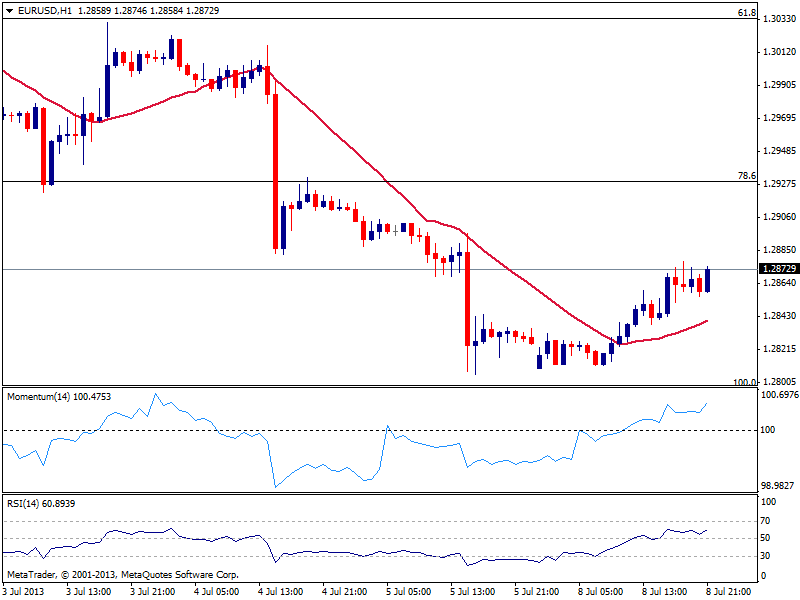

EUR/USD Current price: 1.2872

View Live Chart for the EUR/USD

Everything moved in slow motion this Monday, particularly European currencies. The EUR/USD spent most of the past two sessions painfully advancing, but adding 60 pips at the end of the day, trading right below 1.2880 strong static resistance level. Draghi brought little news on his testimonies, as the overall subdued outlook persists. As for the EUR/USD, the hourly chart shows price above 20 SMA while indicators head north above their midlines, supporting a short term upward continuation. In the 4 hours chart 20 SMA maintains bearish slope currently around 1.2900 while indicators approach their midlines, still in negative territory. Movements up to 1.2925, 78.6% retracement of its latest bullish run, should be seen as corrective, with a break above opening doors for an extension towards 1.2960/1.3000 over the upcoming days.

Support levels: 1.2840 1.2795 1.2745

Resistance levels: 1.2880 1.2925 1.2960

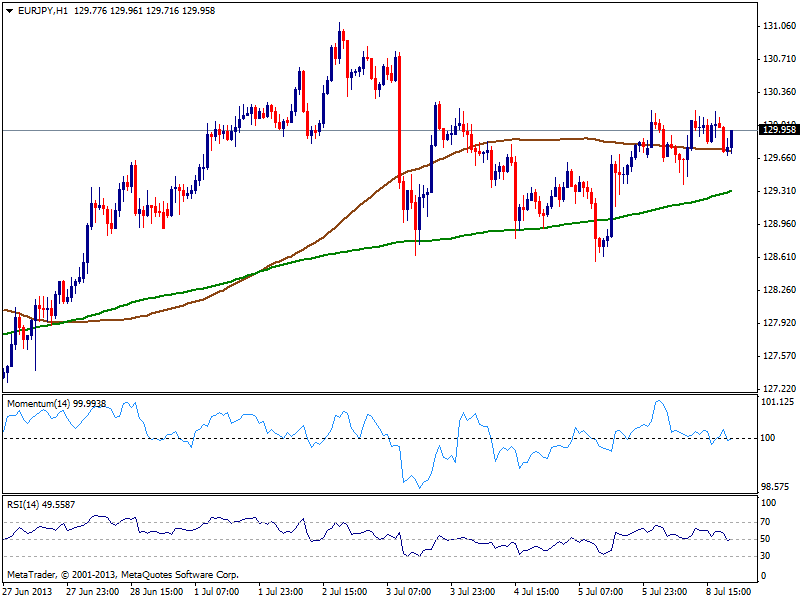

EUR/JPY Current price: 129.96

View Live Chart for the EUR/JPY

The EUR/JPY ranged also for most of the day around the 130.00 area, entering Asian session with a pretty neutral short term stance according to the hourly chart, as indicators hover around their midlines while price stands around its 100 SMA. In the 4 hours chart there’s a limited bearish tone coming from technical readings and the fact that price seems unable to stabilize above the 130.00 mark. The pair needs to break strongly above 130.50 to be able to continue advancing, and with stocks in positive territory, seems there’s not much room for a break lower at the time being.

Support levels: 129.50 129.10 128.80

Resistance levels: 130.10 130.50 131.00

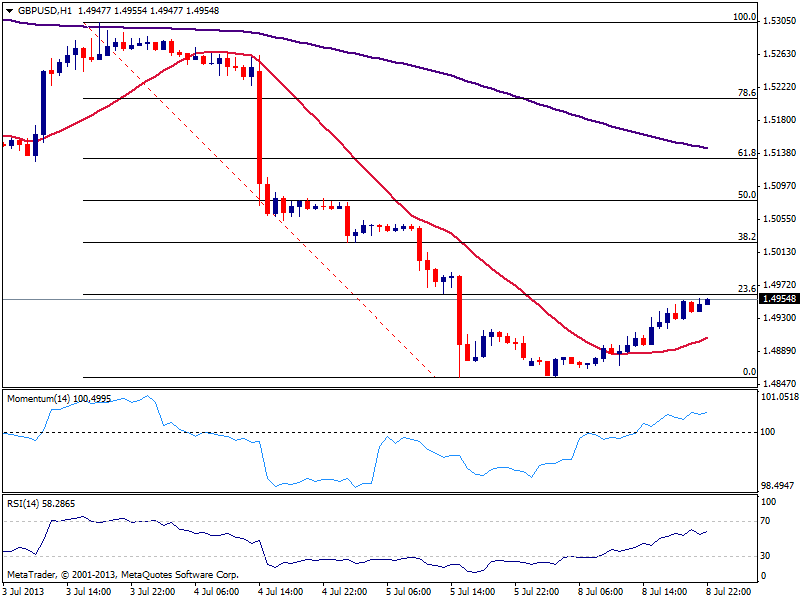

GBP/USD Current price: 1.4954

View Live Chart for the GBP/USD

The GBP/USD maintains the short term positive tone seen on previous update, stalling below 1.4960, 23.6% retracement of its latest bearish run, and with the hourly chart showing indicators still heading higher in positive territory. In the 4 hours chart technical indicators already corrected extreme oversold readings still standing in negative territory although heading higher, which suggests more gains could be seen in the short term, with sustained gains above mentioned resistance.

Support levels: 1.4920 1.4860 1.4830

Resistance levels: 1.4960 1.5000 1.5050

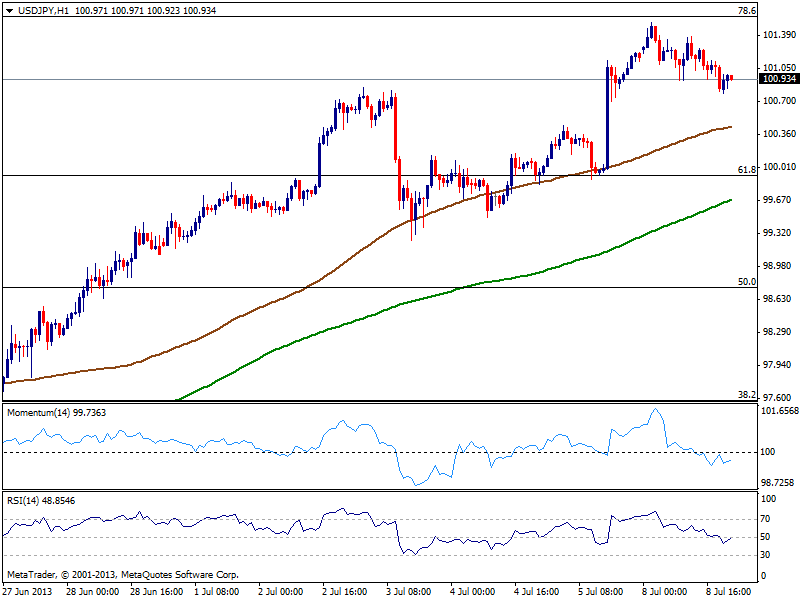

USD/JPY Current price: 100.93

View Live Chart for the USD/JPY

The USD/JPY trades barely unchanged from its US opening, standing now below the 101.00 level after testing the 78.6% retracement of if latest bearish run around 101.60, and key resistance level to bring back to life the strong bullish trend. . The hourly chart shows indicators in neutral territory, and moving averages still heading higher below current price, with 100 SMA now around 100.30, offering support in case of further losses. Bounces from the indicators may see the pair reattempting to recover the 101.00 area, although once below, a test of 99.90 could be expected.

Support levels: 100.70 100.30 99.90

Resistance levels: 101.20 101.60 102.00

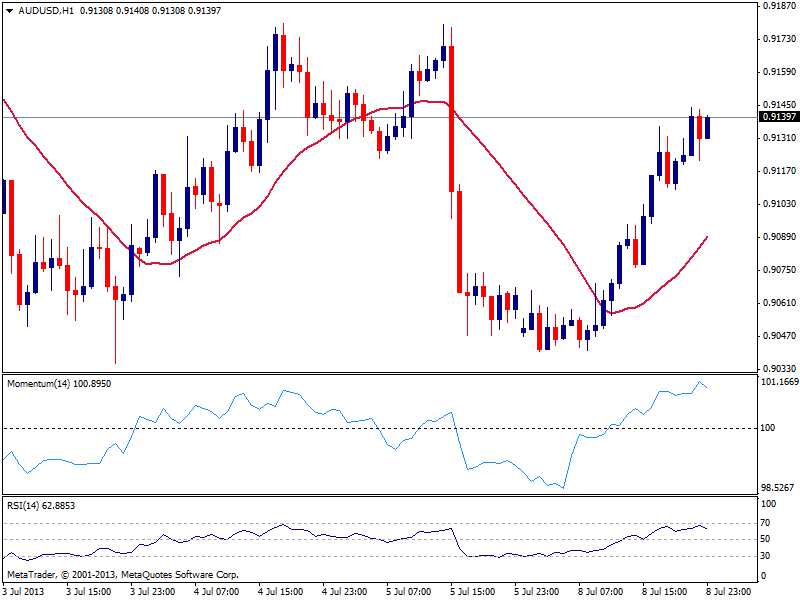

AUD/USD: Current price: 0.9139

View Live Chart for the AUD/USD

The AUD/USD maintained the positive tone for most of the day, holding near its daily high of 0.9144. the hourly chart shows price pressuring higher despite indicators look a bit exhausted and pointing for a correction lower, although as long as above 0.9120, chances remain to the upside with a break above 0.9180 pointing for a rally towards 0.9210. In the 4 hours chart momentum is flat around 100 while price advances above an also flat 20 SMA, which suggests there’s not enough buying interest around at the time being.

Support levels: 0.9080 0.9035 0.8990

Resistance levels: 0.9180 0.9210 0.9250

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.