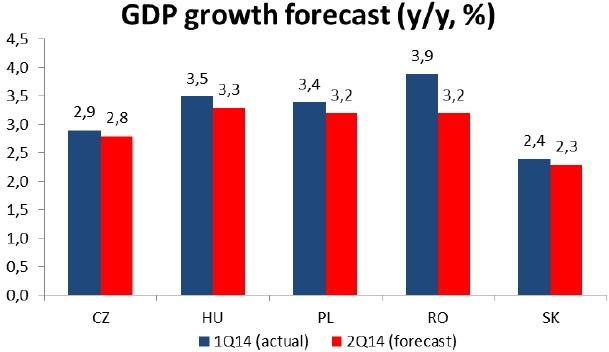

Chart of the Day:

Slower growth in 2Q - Today morning, flash estimates of 2Q GDP will be published for CZ, HU, PL, RO and SK. We expect a deceleration of the annual growth rates in a range of 0.1pp (Czech Republic) and 0.7pp (Romania), but growth should remain above or close to 3% in most CEE countries. Any disappointment in growth will fuel discussions about monetary easing, especially in countries which still have the potential to cut rates (Poland and Romania).

Analysts’ Views:

PL Macro: The inflation rate was in line with market expectations at -0.2% y/y in July. The negative print supports expectations for a rate cut, which in our view has slowly become unavoidable especially if, as we expect, we see economic growth in 2Q14 slowing to 3.2% y/y followed by a further slowdown in 3Q14. Thus, all conditions required by the MPC to cut the key rate would materialize. Such a scenario supports a low level of yields and we curently see 10Y POLGBs at 3.4% at the end of 3Q14.

Traders’ comments:

CEE Fixed Income: Poland’s central bank needs to keep in mind the risk of tensions in Ukraine weakening the zloty as it considers easing policy after consumer prices fell, said rate setter Andrzej Kazmierczak according to Bloomberg. “Heightened uncertainty on Ukraine has increased risk on emerging-market debt and could trigger capital outflow,” Kazmierczak added. “This should prompt extreme caution when considering the possibility of interest-rate cuts.” As has become typical within the NBP Elzbieta Chojna- Duch, another of the rate panel’s 10 members, said around the same time that it’s “high time” for the central bank to consider easing policy as the Russian ban on food exports is set to extend the period of negative inflation”. We know the NBP had forecast the price drop and also said a temporary slump wouldn’t warrant a rate cut so today’s GDP data will likely be all the more important. However, here too Kazmierczak remains adamant “Negative inflation was expected and economic slowdown is a fact. Now we need to wait for third-quarter data to determine if it will be prolonged. In my view, the zloty’s exchange rate requires us to maintain interest-rate disparity versus the euro area.” The PLN strengthened but POLGB yields fell in yesterday’s trading session which indicates that investors were more focussed on global sentiment and a general bounce in risk sentiment following the recent sell-off in risky assets but with 10y German Bund yields heading for record lows and Polish FRAs pricing in a rate cut it looks as broader markets are siding with the deflationist camp. In the corporate space, S&P followed through with its intention to cut the ratings on Austria’s largest banks citing a new Austrian law which “indicates reduced predictability of extraordinary government support for systemically important banks”. This was widely expected and developments in Ukraine and Hungary will drive price movements so it’s probably worth mentioning that Hungarian GDP growth is expected to be strong which would boost the HUF in the absence of further escalation in Ukraine.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.