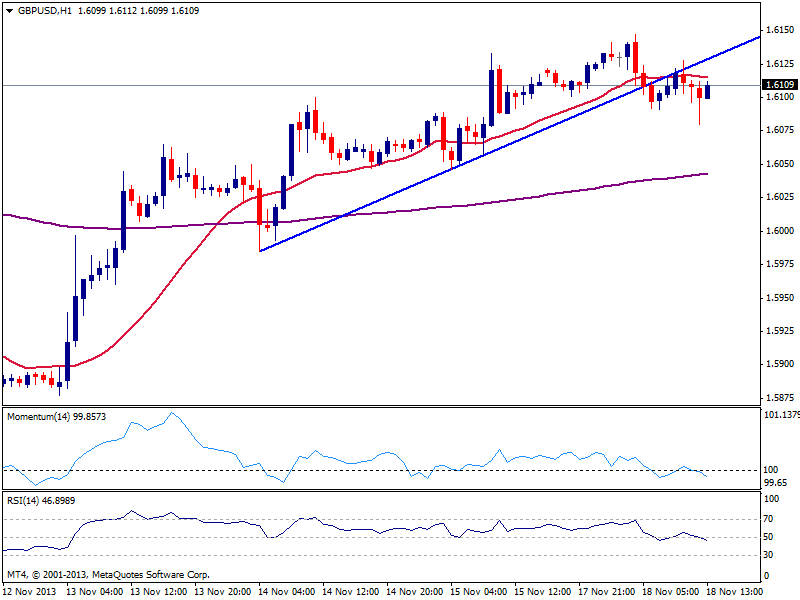

GBP/USD Current price: 1.6109

View Live Chart for the GBP/USD

After surging to a daily high of 1.6147, the GBP/USD broke below a short term ascendant trend line, but held above 1.6080 and quickly recovered the 1.6100 mark. A more hawkish than usual FED’s Dudley triggered a kneejerk down to 1.6080, albeit very short lived. Ahead of Asian opening, the pair presents a very shy bearish tone in the hourly chart, as per price capped below 20 SMA and indicators heading lower below their midlines. In the 4 hours chart price bounced pretty nice from a still bullish 20 SMA, while indicators lost the bearish slope and turned flat in positive territory, denying for now, chances of a stronger slide. The upside however is still limited, as price needs to accelerate and stabilize above 1.6120 to show a bit more of an upward tone, while a break below mentioned support should expose the pair to a test of 1.6000/20 price zone.

Support levels: 1.6080 1.6050 1.6020

Resistance levels: 1.6120 1.6150 1.6190

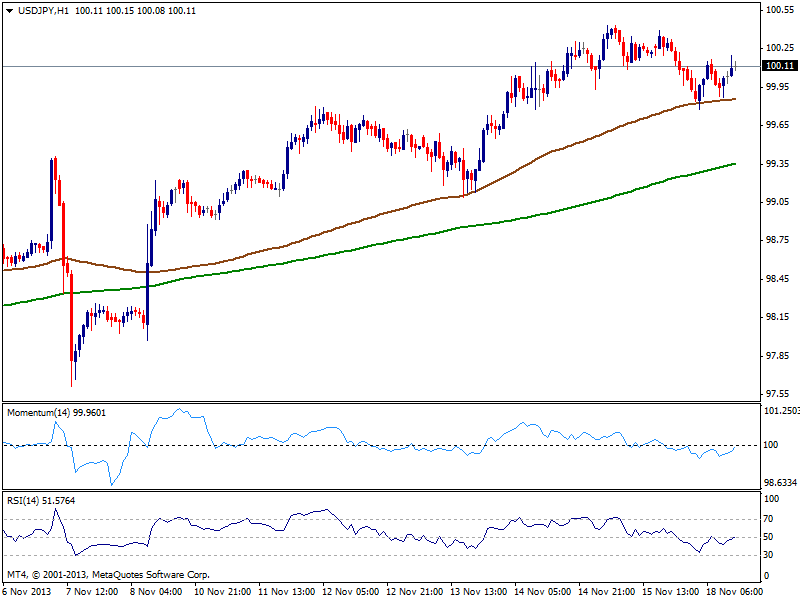

USD/JPY Current price: 100.11

View Live Chart for the USD/JPY

Not a good day for USD/JPY that barely managed to hold the 100.00 area. The pair has been mostly under pressure, although the hourly chart shows price found support in its 100 SMA currently around 99.80. In the mentioned time frame, indicators head higher approaching their midlines still in negative territory, while the 4 hours chart present a slightly negative tone. Taking a look at the daily chart and considering the past 5 months, gains above 100.00 had produced lower highs and remained short lived, and this time seems not much different: price needs to take 100.70 area, September highs, to actually confirm a bullish continuation while losses below 99.70 may see a slide down to 99.20 price zone.

Support levels: 99.70 99.40 99.10

Resistance levels: 100.35 100.70 101.10

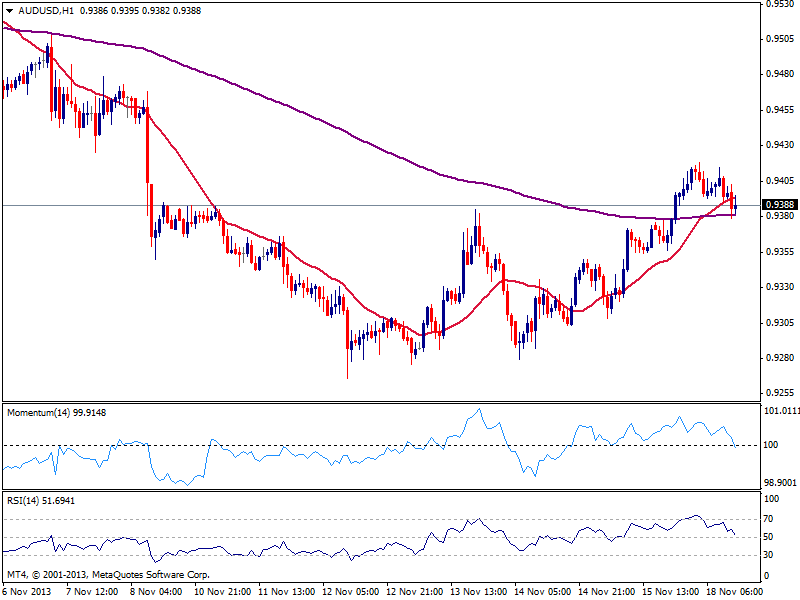

AUD/USD Current price: 0.9388

View Live Chart for the AUD/USD

The AUD/USD reached 0.9420 before easing some also presenting a quite disappointing behavior compared to other currency pairs. Gold may have weighted also in the pair, as metals had remained under strong selling pressure since ever the week started. As for technical readings, the hourly chart shows price right below its 20 SMA as indicators enter negative territory, while the 4 hours chart shows price faltered a few pips below 200 EMA as momentum continues to head north above its midline. Support around 0.9340/50 will now be key as if buyers surge on approaches to it, will likely keep the upward momentum alive. A break below it however, may see the pair retesting the 0.9260 lows in the upcoming sessions.

Support levels: 0.9385 0.9340 0.9300

Resistance levels: 0.9420 0.9470 0.9510

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 after downbeat NFP data, eyes on Fedspeak

Gold price trades in positive territory above $2,310 after closing the previous week in the red. The weaker-than-expected US employment data have boosted the odds of a September Fed rate cut, hurting the USD and helping XAU/USD find support.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.