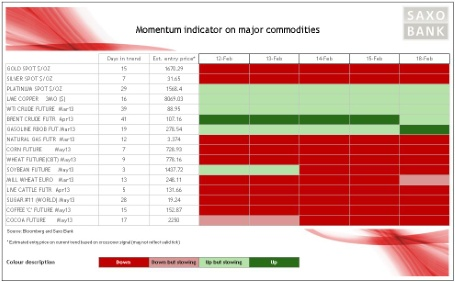

The negative momentum seen in precious metals and the whole agriculture sector over the past week could now potentially also engulf copper. Being a growth dependent commodity, copper has, just like energy - minus natural gas -been well supported at the beginning of this year. But since February 4, we have seen lower highs almost every day. Yesterday resulted in a breach of support and today this weakness has continued. The drop was triggered by concerns about the strength of Chinese demand after local media reported that further initiatives to prevent property prices from rising too fast was being considered.

Crude oil prices are currently trading sideways, with support in WTI crude oil at 94.90 USD/barrel and resistance in Brent crude oil above 118 USD/barrel being the two levels the market is focusing on. The main driver, however, is gasoline which, at the moment, is the only commodity showing a double-digit return in 2013. This continued rally could become a concern for drivers in the US, who are paying record prices at the pump for this time of year. The current national average retail price for gasoline currently costs 3.73 USD/gallon, some 30 percent above the average for the past five years and only 9 percent away from the peak reached in July 2008 just before the collapse.

It goes to show that energy prices can not continue to rally without a sound foundation in terms of economic growth to back it up. We are once again facing the risk of an early beginning-of-the-year rally running out of steam and being followed by a correction. With WTI Crude potentially showing negative momentum from today and given the continued weakness in all other sectors, the risk of a correction in both crude oils is rising.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.