Could work from home boost potential US output growth?

Executive Summary

The measures taken to combat the spread of COVID over the past year have had wide implications for the U.S. economy. One of the most notable effects has been the swift shift for millions of employees to working from home (WFH). With a large share of the workforce having successfully navigated their professional work from company offices to kitchen tables, the big question is how much WFH will last in the post-pandemic world? Furthermore, what are some of the potential implications of a more permanent shift in the work environment?

In this report, we examine WFH and its ability to have a meaningful effect on U.S. productivity growth and thereby potential U.S. output growth more generally. Using our earlier work projecting a rebound in the labor force participation rate post-COVID, we estimate that WFH would only need to raise total factor productivity growth by 0.3 points per year beyond what the Congressional Budget Office currently projects to raise potential growth back to its 2002-2007 pace. That might not seem like much of a lift. However, the ability of individuals to work from home without losing productivity varies widely by industry. Accounting for the range in industry capability and composition of the U.S. workforce, we estimate that the fraction of employees working from home would need to raise total factor productivity growth by a steeper 0.9% per annum, which is probably is not achievable. Consequently, it will likely take more than just WFH to raise potential GDP growth in the coming years back to the rate of nearly 3% per annum that prevailed immediately prior to the financial crisis.

Possible Effects of Work from Home

Millions of individuals have begun working from home since the onset of the pandemic nearly a year ago. The Bureau of Labor Statistics estimates that 24% of employed persons teleworked specifically because of the pandemic in December.1 Only 8% of employees worked exclusively from home at least one day per week prior to the pandemic, and just 2% of employees worked from home five days a week.2 As analysts contemplate the post-pandemic world in the context of this surge in WFH, one of the questions they have been asking is how permanent WFH will become? Some individuals seem to prefer their new WFH environment, with studies finding that many office workers want some option for remote work post-COVID.3 Furthermore, many employers may be able to economize on office space if WFH remains a significant feature of the post-COVID work environment. So, there are reasons to believe that WFH could be with us on a more permanent basis. If so, could it have a meaningful effect on productivity and, thereby, on potential economic growth?

This report leverages analysis that we have undertaken in the past year. We wrote about the effects that WFH could potentially have on labor productivity in a report published last July. One of the studies that we referenced in that report suggested that WFH could boost productivity, subject to some important caveats.4 More recently, we published a report projecting the labor force participation rate (LFPR) over the next few years, which factored in the potential for WFH to boost participation. In this report, we use these projections and recent analysis by the McKinsey Global Institute as well as the Congressional Budget Office's (CBO) 10-year economic forecasts to analyze the ability of WFH to have a meaningful effect on productivity growth, and thereby the potential growth rate of the U.S. economy.

Potential Output Growth Has Downshifted

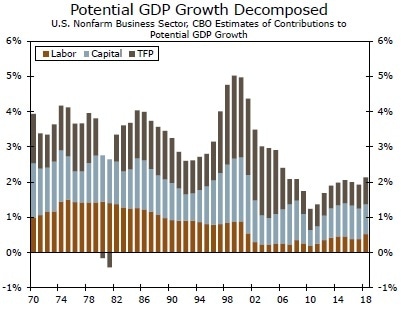

As shown in Figure 1, the CBO estimates that the potential economic growth rate of the U.S. nonfarm business sector has fluctuated over the past few decades and has generally followed a downward trend over that period.5 The rate of potential GDP growth in the nonfarm business sector averaged 2.8% per annum during the expansion that spanned 2002 through 2007, but it downshifted to only 1.9% during the long economic upswing that ended with the onset of the pandemic last year.

There are three main components of potential GDP growth: growth in labor, growth in capital and growth in total factor productivity (TFP). In simple terms, TFP measures the output gains that arise from factors such as technological change, superior methods to use capital and labor, harder work effort, greater human capital, etc. Labor input has decelerated markedly in the past two decades as the entrance of baby boomers and women in greater numbers, which boosted growth in labor supply in earlier years, ran its course (Figure 2). This deceleration in the labor force growth is one of the factors that has weighed on potential output growth in recent years. But growth in capital and TFP have also slipped into lower gears, weighing on potential GDP growth as well.

Can Work from Home Lift Potential Output?

What is the outlook for potential GDP growth in the U.S. economy in coming years? Table 1 presents two different scenarios. Scenario I is based on the 10-year forecasts of the CBO. Although the CBO looks for TFP growth to pick up a bit from the 0.7% per annum rate that it averaged during the most recent expansion, continued deceleration in the labor force will exert some headwinds on potential GDP growth in the nonfarm business sector in coming years. Specifically, the CBO forecasts that potential GDP growth will average roughly 2.0% per annum over the rest of the decade.

Scenario II is based on the projections of the LFPR that we highlighted in our recent report. The CBO forecasts that the LFPR in the nonfarm business sector will decline 2020 to 60.7% in 2030 from 61.8% in 2020, thereby weighing on the growth rate of labor supply. Using some reasonable assumptions in the LFPR report we referenced earlier, we forecast that the LFPR could trend up to more than 63% by the end of the decade. This stronger rate of labor force participation translates into a stronger rate of potential GDP growth. Indeed, potential GDP growth could strengthen to 2.5% per annum in coming years if the LFPR rises as we project in Scenario II.

As noted previously, the rate of potential GDP growth in the nonfarm business sector averaged 2.8% per annum during the expansion that spanned 2002 through 2007. To return to that rate of potential GDP growth, TFP would need to grow only 0.3 percentage points more per annum (assuming that growth in the labor and capital inputs remain unchanged relative to the rates shown in Scenario II). If WFH makes working individuals more productive, a 0.3 percentage point increase in TFP growth per annum does not seem to be unreasonable. WFH could conceivably return the economy's potential growth to the solid rates it registered immediately prior to the financial crisis.

However, not all individuals are able to work from home, let alone work as effectively in a WFH environment as they would in person. The capability to work from home varies significantly by industry, as some jobs require sharing specialized machinery, moving physical items from one place to another or interacting in-person.

To estimate the share of the U.S. workforce that could plausibly work from home without a loss of productivity, we use an analysis from the McKinsey Global Institute.6 The study finds that the share of work that can be done remotely without losing any efficacy ranges widely across 16 major industries that we consider in our analysis. At the low end, McKinsey estimates that only 8% of work in the accommodation & food services industry can be done remotely, while at the upper end 76% of work finance & insurance industry could be performed at home without denting productivity.

Accounting for each industry's scope to work from home and the size of those industries, we estimate that only about 30% of the U.S. workforce could work from home without a loss of productivity. This estimate implies that WFH would need to the raise the TFP of individuals who can work from home by roughly 0.9% per annum to drive economy-wide TFP up to a 1.4% pace and facilitate potential GDP growth climbing back to 2.8%. According to CBO estimates, TFP rose at an average rate of 1.4% per annum between 1950 and 2019. With this long-run average in mind, we do not think it is plausible to expect that individuals who have the ability to work from home would be able to realize a 0.9 percentage point per annum increase in their TFP from WFH alone.

WFH Only One Possible Way to Lift Productivity Growth

We took only a narrow view of the pandemic's effect on potential GDP growth in this report. That is, we focused narrowly on how WFH could increase TFP growth and, thereby, long-run GDP growth. But, the long-run response from businesses to the pandemic could potentially be more extensive than simply WFH. For example, businesses could invest more heavily in digital capabilities. Not only could TFP growth be bolstered by more extensive use of digital capabilities, but higher investment in equipment would lead to capital deepening, which would also strengthen potential GDP growth, everything else equal.

Another way the pandemic may ultimately strengthen TFP growth is by sparking more dynamism in the economy. Although many businesses have closed permanently, new business formation has surged (Figure 4). The flurry of entrepreneurship increases the chances of TFP rising from novel products and processes in coming years. And beyond productivity growth, another way to boost potential GDP growth would be to increase the labor supply not only through higher participation rates as we discussed in our prior report, but stronger population growth. Faster growth in the working-age population over the current decade could be achieved through higher immigration, which has slowed in recent years (Figure 5).

We are still in the early stages of determining how the pandemic may change the course of economic growth over the medium to long term. In the near term, potential GDP growth has suffered from a sharp drop in the labor force from lower labor force participation and from weaker capital spending. Looking forward, however, we suspect that a rebound in the LFPR will help to lift the potential growth rate of the U.S. economy somewhat. Furthermore, WFH could lead to some acceleration in TFP growth. That said, returning to a potential GDP growth rate in the nonfarm business sector of 2.8% per annum likely will require more than just a modest increase in the LFPR and the marginal TFP-enhancing effect of WFH.

Author

Wells Fargo Research Team

Wells Fargo