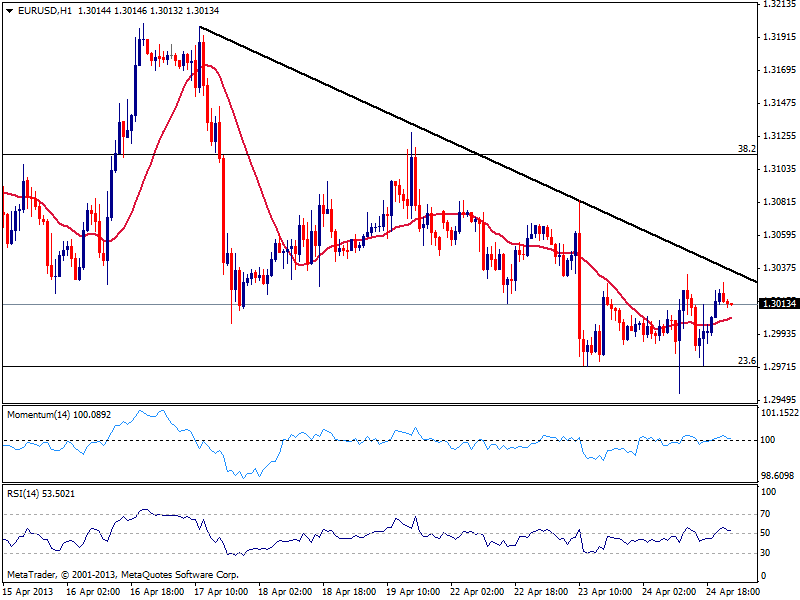

EUR/USD Current price: 1.3013

View Live Chart for the EUR/USD

A fresh weekly low, this time at 1.2954, was not enough to trigger further sells in the EUR/USD, that managed to recover from the level, back to current 1.3000 area where it stands. Back and forth, the pair has spent most of the last sessions struggling around the level, looking heavy as market players had already priced in a probable rate cut next week, regardless will hardly mean anything for anyone. Fundamental data both sides of the shore disappointed this Wednesday, giving no much clues on direction either, while US stocks traded in tight ranges ending up barely below their opening.

As for the EUR/USD, short term bias remains negative, with a descendant trend line now standing around 1.3030/40 area, offering short term resistance. Technical readings are flat in the hourly chart, reinforcing the idea of a stronger break below 1.2970 required to trigger more slides. In the 4 hours chart 20 SMA heads south and capped the upside at least twice over the past 24 hours, offering now dynamic resistance also in the 1.3030/40 area.

Support levels: 1.2970 1.2925 1.2880

Resistance levels: 1.3040 1.3070 1.3115

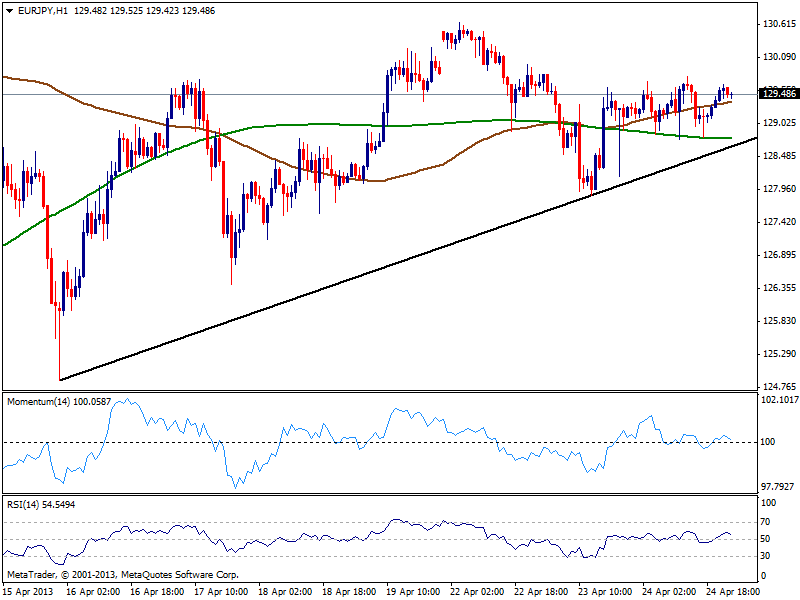

EUR/JPY Current price: 129.49

View Live Chart for the EUR/JPY (select the currency)

Not much to add to previous updates on yen pairs, as sellers prefer to wait for pullbacks or a break of recent highs to continue riding the trend. With no follow trough above 130.00, but with retracements also limited, the EUR/JPY hourly chart sees price holding above 100 SMA, indicators barely above their midlines, and a short term ascendant trend line standing around 128.40 now, all of which supports certain consolidation and limited retracements for current session. In bigger time frames, a slightly bullish tone persists although with not enough momentum at the time being, with a break above 130.60 now required to see the bullish trend resume.

Support levels: 129.10 128.80 128.20

Resistance levels: 130.10 130.60 131.30

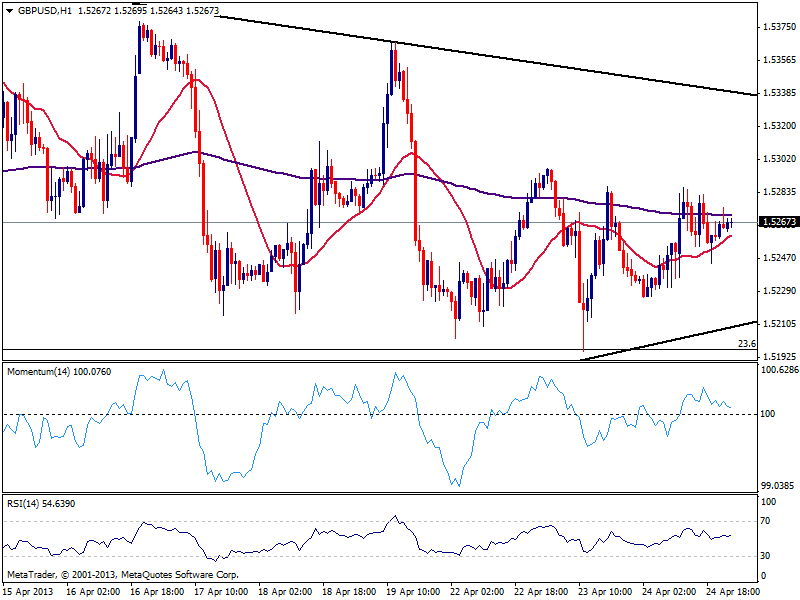

GBP/USD Current price: 1.5267

View Live Chart for the GBP/USD (select the currency)

The GBP/USD remains hovering around 1.5260 area, and an early attempt to extend gains was limited by 1.5290/1.5300 where strong selling interest remains aligned. The hourly chart shows price above a bullish 20 SMA as indicators head lower above their midlines, while in the 4 hours chart technical readings remain flat. 1.5190/1.5300 are the extremes of the range to play, probably until next week.

Support levels: 1.5225 1.5190 1.5150

Resistance levels: 1.5280 1.5300 1.5330

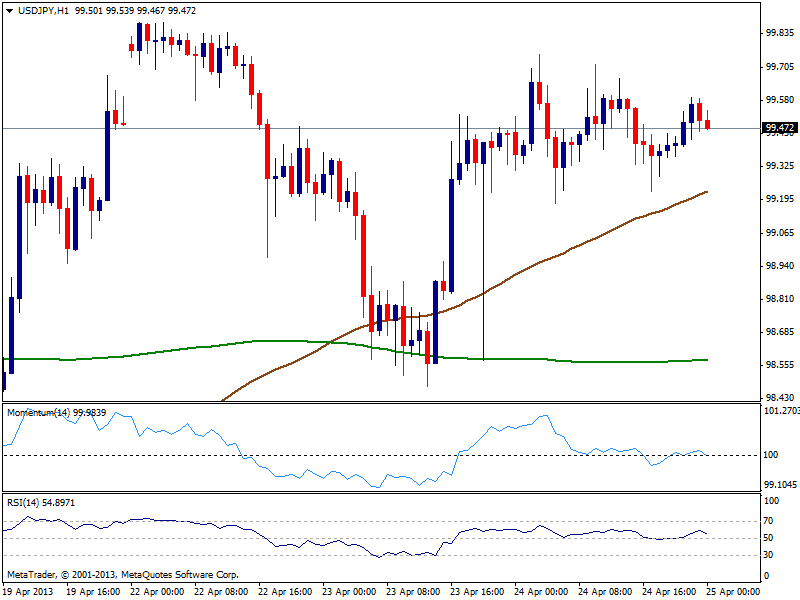

USD/JPY Current price: 99.47

View Live Chart for the USD/JPY (select the currency)

As said for EUR/JPY yen crosses maintain the range, with the pair comfortable in the 99.20/99.70 price zone. Short term technical readings hold a positive tone, as despite indicators hold flat near their midlines, 100 SMA advances higher below current price, widen the distance with 200 one. At this point is a matter of patient, and waiting for the pair to finally take out the 100.00 level.

Support levels: 99.20 99.00 98.60

Resistance levels: 99.70 100.00 100.35

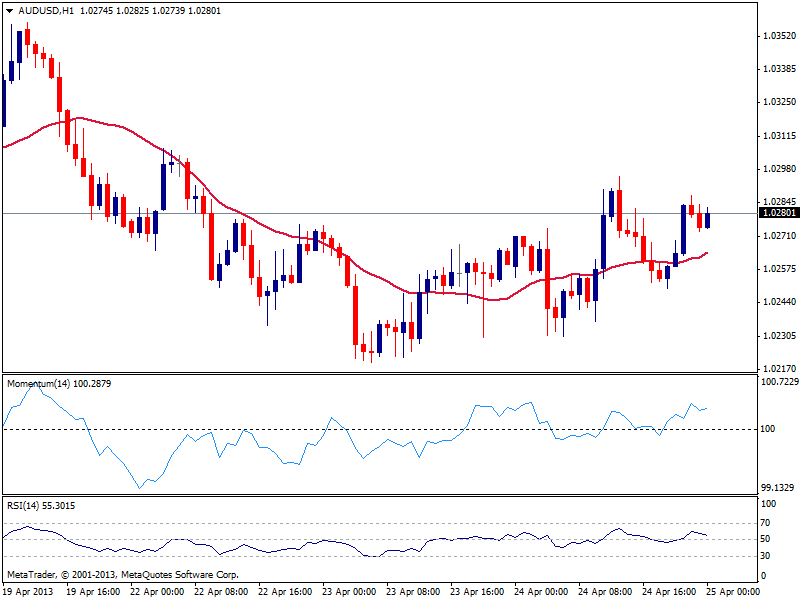

AUD/USD: Current price: 1.0280

View Live Chart for the AUD/USD (select the currency)

The AUD/USD ends the day with a positive tone, although found sellers around 1.0300 and barely added 20 pips on the day. The hourly chart shows an increasing bullish tone, with price above 20 SMA, slowly grinding higher, and momentum above 100 and heading north. In the 4 hours chart technical readings also turned positive, yet 1.0335 static resistance area ahs prove strong in the past: only steady gains above this level will favor further AUD recoveries, while slides below 1.0260 will put the pair back in the bearish track.

Support levels: 1.0260 1.0220 1.0180

Resistance levels: 1.0300 1.0335 1.0370

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.