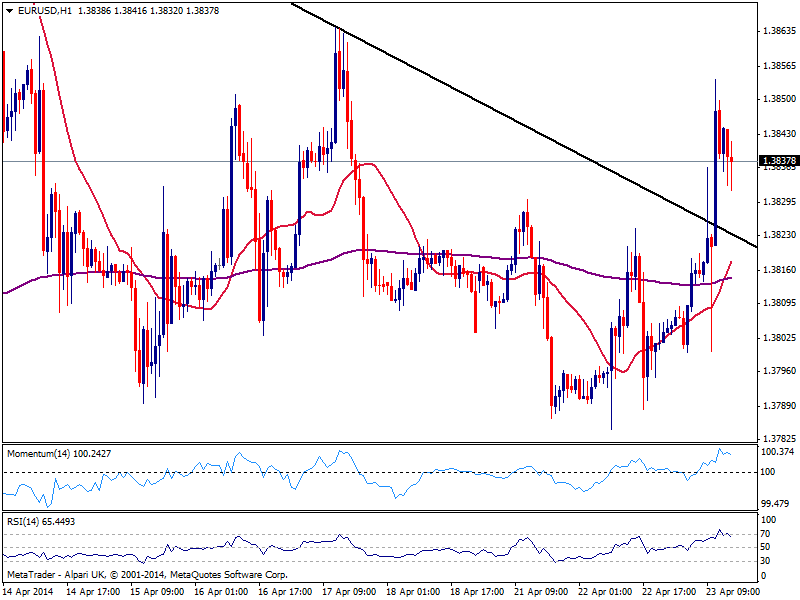

EUR/USD Current price: 1.3827

View Live Chart for the EUR/USD

The EUR/USD saw a nice upward breakout, rising to a fresh weekly high of 1.3854 on the back of positive PMI readings in Germany and the EU. But the movement fades ahead of US opening, with futures slightly down along with local share markets. Later on the day, Apple and Facebook, among other, will publish their earnings reports, and another round of lively activity should be then expected. In the meantime, the EUR/USD holds above former resistance of 1.3825 with the hourly chart showing indicators losing upward potential in positive territory, and price developing well above a bullish 20 SMA. Past week high of 1.3860 comes as immediate resistance level, as only above it the pair will be able to extend further.

Support levels: 1.3825 1.3780 1.3750

Resistance levels: 1.3860 1.3890 1.3920

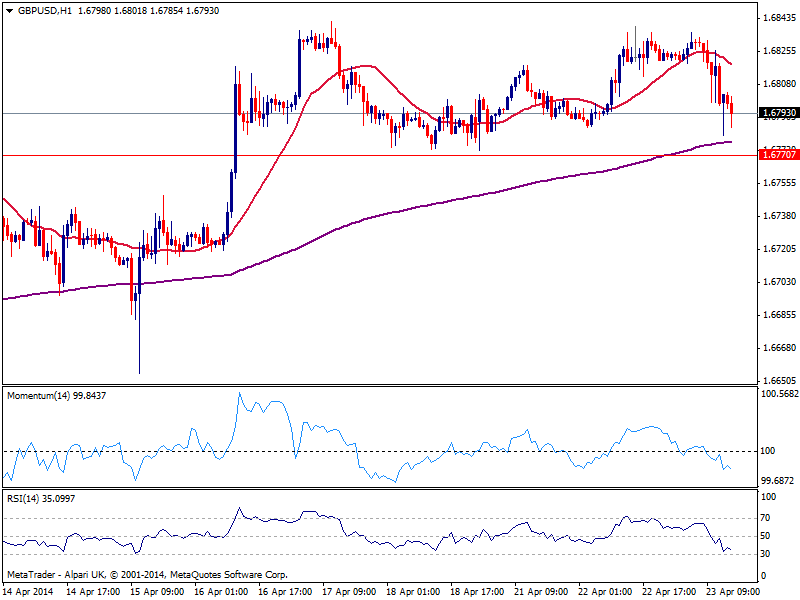

GBP/USD Current price: 1.6792

View Live Chart for the GBP/USD

The GBP/USD not only gave up yesterday’s gain, but extended its slide down to 1.6781, bouncing some after approaching the critical support area. The hourly chart maintains a clear bearish tone, as per indicators heading lower below their midlines, and 20 SMA gaining bearish slope above current price. In the 4 hours chart current candle points to close right below its 20 SMA while indicators turned south approaching their midlines: further falls beyond 1.6770 support are required to confirm a downward extension that can extend down to 1.6700/20 to complete the double roof figure clear in the mentioned chart.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

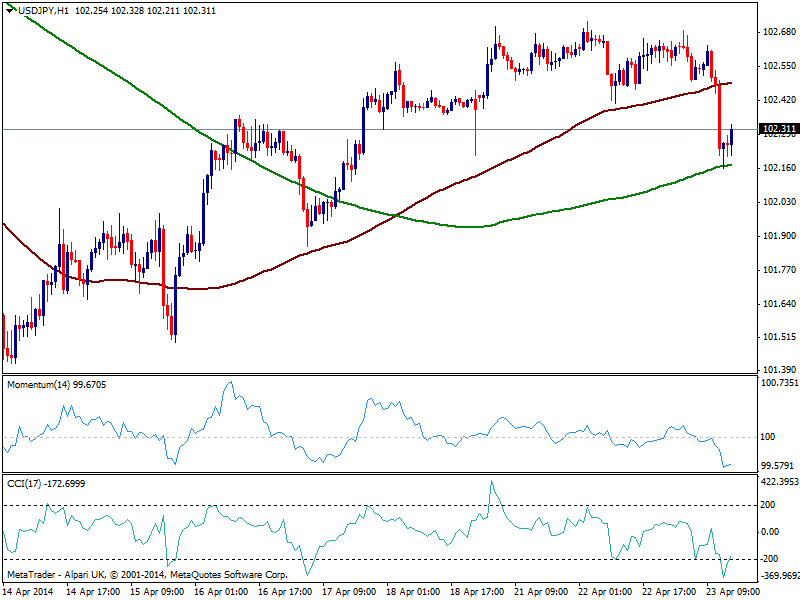

USD/JPY Current price: 102.31

View Live Chart for the USD/JPY

The USD/JPY stands among the winners today, having accelerated against the greenback with the pair down to 102.16. Repeated failure around 102.60 finally weighted on the pair, along with another round of soft Chinese data with manufacturing PMI shrinking below expected. The pair however found support around its 200 SMA in the hourly chart, and indicators in the mentioned time frame pull slightly higher from oversold readings, albeit far from supporting a steady recovery. In the 4 hours chart, the pair presents a strong bearish momentum, with scope to test 101.70 support area if stocks maintain the negative bias.

Support levels: 102.10 101.70 101.30

Resistance levels: 102.60 102.95 103.20

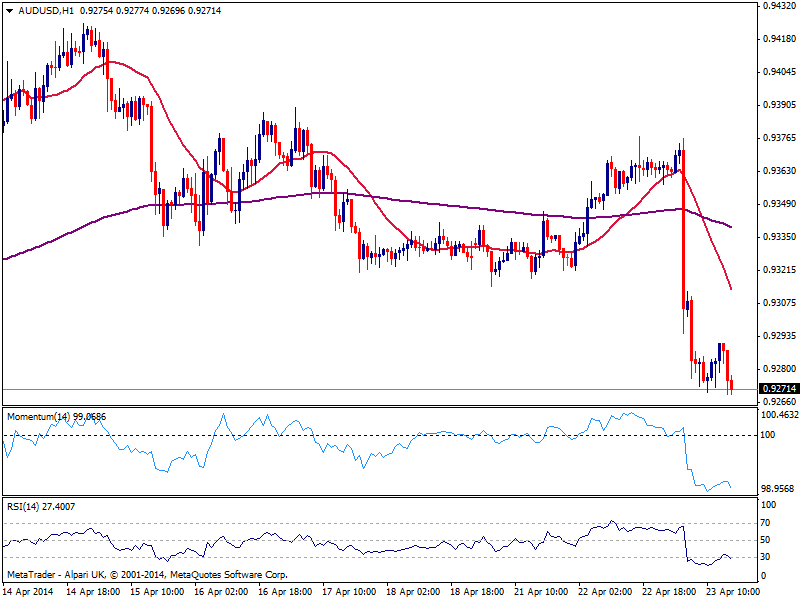

AUD/USD Current price: 0.9271

View Live Chart for the AUD/USD

Australian dollar suffered big since past Asian session, amid falling inflation in the area, well below expected. The AUD/USD approached 0.9260 strong midterm static support area, and remains right above it, with the hourly chart showing the bearish tone prevails: indicators turned south after correcting partially oversold readings, while the 4 hours chart also maintains a bearish tone, albeit with indicators losing bearish momentum. A break below the support should lead to a stronger downward acceleration, with scoop to test 0.9130 on the upcoming days.

Support levels: 0.9260 0.9210 0.9370

Resistance levels: 0.9300 0.9340 0.9380

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.