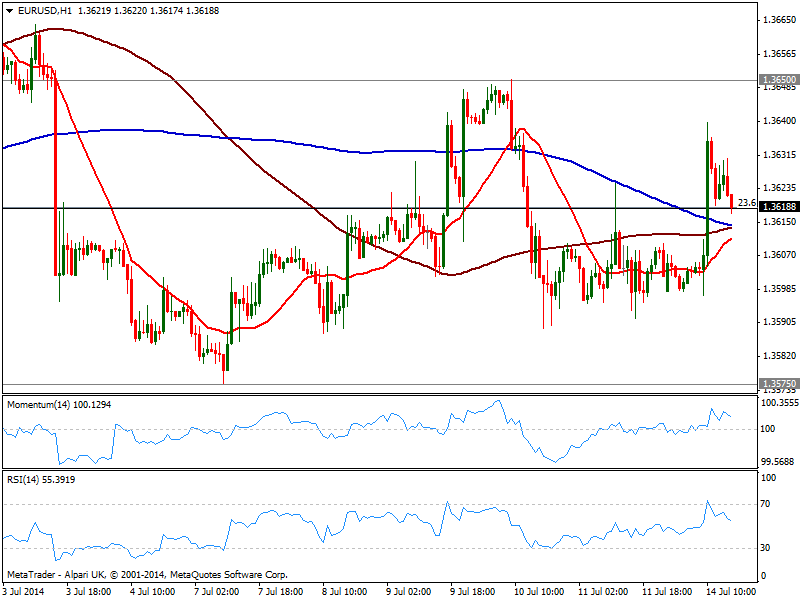

EUR/USD Current price: 1.3619

View Live Chart for the EUR/USD

In a usual thin Monday most remarkable event is the recovery in local share markets, as latest events in the Portuguese banking sector seem now contained. Safe havens eased all through the session, but the EUR/USD was unable to go too far away: the pair reached a daily high of 1.3640 before turning back south, now trading around key Fibonacci support of 1.3620. The hourly chart shows price easing towards a congestion of moving averages, all together around 1.3610 as indicators turn lower above their midlines. In the 4 hours chart the pair is biased lower also, yet unless a break below 1.3570, the downside should extend much today.

Support levels: 1.3620 1.3570 1.3530

Resistance levels: 1.3650 1.3680 1.3725

GBP/USD Current price: 1.7072

View Live Chart for the GBP/USD

With not much behind it but stops triggered, the GBP/USD eased down to 1.7069 so far today, and holds near that low early US session, with the hourly chart showing a strong bearish tone as per indicators accelerating south below their midlines, and price well below its 20 SMA. In the 4 hours chart the technical picture is clearly bearish, with a break below 1.7060 Fibonacci support required to confirm further slides today.

Support levels: 1.7060 1.7020 1.6990

Resistance levels: 1.7095 1.7150 1.7180

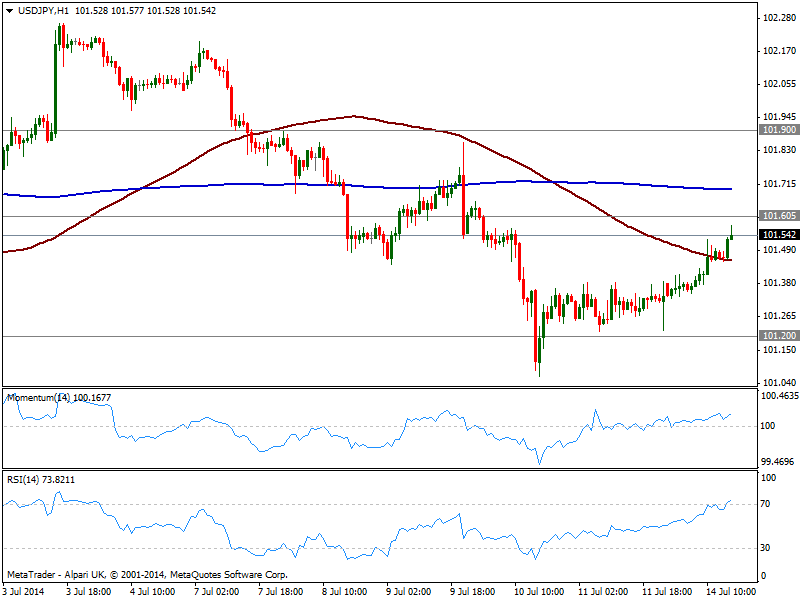

USD/JPY Current price: 101.54

View Live Chart for the USD/JPY

Yen eased in a more confident environment, with the USD/JPY up near 101.60 former support and immediate strong resistance level. The hourly chart shows indicators heading north in positive territory, as price extended and finds now intraday support in its 100 SMA. In the 4 hours chart the momentum nears its midline but remains below it, with a mild positive that needs further confirmation: some further advances beyond mentioned resistance should see an approach to the 102.00 figure, moreover if US indexes extend is pre opening gains.

Support levels: 101.20 100.70 100.25

Resistance levels: 101.60 101.95 102.35

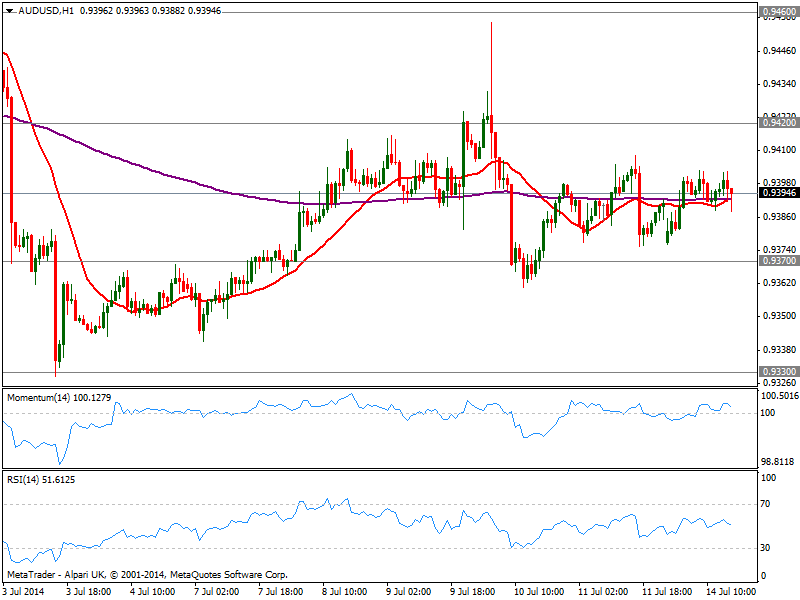

AUD/USD Current price: 0.9394

View Live Chart for the AUD/USD

The AUD/USD has shown little progress over the past two sessions, confined to a tight range around the 0.9400 figure that leaves the hourly chart with a clear neutral technical stance. In the 4 hours chart a mild positive tone is present albeit technical readings lack enough momentum to confirm more intraday gains at the time being: price needs either to accelerate above 0.9420 or below 0.9370 to get more attention from investors today.

Support levels: 0.9370 0.9330 0.9300

Resistance levels: 0.9420 0.9460 0.9500

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.