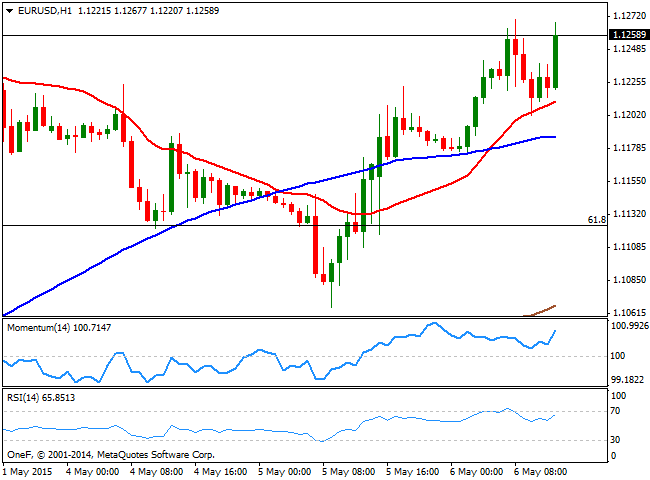

EUR/USD Current price: 1.1259

View Live Chart for the EUR/USD

The EUR/USD pair not only advanced above the 1.1200 level, but also reached a fresh weekly high of 1.1270, finding support in better-than-expected PMI readings in Europe. The EU Services PMI for April surge to 54.1, whilst the Composite beat expectations by printing 53.9. The readings were generally higher in all of the European major economies, with Germany being the only laggard. In the meantime, Greece has made a €200 million payment to the IMF, taking off the pressure over the common currency. The country is due to repay another €750 million to the IMF next May 12, which means by then, the market's sentiment may flip again towards risk off. In the US, the ADP survey missed expectations in April, printing just 169K, below previous 189K and below expectations of 200K, adding to the bearish dollar case. The EUR/USD pair advances towards its daily high after the news, with the 1 hour chart showing that the price held above a mild bullish 20 SMA and that the technical indicators head higher above their mid-lines, anticipating additional advances. In the 4 hours chart the pair advances above a flat 20 SMA in the 1.1180 area, whilst the technical indicators head higher above their mid-lines, anticipating additional advances.

Support levels: 1.1225 1.1180 1.1450

Resistance levels: 1.1280 1.1330 1.1365

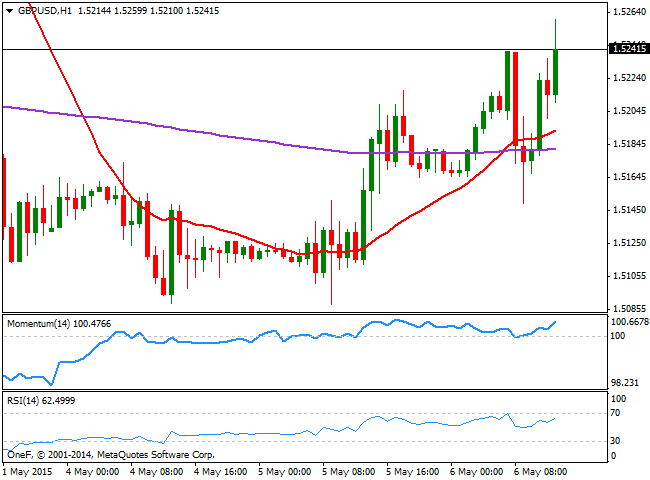

GBP/USD Current price: 1.5242

View Live Chart for the GBP/USD

The British Pound advances this Wednesday, extending up to 1.5260 against the greenback on the back of stronger local data and poor US employment readings. In the UK, the Services PMI for April surged to a eight month high of 59.5. The technical picture favors further short term advances, as the 1 hour chart shows that the price extends above a bullish 20 SMA, whilst the technical indicators head north well above their mid-lines. In the 4 hours chart the 20 SMA stands below the current level, flat around 1.5160 now, acting as intraday support whilst the technical indicators head higher in positive territory, supporting the shorter term view. Nevertheless, beware of quick profit taking on spikes ahead of Thursday UK elections.

Support levels: 1.5210 1.5160 1.5120

Resistance levels: 1.5260 1.5300 1.5340

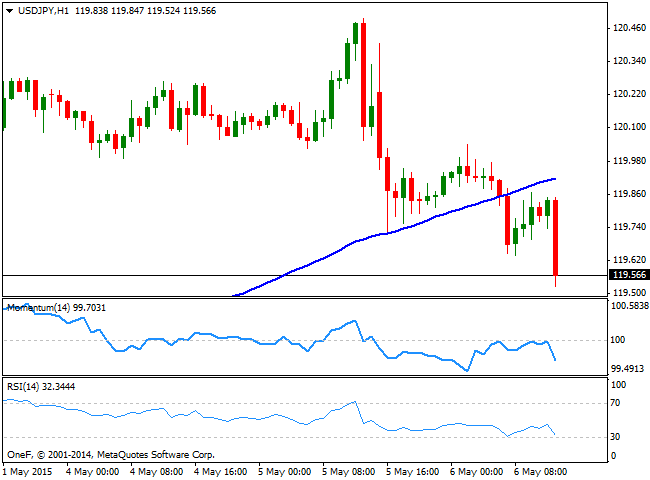

USD/JPY Current price: 119.56

View Live Chart for the USD/JPY

The USD/JPY pair accelerated its decline, now trading at fresh daily lows in the 119.50 region. The 1 hour chat shows that the price broke below its 100 SMA during the Asian session, whilst the latest decline has turned the technical indicators sharply lower from their mid-lines. In the same chart, the 200 SMA stands at 119.45 providing an immediate short term support. In the 4 hours chart the pair presents a strong downward potential, as the technical indicators head sharply lower below their mid-lines, whilst the price is breaking through the 200 SMA that presents a mild bearish slope and stands above the 100 SMA, suggesting the longer term interests are biased lower.

Support levels: 119.45 118.90 118.50

Resistance levels: 119.80 120.10 120.45

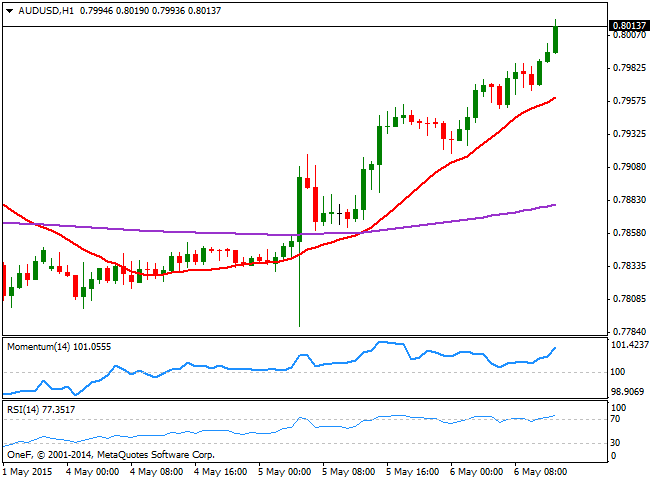

AUD/USD Current price: 0.8015

View Live Chart for the AUD/USD

The AUD/USD pair continues advancing, trading above the 0.8000 figure ahead of the US opening. The pair has been in a steady advance ever since the latest RBA meeting, as despite the Central Bank cut its rates by 0.25%, the statement was far more hawkish than expected. Technically, the 1 hour chart shows that the price advanced sharply above a bullish 20 SMA whilst the technical indicators head higher in positive territory, and with the RSI indicator heading north around 76. In the 4 hours chart the overall stance is also bullish, supporting further advances towards recent highs in the 0.8100 price zone.

Support levels: 0.7980 0.7940 0.7900

Resistance levels: 0.8020 0.8060 0.8100

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.