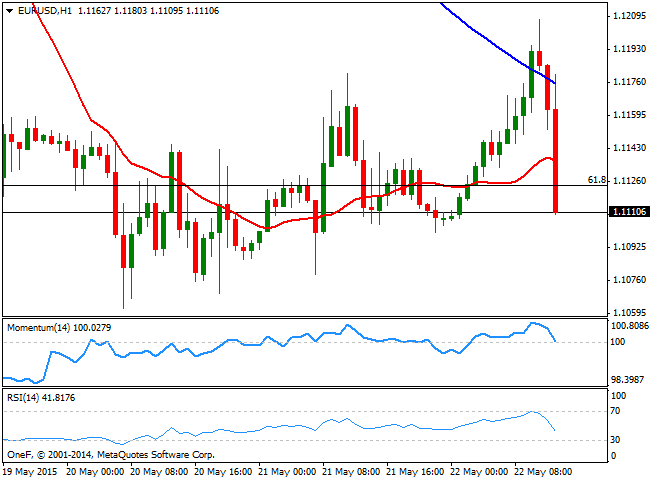

EUR/USD Current price: 1.1090

View Live Chart for the EUR/USD

The EUR/USD flirted with the 1.1200 price zone during the European session, amid general dollar weakness, albeit selling interest around the level sent the pair back down towards the 1.1150 price zone. Earlier in the day, the German IFO Survey showed business expectations fell below expected, whist the current situation was seen better than expected, but worse than in the previous month according to May readings. In the meantime, a Central Bankers forum is being held in Portugal and authorities from most of the major economies are scheduled to speak along the day, with investors looking for clues on upcoming economic policy meetings. The US released its inflation figures ahead of the opening, showing that core consumer prices rose in April by the most in 2 years, up to 1.8% yearly basis and 0.3% compared to the previous month. The dollar surged sharply across the board, and the EUR/USD trades near the 1.1100 level, with the 1 hour chart showing that the price is now below its 20 SMA, and the key Fibonacci resistance at 1.1120, whilst the technical indicators have turned sharply lower around their mid-lines. In the 4 hours chart the technical indicators are turning lower around their mid-lines, supporting additional declines should the price extend below 1.1100.

Support levels: 1.1100 1.1050 1.1000

Resistance levels: 1.1160 1.1210 1.1250

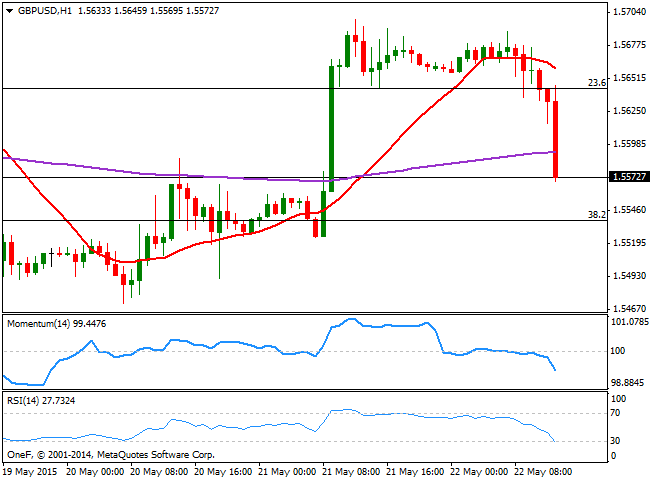

GBP/USD Current price: 1.5570

View Live Chart for the GBP/USD

The GBP/USD trader lower in range during the first half of this Friday, reaching a daily low of 1.5615, but for the most consolidating around the 1.5640 level, 23.6% retracement of the bullish run between 1.5088 and 1.5814. US inflation figures release however, pushed the pair lower, now trading below the 1.5600 figure ahead of Wall Street opening. The short term picture supports a downward continuation, with the technical indicators heading sharply lower and the 20 SMA gaining bearish slope above the current price. In the 4 hours chart the price is pressuring a flat 20 SMA in 1.5580, whilst the technical indicators have turned south in positive territory, supporting a test of 1.5535, 38.2% retracement of the same rally. If the price extends below this last, this week low of 1.5445 comes as a probable bearish target for the day.

Support levels: 1.5535 1.5495 1.5445

Resistance levels: 1.5610 1.5640 1.5690

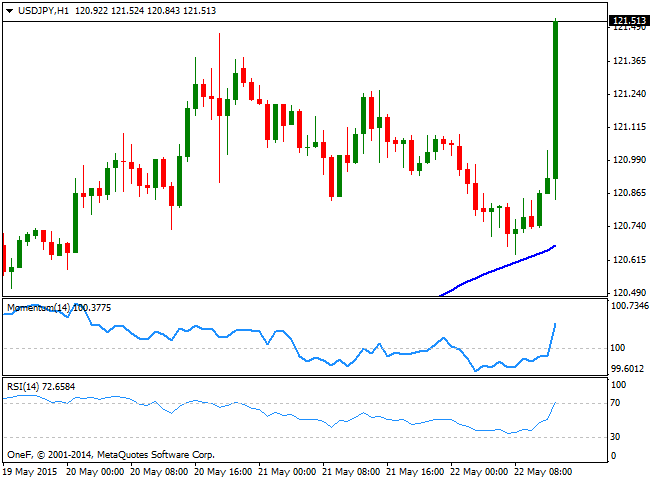

USD/JPY Current price: 121.51

View Live Chart for the USD/JPY

The USD/JPY pair fell down to 120.63 on the back of BOJ monetary policy decision to keep its economic policy unchanged during the Asian session, but surged to fresh monthly highs as dollar gains strength across the board. The 1 hour chart shows that the price is advancing above the 100 SMA that presents a strong bullish slope, while the technical indicators head strongly north above 100. In the 4 hours chat the technical indicators bounced from their mid-lines and regained the upside, supporting a retest of the 122.00 price zone with renewed buying interest above 121.60.

Support levels: 121.15 120.85 120.45

Resistance levels: 121.60 122.10 122.50

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.