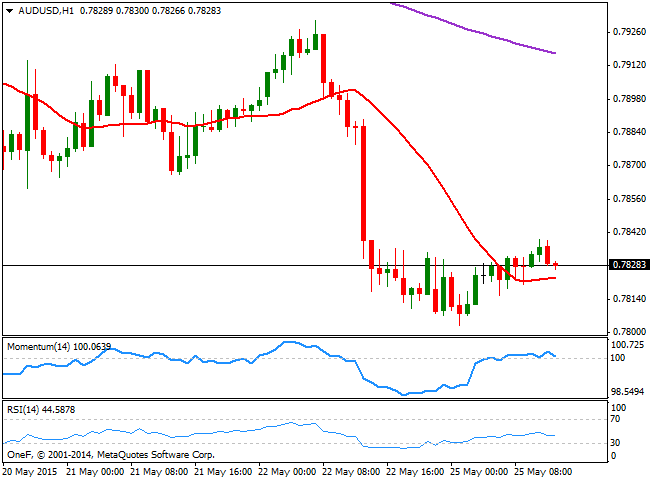

AUD/USD Current price: 0.7827

View Live Chart for the AUD/USD

The AUD/USD trades around its daily opening, having set a daily low of 0.7802 earlier in the day. The downside is favored on a break below the critical figure, as the 1 hour chart shows that the indicators are turning south around their midlines, albeit limited due to the lack of volume. In the 4 hours chart, the price continues to extend below its 200 EMA, wilst the 20 SMA has crossed below it and maintains a strong bearish slope, supporting the general negative tone.

Support levels: 0.7800 0.7775 0.7750

Resistance levels: 0.7845 0.7890 0.7930

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.