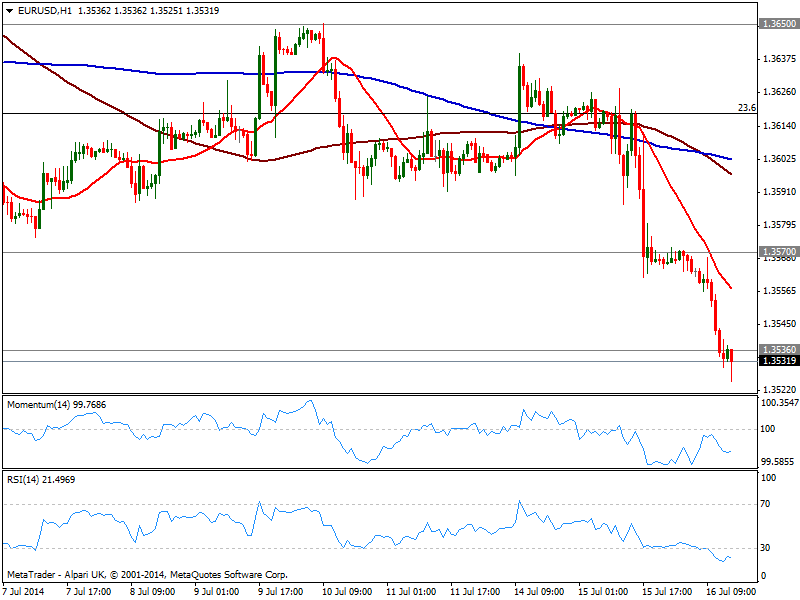

EUR/USD Current price: 1.3531

View Live Chart for the EUR/USD

The EUR/USD trades at its lowest level in over a month, flirting around 1.3520 and extending the decline post Yellen’s first testimony. Due to continue speaking before the Senate today, market may have already absorbed most of what she has to say regarding upcoming economic policies, albeit more market reactions should not be disregarded just yet. With no other major catalysts for the EUR/USD today, the hourly chart shows a strong bearish tone, with moving averages well above current price and heading south, while indicators are biased lower below their midlines. In the 4 hours chart the bearish momentum is even stronger, pointing for a retest of June low of 1.3502, ahead of this year low of 1.3476. To the upside, 1.3570 has attracted intraday sellers so recovery up to that level will likely be seen as selling opportunities.

Support levels: 1.3500 1.3476 1.3440

Resistance levels: 1.3570 1.3620 1.3650

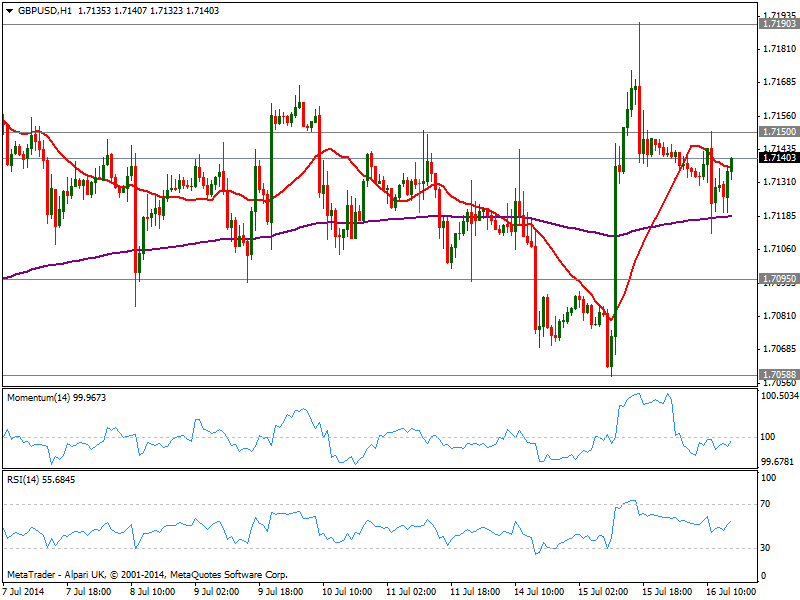

GBP/USD Current price: 1.7140

View Live Chart for the GBP/USD

Pound eased to a daily low of 1.7112 against the greenback, on the back of weak wages within employment figures, but the pair trades in its latest range, with the hourly chart showing price trying to advance above its 20 SMA and indicators aiming higher and nearing their midlines. In the 4 hours chart price found support in a flat 20 SMA while indicators bounce some from their midlines, heading north but lacking strength. The upside remains favored, albeit a break above 1.7150 is required to confirm a new leg up.

Support levels: 1.7120 1.7095 1.7060

Resistance levels: 1.7150 1.7180 1.7220

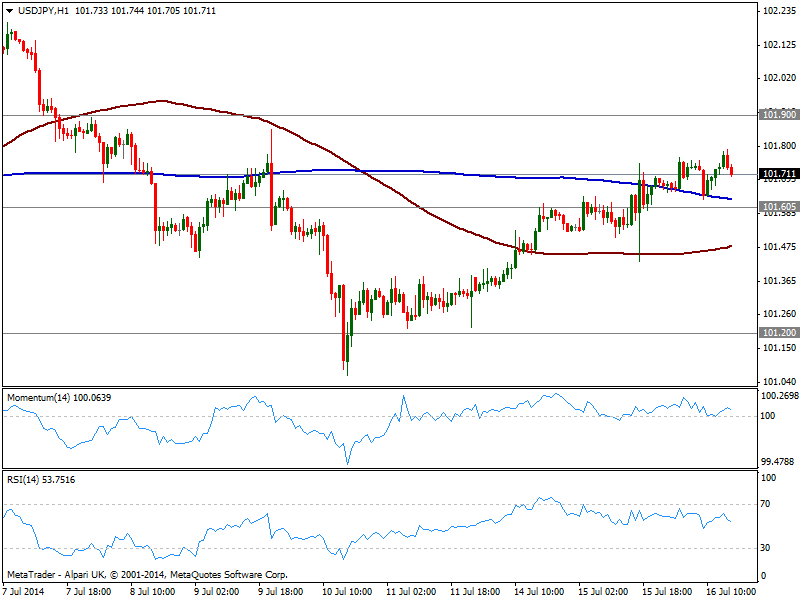

USD/JPY Current price: 101.70

View Live Chart for the USD/JPY

The USD/JPY added a few pips on the day as stocks regained the upside after yesterdays’ fear driven slide. Nevertheless the pair shows no upward momentum, and the hourly chart shows price easing towards 101.60 support, while indicators turned lower above their midlines. In the 4 hours chart technical readings also turned south in positive territory, not yet signaling a downward move: either a price acceleration above 101.95 or below 101.60 is required to confirm a more directional intraday move.

Support levels: 101.60 101.20 100.70

Resistance levels: 101.95 102.35 102.80

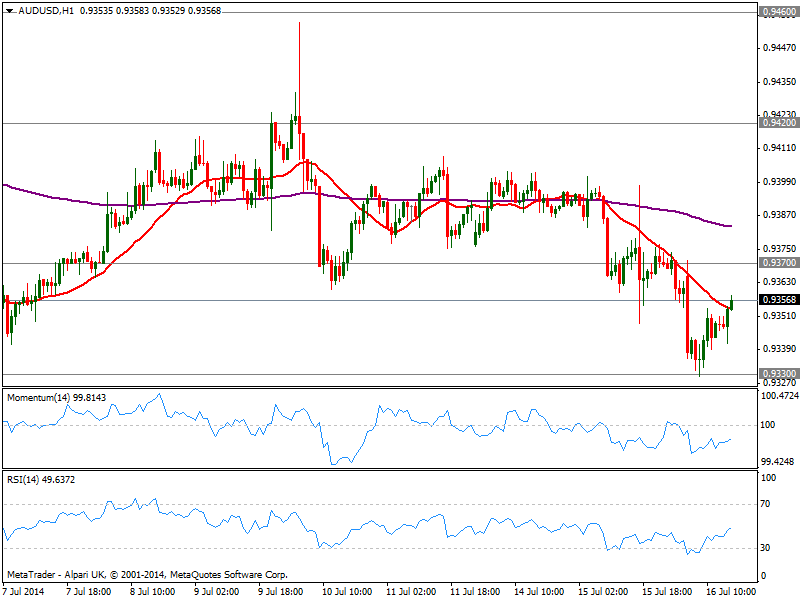

AUD/USD Current price: 0.9356

View Live Chart for the AUD/USD

The AUD/USD tested 0.9330 strong static support during Asian hours, again founding buying interest in the key level. The hourly chart shows price above a still bearish 20 SMA, while indicators stand in negative territory, giving little support to this latest recovery. In the 4 hours chart a mild bearish tone prevails as per price below its 200 EMA and momentum heading south below its midlines.

Support levels: 0.9330 0.9300 0.9260

Resistance levels: 0.9370 0.9420 0.9460

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.