Global COVID-19 update: Global cases surpass 5 million, financial markets taking it in their stride

- Global coronavirus cases have surpassed 5 million.

- At more than 5 million cases, the virus has infected more people in under six months than the annual total of severe flu cases.

- The question now is whether the financial markets can continue to recover, or the next phase is a prolonged market meltdown?

Reuters has reported that global coronavirus cases have surpassed 5 million and that Latin America is overtaking the United States and Europe, reporting the largest portion of new daily cases globally.

Key notes

It represents a new phase in the virus’ spread, which initially peaked in China in February before large-scale outbreaks followed in Europe and the United States.

Latin America accounted for around a third of the 91,000 cases reported earlier this week. Europe and the United States each accounted for just over 20%.

A large number of those new cases came from Brazil, which recently surpassed Germany, France and the United Kingdom to become the third-largest outbreak in the world, behind the United States and Russia.

Cases in Brazil are now rising at a daily pace second only to the United States.

The first 41 cases of coronavirus were confirmed in Wuhan, China, on Jan. 10 and it took the world until April 1 to reach its first million cases. Since then, about 1 million new cases are reported every two weeks, according to a Reuters tally.

At more than 5 million cases, the virus has infected more people in under six months than the annual total of severe flu cases, which the World Health Organization estimates is around 3 million to 5 million globally.

The pandemic has claimed over 326,000 lives, though the true number is thought to be higher as testing is still limited and many countries do not include fatalities outside of hospitals.

Over half of the total fatalities have been recorded in Europe.

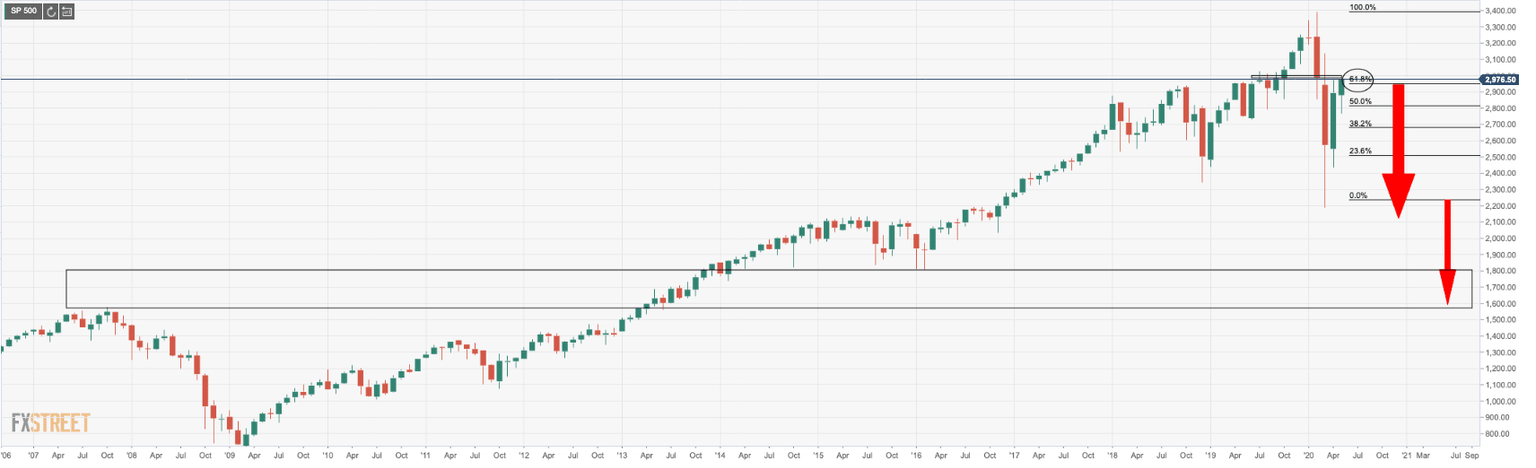

Meanwhile, markets have been getting behind governments around the world encouraging relaxations of social distancing measures and getting their populations and businesses back to work. We have seen 61.8% Fibonacci retracements in the US benchmarks which are a massive milestone when comparing to prior financial market crashes. Historically, minor corrections take place ahead of the real market crash. The question now is whether the financial markets can continue to recover, or if this was a typical 'hope' fuelled correction before the real pain and prolonged market meltdown?

The world faces a prolonged health crisis

While there is no way to tell exactly what the economic damage from the global COVID-19 novel coronavirus pandemic will be, it has been assumed that the combination of the virus, trade wars, an oil markets price war and an inflated economic bubble fuelled by quantitative easing and low-interest rates, (aka the Fed-put), can only lead to one thing.

Early estimates predicted that, should the virus become a global pandemic, most major economies will lose at least 2.4 per cent of the value their gross domestic product (GDP) over 2020. This equates to around a global growth rate of 3% falling to about 2.4%. However, these estimates were made prior to the pandemic and the subsequent implications of widespread restrictions on social contact to stop the spread of the virus. The result of which has essentially put a wrench in the cogs of the global financial system and has jammed the clockworks of the worldwide economy. Consequently, the coronavirus is tallying up to an estimated cost of up to $8.8tn. During this crisis, we have also seen the Dow Jones report its largest-ever single-day fall of almost 3,000 points on March 16, 2020 – surpassing its previous record of 2,300 points that was set only four days earlier.

Not only does the world face a prolonged health crisis, but without there being an ounce of demand left in the global economy, it is that dynamic that has economists contemplating whether the COVID-19 pandemic could lead to a global recession on the scale of the Great Depression. To combat such a scenario, many governments are increasing their provision of monetary welfare to citizens. There are also schemes to ensure that businesses have access to the funds needed to keep their staff employed throughout the pandemic. But the reality is, no matter how much mud you throw at the wall, it is not going to stick while there is no vaccine, cure, or both.

In addition to the dangers to public health and the welfare of populations, the resulting lockdowns and shutdowns could have long-lasting effects on people and societies, ultimately destroying life as we know it and the prospect of an economic recovery. Business owners will be reluctant to take on staff for fear of a second or third wave and people will be fearful of attempting to go back to work. A vaccine is a long way off and even when one has been discovered and approved, it will take a long time to filter through to the world's population. There is a geopolitical uncertainty to that as well – a bridge to be crossed when we get there and it will be an additional risk for markets to have to consider, sooner or later. Who will be entitled to the vaccine first? Latin America could be the worst affected victim but one of the last in line on the waiting list for a vaccine, if indeed, the world's wealthiest nations are prioritized.

On a very basic level, high structural unemployment is unavoidable and with that, consumer confidence and the speed of economic recovery will undoubtedly prevent any sort of a fast economic recovery. There were deep-rooted structural problems for the world economy before the virus, such as demographics, which will now have been exposed sooner. In any way shape or form that the world starts to recover from the lockdown, it is also likely to reveal a wider gap between the have's and have-nots, as well as the wealth gap between young and old. The scale of the ramifications of what has just happened to the world will pose significant educational and employment challenges that risk a second lost generation.

The next wave

As governments tempt the fate of the second wave of COVID-19, through no choice of their own, the odds of such an outcome are seemingly high when considering there are already new cases in China, Russia and even South Korea which had been praised for its containment of the first wave. As written in a prior update from Wednesday's US session, "as traders, we are inherently looking to the past for clues about what could occur in the future."

The influenza pandemic of 1918 (the Spanish Flu) had three major waves, starting in March 1918, its peak came during a second wave late that same year. The second wave was a stronger mutation than the first version of the virus and the U.S. Centers for Disease Control and Prevention (CDC) has said the second wave was responsible for the majority of the deaths in the US — the flu's likely country of origin. It is also worth noting that a third wave came in early 1919 and lasted until mid-year when, according to the CDC, the Spanish flu subsided.

Either the markets are complacent, or the next financial market's wipe-out is a foregone conclusion and it is only a matter of time until the tidal wave of COVID-19 hits our trading screens. We keep our eyes on the 5-year US Treasury yields and the 61.8% Fibonacci retracements in the US benchmarks. With yields bobbing along with the lows, the closer to zero they get the more likely a financial depression will be the outcome. With equity markets travelling on fumes, the 61.8% is the golden ratio where we would expect the top of the correction to solidify – if not, the 78.6% could be the bear's last defence.

S&P500 Index (Bears looking to 2008 GFC levels)

Now, for the purpose of balanced analysis, we should also consider an alternative viewpoint, but it is hard to move away from the question, 'had there not been a black swan event, how long would it have taken before the bubble would have popped?" Nonetheless, an obvious positive will be progress towards a vaccine. Inevitably, one will be found – eventually.

So long as there is hope, investors will buy into it. It could be argued that there is going to be pent up demand, enough at least to support the world economy from complete collapse and sufficiently to prevent some of the more apocalyptic predictions coming to fruition. In a worst-case scenario, perhaps some kind of a debt jubilee wouldn't be so bad – although there will be plenty of pain along the way, and someone/thing will have to foot the bill at some point in one form or another.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.