Copper in Q3 – High volatility and strong liquidity makes copper attractive to traders

US Tech, Gold and Copper stocks are the 3 markets that look technically positive at the moment, while others are moving evenly to the side.

The US100 continues to trade near record highs, Gold is at its highest level in around eight years and Copper is at levels last seen in January. Strengthening the price of Tech and Copper shares in general is seen as a good indicator of global growth and shows that market sentiment remains positive despite an increase in virus cases in the US and Australia. An increase in gold prices tends to give an indication of a vulnerable economy; it could be in recession or there could be geopolitical instability.

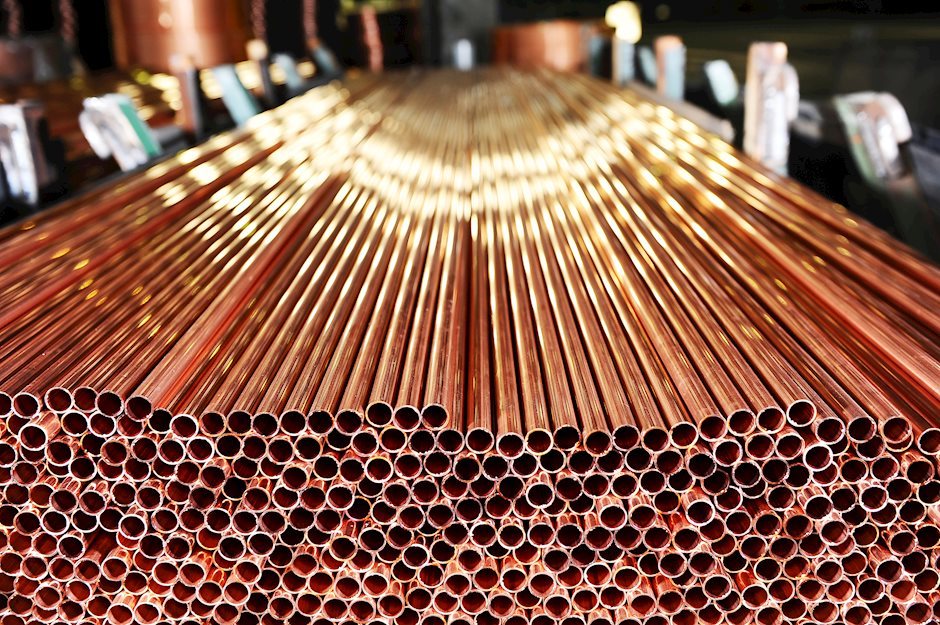

Copper

Copper prices are believed to provide a measure of economic health, because changes in copper prices can suggest global growth or an upcoming recession. With high volatility and strong liquidity, copper is attractive to traders. Spot copper prices are influenced by extraction and transportation costs, as well as supply and demand.

Spot copper prices recorded a V-shaped recovery from 1.97 to 2.7 during Q2, up by 41.79%. Market sentiment became positive when the economic openings began in May and June. The RBA statement slightly shook the copper movement this week. Currently the price is moving under $2.8 per pound. However, a rally to the 2.88 resistance is still possible. Technically the price will likely test the internal trendline and descending trendline at the price of 2.8.

Meanwhile, the London Metal Exchange copper contract has approached prices not seen since pre-pandemic trading, as investors continue to pay attention to broader market phenomena in addition to fundamentals, with the Chinese equity market having its best daily performance in five years.

Bulls have dominated copper trading in recent weeks, with price charts showing a solid V-shaped recovery. Studies showed a strong correlation between copper prices and world trade, regional GDP growth in China, the US and EU, as well as oil and gold prices. As copper is often referred to as a determinant of the direction of the world's fiscal position, much optimism came from various global fiscal packages aimed at sustaining countries that were hit by the coronavirus pandemic. Many investors are positioning for recovery, adding that another reason behind copper continuing to move higher is signs that London Metal Exchange inventory data continues to show outflows. LME data shows global copper stockpiles have fallen 8,525 tonnes to a total of 197,850 tonnes.