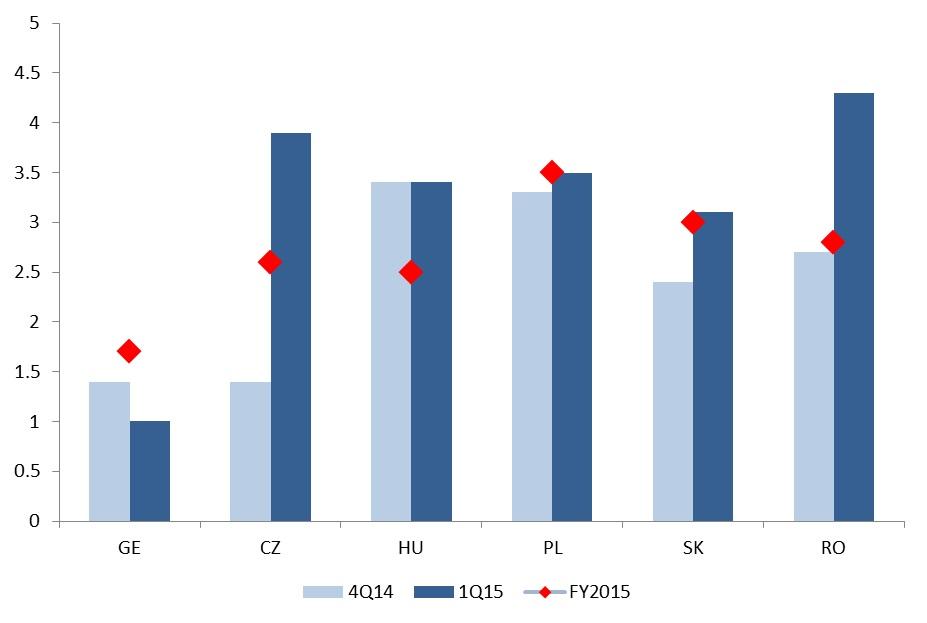

Chart of the Day:

Analysts’ View:

CEE GDP releases surprised to upside in 1Q15. Even though we have had upbeat expectations for CEE, last week’s outcomes in all of the above countries surprised us to the upside. The strongest surprise definitely came from the Czech Republic, where the economy recorded an incredible 2.8% q/q expansion (3.9% y/y). Although considerable revisions are often carried out by the Czech Statistical Office, it seems that the Czech economy finally caught up with many CEE countries in terms of yearly growth. Romania delivered the strongest y/y expansion (4.3%) from the above pool, while Slovakia also delivered a notable upside surprise (3.1%), which made us revise our GDP forecast for this year to 3%, from the previous 2.5%. On top of all of this good news, we also saw upside surprises in Poland and Hungary as well. The strongest driver of growth is increasingly domestic demand (mostly household consumption), but given that lower oil prices not only made more room for consumption, but also slashed import prices as well, net exports could also have performed well. Current PMI readings suggest a somewhat milder 2Q15, while the recent increase of oil prices also signal that one of the most important contributors to the stellar 1Q15 performance is now contributing less. Against the backdrop of 1Q15 GDP releases, we now see considerable risks that growth will reach or even exceed 3% this year in the CEE region* (including Croatia and Serbia, where there are still challenges to a better economic performance).

Looking Ahead in CEE This Week: Each day this week has something to offer with regards to macro releases, albeit much less than last week, when we were pleased to see many upside surprises in 1Q15 GDP. The focus is shifting more to the second and third quarters of this year; obviously, after such positive outcomes for the beginning of the year, we think that growth could slow down at least a little bit in 2-3Q. Poland will be under the spotlight this week, with many monthly releases already from 2Q15 (April), which should shed more light on developments in the real economy.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.