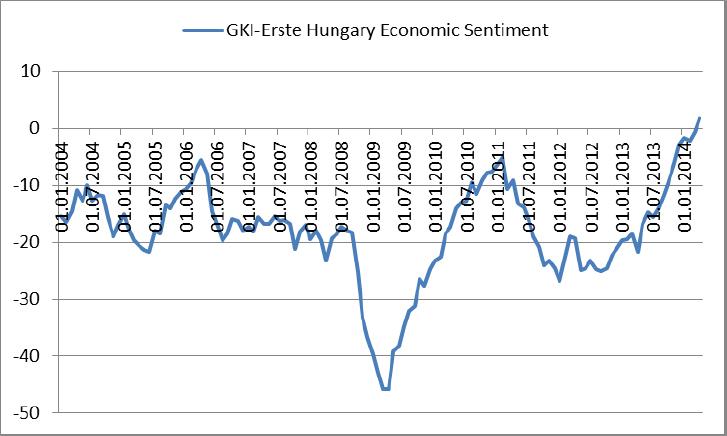

Chart of the Day:

Hungarian Economic Sentiment: The GKI-Erste index turned positive for the first time in 16 years last month. The index displays a balance of positive and negative answers to questions about the outlook for the economy.

Analysts’ Views:

HU Rates: The Debt Management Agency managed to sell HUF 80 bn in 3M T-bills yesterday, 20 bn more than planned, amid an investor demand of HUF 142 bn. The average yield came in at 2.65%, while accepted yields ranged between 2.60-2.66%. Despite the negative news flow with regard to the Russian-Ukrainian conflict, Hungarian markets remained calm. This is also visible by looking at exchange rate movements as the forint appreciated too (in parallel with the Turkish lira and the South African rand). The forint was, therefore, a positive outlier yesterday, after lagging behind regional peers on Easter Monday. The robust current account position, the goverment's commitment to keep the budget deficit in check and risks of further ECB action should allow another 10 bp reduction of the policy rate next week in Hungary, to 2.5%. Nonetheless, for the time being, we expect the rate cutting cycle to halt at this level, as inflation is expected to increase slowly in the remainder of this year from the current, record-low levels. We continue to see the EURHUF at 302-303 by year-end.

Traders’ Comments:

CEE Fixed Income: Economic sentiment rose to the highest level since 1998 in Hungary last month and consumer confidence increased to a rate last seen in 2006. The positive sentiment was also broadly based with optimistic companies outnumbering pessimists in all areas except construction. Lest we get too carried away by this, Asian equities opened higher in the wake of another buoyant session in the US, but pared gains after the latest sign of a continuation of the slowdown in China as HSBC’s preliminary PMI rose only slightly to 48.3, signalling that activity contracted for a fourth consecutive month in April. CEE fixed income has been slow to come out of the blocks after the Easter break but yields are drifting lower in the absence of any major catalyst, indicating that investor sentiment is also generally positive but is more likely driven by the prospect of low rates for longer, or even QE in the Eurozone, rather than optimistic growth prospects.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.