Crude oil ended higher in its third positive close out of the past four weeks, thanks to ongoing Middle East tensions, falling US crude inventories and storm Barry in the Gulf of Mexico – all raising short term supply shock risks. But Hurricane Barry was not as destructive as feared after making landfall on the Louisiana coast on Saturday with winds barely meeting hurricane criteria. For that reason, crude oil speculators evidently took profit on Monday which saw prices fall noticeably. Both oil contracts started Tuesday on the front ahead of US oil inventories data.

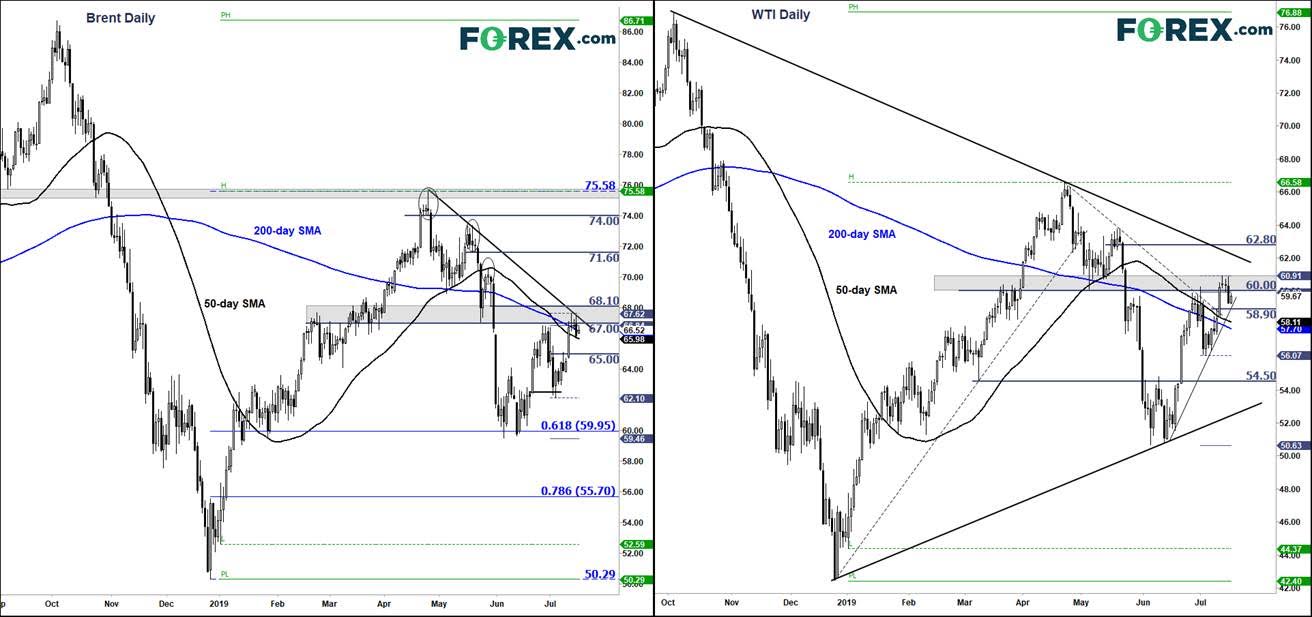

Monday's selling did indeed look like it was driven by profit-taking and technical selling given the small ranges oil prices had traded around in the closing days of last week, after a burst of bullish momentum earlier in the week had probably seen speculators tighten their stop loss orders to protect their profits from evaporating in what is a headline-driven market. In addition, both contracts had reached key resistance levels with Brent at $67/68 and $60/61 rage, levels which were formerly support and now resistance. Unless these resistance levels break, there is a risk we may see a deeper pullback in the coming days amid concerns over Information Administration (EIA) tomorrow afternoon a deteriorating demand outlook.

On the supply side, traders will be watching the latest US oil inventories data closely after the recent sharp falls in oil stocks. If we see more unexpectedly sharp de-stocking in crude inventories, then this could keep prices supported for a while yet. However, if a bigger build is reported then this will likely give speculators an excuse to sell oil aggressively after the recent rally, which may have potentially ended following Monday's sell-off around the resistance levels mentioned above. The American Petroleum Institute (API) will report their unofficial figures tonight ahead of the government data from the Energy Information Administration (EIA) tomorrow afternoon.

Ahead of these, Brent and WTI were both hovering just below the lower end of their respective resistance areas of $67.00 and $60.00 after starting the session on the front foot. So, there was the potential for prices to turn lower given yesterday's bearish-looking price candles.

Figure 1:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.