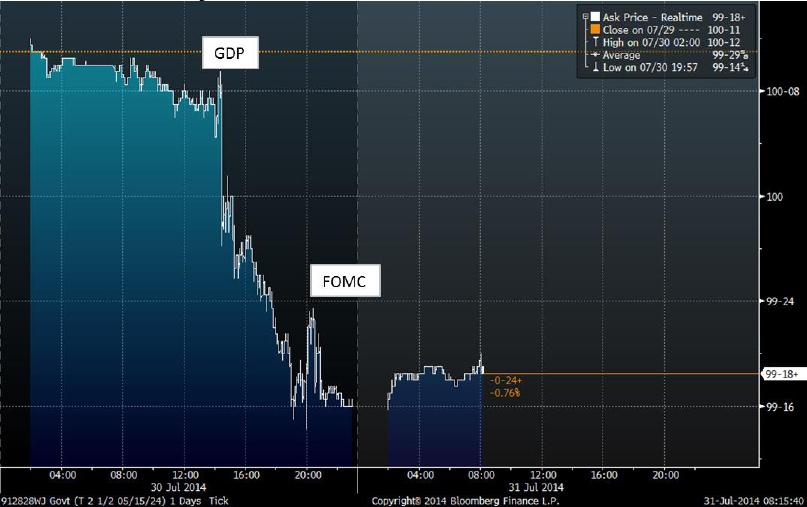

Chart of the Day:

US T-Bonds: Dovish comments from the Fed failed to calm bond investors nerves following a surprisingly strong GDP number.

Analysts’ Views:

CZ Rates: After today's CNB meeting, the bank board is expected to leave both the key interest rate (2W repo rate at 0.05%) and FX intervention target unchanged (EURCZK above, but close to 27). However, as the new macroeconomic projection is scheduled to be released after the meeting, the lower than previously anticipated CPI growth in 2015 (2.2% according to the current forecast) may force the CNB to further postpone the withdrawal from the FX intervention regime from next year's second quarter deeper into 2015, or even into 2016. In spite of CPI nestling down close to zero since the beginning of 2014 (0.0% in June), we see the probability that the CNB will proceed with an increase of the current FX intervention floor as fairly low (due to the rather positive outlook for CPI growth in the coming months, driven by rising core inflation - reflecting a continuing improvement in domestic demand). Therefore, we expect to see EURCZK remain at 27.50 at least until the end of 2Q15.

PL Macro: Russia announced another embargo on Polish products. This time, the importation of fruit and vegetables will be banned, starting from August 1, and Polish producers may have trouble redirecting the exports to other countries. However, we do not expect the embargo to have a major negative impact on our growth forecast of 3.1%. The inflation rate actually seems to be more endangered, as the embargo may only strengthen the downward pressure. In particular, food price developments have already surprised on the downside. That should further strengthen expectations of a rate cut and low level of yields (we currently see the 10Y yield at 3.4% at the end of 3Q14).

Traders’ Comments:

CEE Fixed Income: Argentina defaulted yesterday. BES announced a loss of EUR 3.58 bn in the first half of 2014 which basically reduced common equity Tier 1 ratio to 2 ppts below the regulatory minimum. BNP Paribas posted a record net loss of EUR 4.32 bn after being fined USD 8.97 bn by US prosecutors. Include the market perception of an increasing likelihood of a rate hike in the US and one could conclude things aren’t looking too rosy for fixed income investors. Not so if you’re a Caa1/CCC+ rated issuer of PIK toggle notes. Play Topco, the polish wireless telecom services company, raised EUR 415 m in 5.5NC1.5 notes at a cash yield of 7.959%. Overall, it was a day of profittaking in CEE fixed income with long dated HGBs looking particularly vulnerable to a shift toward “risk-off” sentiment.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.