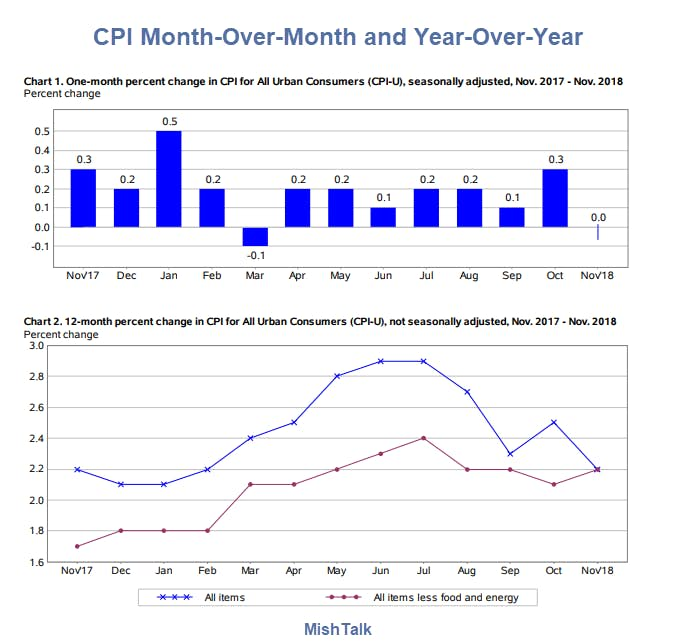

The CPI came in unchanged for November as expected today. Energy, apparel, and transportation were all negative.

The BLS reports the CPI for All Items was unchanged in November as the price of gasoline fell while the price of shelter and food rose.

Food

The food index rose 0.2 percent in November. The index for food away from home rose 0.3 percent, the largest increase since May.

Energy

- The energy index fell 2.2 percent in November after rising 2.4 percent in October.

- The gasoline index declined 4.2 percent in November following a 3.0-percent increase in October. (Before seasonal adjustment, gasoline prices fell 7.3 percent in November.)

- The natural gas index rose 0.7 percent after declines in the previous 2 months. The electricity index rose 0.3 percent in November following a 2.3-percent increase in October.

- The energy index increased 3.1 percent over the last 12 months, a smaller rise than the 8.9-percent increase for the 12 month period ending October.

All Items Less Food and Energy

- The index for all items less food and energy increased 0.2 percent in November, the same increase as the previous month.

- The shelter index increased 0.3 percent in November following 0.2-percent increases in October and September. The rent index rose 0.4 percent and the index for owners’ equivalent rent increased 0.3 percent.

- The used cars and trucks index increased 2.4 percent in November.

- The medical care index rose 0.4 percent in November with its component indexes mixed. The hospital services index rose 0.5 percent in November, its first increase since July, and the index for prescription drugs also increased 0.5 percent. The index for physicians' services, in contrast, declined 0.3 percent.

- The recreation index rose 0.4 percent in November, and the index for water and sewer and trash collection services increased 1.2 percent.

- The index for wireless telephone services fell 2.2 percent, its largest decline since March 2017. The index for airline fares decreased 2.4 percent in November after being unchanged in October. The index for motor vehicle insurance declined 0.5 percent in November after rising 0.5 percent in October.

- The index for all items less food and energy rose 2.2 percent over the past 12 months. The shelter index increased 3.2 percent. The medical care index rose 2.0 percent over this span, as the hospital services index increased 3.5 percent.

- Several indexes decreased over the last 12 months. The communication index fell 1.7 percent over the span, and the indexes for apparel, lodging away from home, and airline fares also declined.

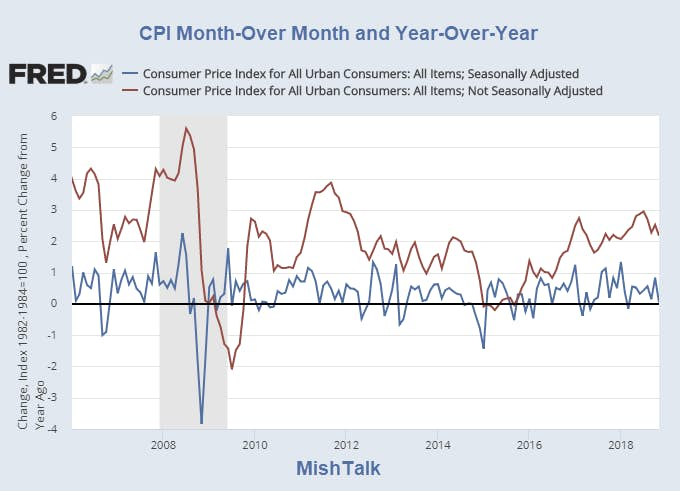

CPI Month-Over-Month and Year-Over-Year

Your results undoubtedly vary.

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.