COVID-19 update: Second wave alert, markets on standby

- An increase of 100% in new cases since the prior day in Spain's COVID-19 jumping above 1,100.

- Risk-off themes doubling up as well, with US President Donald Trump holding a news conference on China this Friday.

In the beginning, for weeks, Spain had held the grim title of suffering the second-highest coronavirus death toll in Europe, trailing only Italy. However, in April, the curve started to drop as the pandemic followed its natural course, partly because the lockdown and other measures were beginning to work. Then, the virus started to show up in force on a rather complacent US soil for which President Trump's administration has taken a lot of criticism for. The US has to lead the leader board of the virus cases ever since with South and Central American nations, as well as Russia now moving in close behind.

Amid guarded optimism, warnings of a data dearth and recognition that the corner has yet to be turned, the Spanish government eased its lockdown, allowing some non-essential workers to return to work. Until now the lockdown has been largely successful. However, as warned, the second wave of new cases have emerged. We have seen a jump of 100% in new cases since the prior day with the number of new cases in Spain jumping above 1,100.

The reasons for the increase are unclear, but no country has reached the levels needed to attain “herd immunity”, which means the second wave of contagion is possible all over the world if the measures to stem the pandemic are not observed.

In China, Chinese doctors are seeing the coronavirus manifest differently among patients in its new cluster of cases in the northeast region compared to the original outbreak in Wuhan, suggesting that the pathogen may be changing in unknown ways and complicating efforts to stamp it out, Bloomberg recently reported.

The findings suggest that the remaining uncertainty over how the virus manifests will hinder governments’ efforts to curb its spread and re-open their battered economies. China has one of the most comprehensive virus detection and testing regimes globally and yet is still struggling to contain its new cluster.

“People should not assume the peak has passed or let down their guard,” Wu Anhua, a senior infectious disease doctor, said on state television on Tuesday. “It’s totally possible that the epidemic will last for a long time.”

Contradictory Fauci

Meanwhile, US Anthony Fauci, the nation's top expert on infectious disease has said that the second wave of coronavirus infections is "'not inevitable" if people are vigilant about proper mitigation efforts.

Fauci, who is the director of the National Institute of Allergy and Infectious Diseases and a key member of the White House coronavirus task force, said on CNN that "we often talk about the possibility of a second wave, or of an outbreak when you’re reopening," Fauci, "We don’t have to accept that as an inevitability."

"And particularly when people start thinking about the fall. I want people to really appreciate that, it could happen but it is not inevitable," he added.

However, last month, he told NBC News that the second wave of COVID-19 was indeed unavoidable. "It’s inevitable that the coronavirus will return next season ... When it does, how we handle it, will determine our fate."

Fauci and other health experts have repeatedly voiced caution about plans to allow nonessential businesses and other public venues to reopen, stressing that widespread testing availability and a comprehensive contact-tracing program need to be in place.

Looking to the past for clues about what could occur in the future

As per a previous article, Global cases surpass 5 million, financial markets taking it in their stride and the next wave, it was stated, "As traders, we are inherently looking to the past for clues about what could occur in the future."

The influenza pandemic of 1918 (the Spanish Flu) had three major waves, starting in March 1918, its peak came during a second wave late that same year. The second wave was a stronger mutation than the first version of the virus and the US Centers for Disease Control and Prevention (CDC) has said the second wave was responsible for the majority of the deaths in the US — the flu's likely country of origin. It is also worth noting that a third wave came in early 1919 and lasted until mid-year when, according to the CDC, the Spanish flu subsided.

Market implications

A week later, the markets have moved on even higher and beyond a 61.8% Fibonacci retracement in the US benchmarks. We now look to the 78.6% retracement which could be the bear's last defence. Or perhaps, we will never get there:

Maybe another firm lockdown is just what we need in terms of geopolitics. The news is starting to move into a critical mass where there may be no turning back from. This week, relations between the US and China may have just ratcheted up to the worst levels since the Korean war in 1950. More on that below:

- US Pres. Trump to hold China news conference on Friday, risk-off themes will be in play

- China's plan of national security law in Hong Kong puts Trump in an unwelcome spot with Xi

- The Hong Kong Dollar, the next black swan?

- Chart of the Week analysis – AUD/JPY

- How do experts view financial conflict of top two economies? – The Global Times

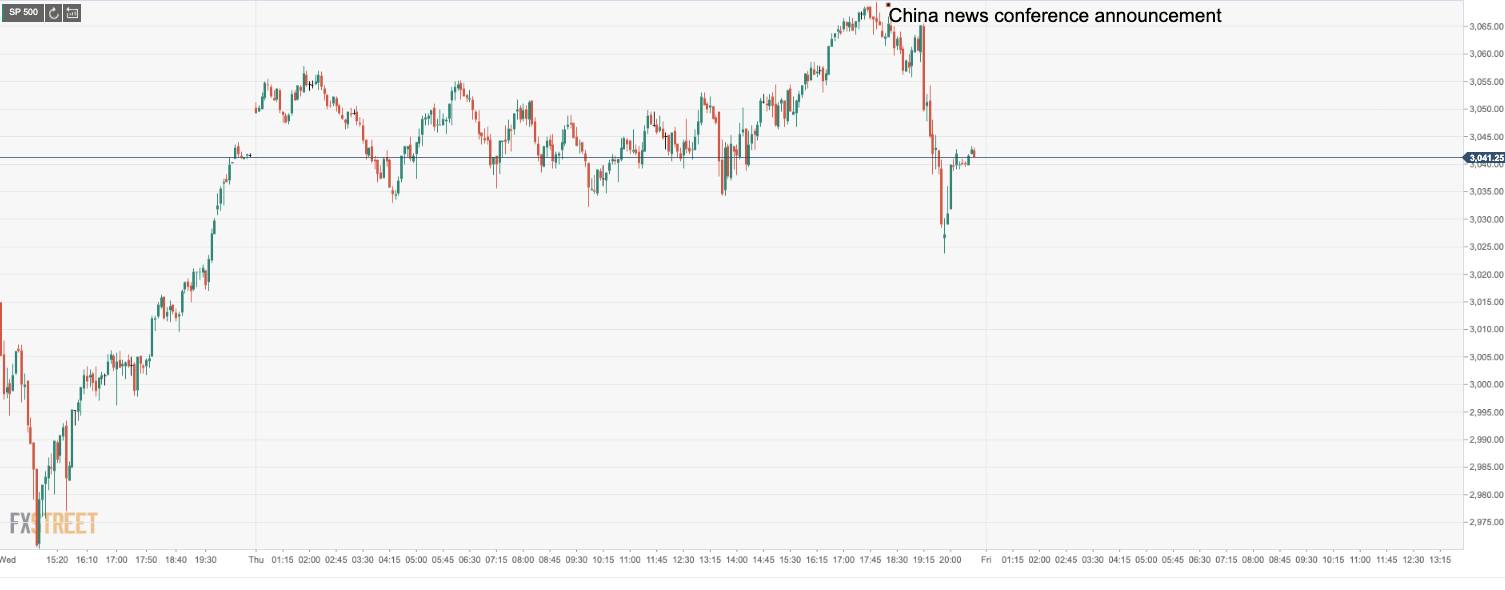

The news that the US President Donald Trump will hold a news conference on China this Friday sent Wall Street into the red in the closing hour and is set to disturb markets into the close for the week. This could well be the straw that broke the camel's back:

S&P 500 falls into the red on Thursday.

Running with the same notion, that we are looking to the past for clues about the future, it is compelling knowing that each major final crash's year has always ended with a '9'...The crash pertaing to a virus that commenced in 2019 for which markets, yet again, could not hold around the 61.8% Fibonacci in 2020 would be another one for the history books.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.