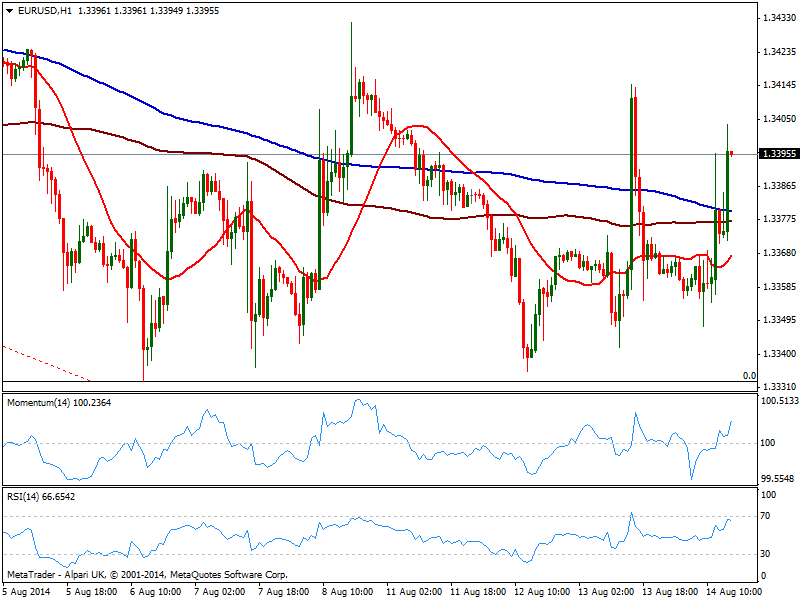

EUR/USD Current price: 1.3364

View Live Chart for the EUR/USD

Having flirted with levels above 1.3400, the EUR/USD closes a second day in a row muted trading in the 1.3360 price zone. News this Thursday had disappointed both side of the Atlantic, with European growth flat and US employment figures down. With this latest, EUR jumped again higher but the advance failed again to sustain above the 1.3400 mark, and even resulted in a lower high daily basis which is still indicative of bearish domain in the pair.

Technically, the 1 hour chart gives little clues, with price below moving averages, 20, 100 and 200 one all together in between 1.3370 and 1.3380, a clear sign of the absence of trend. In the 4 hours chart, 20 SMA gains a mild bearish slope right above current price, while indicators turn lower in neutral territory, still lacking clear directional strength. The trading range is limited to 1.3330/1.3440 and it will take a clear break of any of such extremes to set a more directional trend in the pair.

Support levels: 1.3370 1.3330 1.3295

Resistance levels: 1.3400 1.3440 1.3485

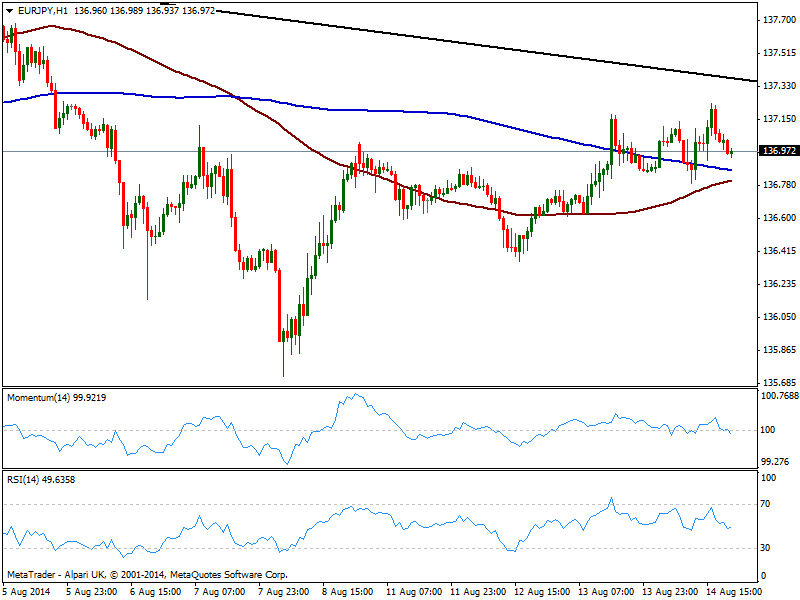

EUR/JPY Current price: 136.97

View Live Chart for the EUR/JPY

Yen crosses managed to post some higher highs daily basis, with the EUR/JPY reaching 137.24 before retracing some. Stocks closed slightly up on the day, while by the end of US session, 10Y yields were standing at 2.40%, helping yen recover some of the lost ground. But technically, the pair presents no changes to latest updates, with latest advance seem mostly corrective, as per being limited below a daily descendant trend line coming from 142.36, May 8th daily high today around 134.40. In the hourly chart indicators head lower around their midlines while 100 and 200 SMA converge in the 136.70 area, offering immediate short term support. In the 4 hours chart technical readings present a mild positive tone, yet it will take a firm advance above mentioned trend line to set a bullish tone in the pair.

Support levels: 136.70 136.20 135.70

Resistance levels: 137.40 137.90 138.30

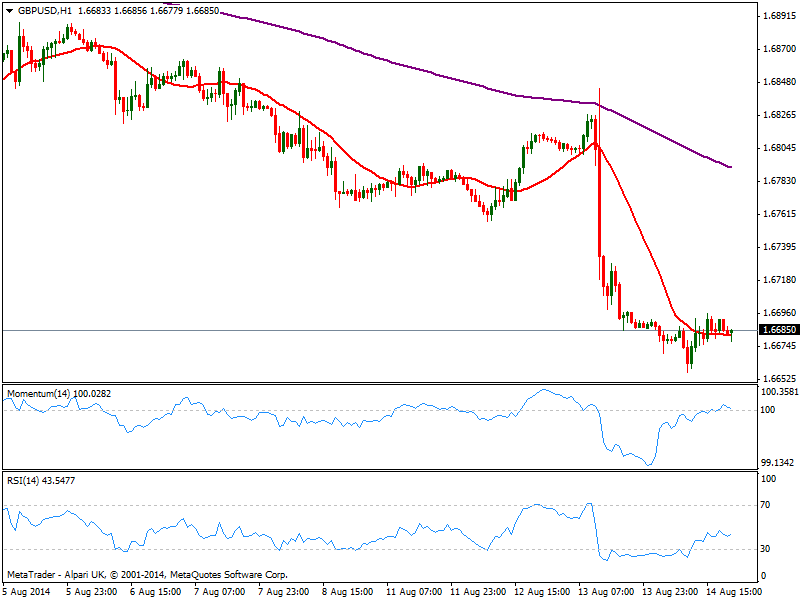

GBP/USD Current price: 1.6685

View Live Chart for the GBP/USD

The GPB/USD consolidated its losses after extending its decline to 1.6657 early Europe, having been unable to regain the 1.6700 figure. The hourly chart shows indicators erased all of their oversold condition to settle around their midlines, while price is trapped around its 20 SMA, lacking a clear direction at the time being. In the 4 hours chart indicators turned back south after a limited upward correction still in oversold levels, which keeps the risk to the downside: a break below 1.6650 should signal a quick slide towards 1.6620 area, while a weekly close below 1.66 should see the pair extending its decline towards 1.6400/50 price zone.

Support levels: 1.6650 1.6620 1.6580

Resistance levels: 1.6700 1.6730 1.6760

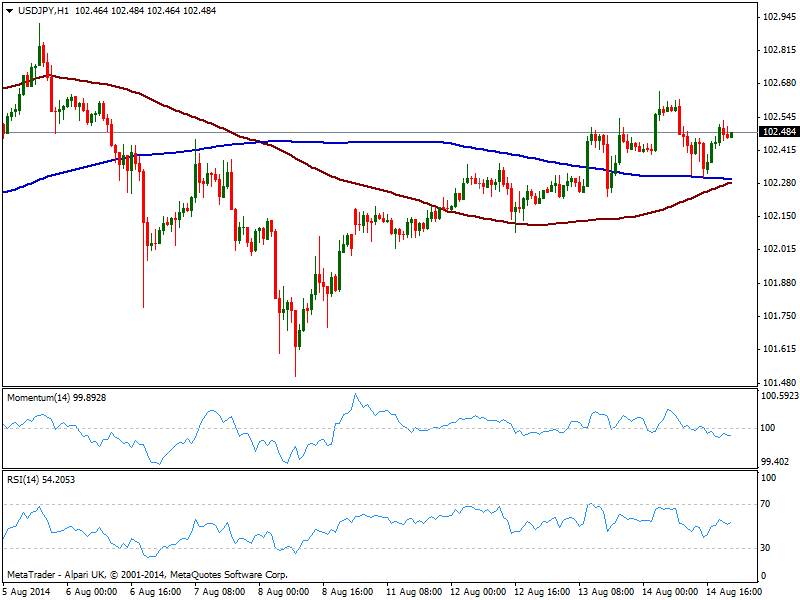

USD/JPY Current price: 102.48

View Live Chart for the USD/JPY

The USD/JPY stands pretty close to its daily high of 102.65, yet despite the advance the pair continues to show no aims of extending its latest gains. In the short term, the hourly chart shows 100 and 200 SMAs both at 102.30 offering immediate short term support, while indicators turned lower below their midlines, keeping the upside limited. In the 4 hours chart indicators maintain a positive tone, which can support an advance up to 102.80 price zone.

Support levels: 102.30 101.95 101.60

Resistance levels: 102.80 103.10 103.45

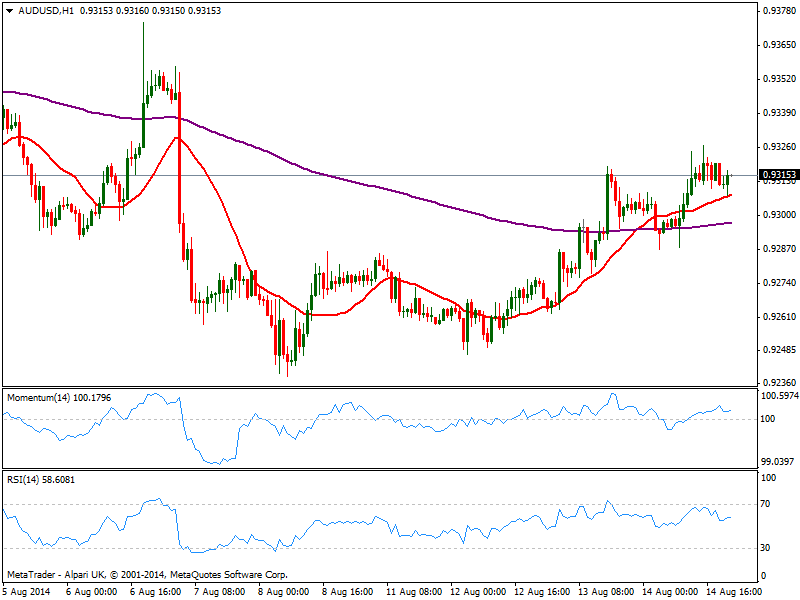

AUD/USD Current price: 0.9315

View Live Chart for the AUD/USD

Australian dollar holds above the 0.9300 mark against the greenback, with the pair however confined to a tight range below the 0.9330 static resistance level. Technically the hourly chart shows a slightly positive tone as 20 SMA maintains a bullish slope below current price and acts as immediate support, while indicators present a slightly positive ton above their midlines. In the 4 hours chart indicators stand in positive territory yet losing upward strength, suggesting further confirmations are required to see price extending up to 0.9370 price zone.

Support levels: 0.9300 0.9260 0.9220

Resistance levels: 0.9330 0.9370 0.9410

Recommended Content

Editors’ Picks

AUD/USD loses ground due to the absence of a hawkish RBA

The Australian Dollar has plunged following the Reserve Bank of Australia's decision to maintain its interest rate at 4.35% on Tuesday. Investors sentiment leaned toward a potentially more hawkish stance from the RBA, particularly after last week's inflation data surpassed expectations.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold price remains on the defensive on a firmer US Dollar

Gold price attracts some sellers on the firmer US Dollar during the Asian trading hours on Wednesday. The hawkish remarks from Federal Reserve officials dampen hopes for potential interest rate cuts in 2024 despite weaker-than-expected US employment reports in April.

FTX files consensus-based plan of reorganization, awaits bankruptcy court approval

FTX has filed a consensus-based plan for its reorganization, coming almost two years after the now defunct FTX filed for Chapter 11 Bankruptcy Protection in the District of Delaware.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.