Briefly: no speculative positions.

News broke that the Winklevoss brothers, twins who battled Facebook founder Mark Zuckerberg in court, are out there to create a fully-regulated Bitcoin exchange. As a matter of fact, they’re already working on it and their team seems to have made some progress, we read in a DealBook article:

Now two of the biggest boosters of the virtual currency, Cameron and Tyler Winklevoss, are trying to firm up support by creating the first regulated Bitcoin exchange for American customers — what they are calling the Nasdaq of Bitcoin.

(…)

The brothers, who received $65 million in Facebook shares and cash in 2008 after jousting with its founder, Mark Zuckerberg, have hired engineers from top hedge funds, enlisted a bank and engaged regulators with the aim of opening their exchange — named Gemini, Latin for twins — in the coming months.

(…)

[The exchange staff has] been creating Gemini’s security infrastructure and trading engine from scratch, and already have a test model of the exchange running. They are planning to be ready to open the exchange as soon as they win regulatory approval from New York state’s top financial regulator, Benjamin M. Lawsky, the superintendent of the state’s Department of Financial Services.

This is definitely good news for U.S. customers since a regulated exchange could possibly alleviate some of the concerns over the security, particularly in light of the Mt. Gox debacle and the BitStamp problems. Ultimately, this will be a question of whether the Gemini team will be able to come up with reliable security measures.

The next months will show if the exchange actually will start operating as quickly. The advent of another marketplace, particularly one regulated by U.S. authorities could also popularize the cryptocurrency in the country. We’ll also see if it might have any effect on the level of transaction fees currently observed on Bitcoin exchanges.

For now, let’s take a look at the charts.

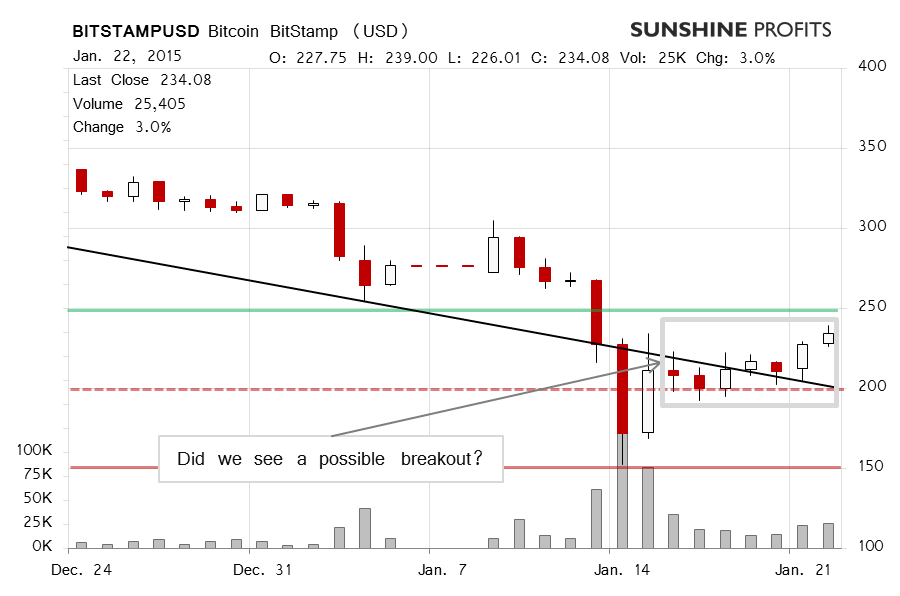

On BitStamp, we saw yet another day of appreciation yesterday. This was on increased volume but not by very much compared with the day before. It was also another day with a daily close above a recent possible declining trend line (marked in black in the above chart). Yesterday, we wrote:

First of all, Bitcoin moved just under 8% higher yesterday, a visible move but not necessarily one that would make anybody raise their brow, given the kind of volatility Bitcoin has consistently managed to display.

Secondly, this was a third day with a close above the possible declining trend line, which combined with an increase in volume is more of a bullish development. But if we look at the actual volume level yesterday, it was not very high by Bitcoin standards.

On the other hand, none of the moves up were strong enough to propel the cryptocurrency above $250 (solid green line in the chart). Today (this is written before 11:00 a.m. ET), we’ve seen more appreciation but it hasn’t really reached this level. Taking the recent developments into account, we would be inclined to think that Bitcoin is still in a downtrend, that the short-term outlook has improved and a move to $250 might follow but this hasn’t really been strong enough to suggest any significant change.

Yesterday, not much actually changed after our alert was published. Today, we’ve seen some depreciation but it hasn’t been strong (this is written around 11:00 a.m. ET). Perhaps more importantly, the volume has been lower than yesterday. One way to read that would be that we’re seeing a pause within a move up. But we haven’t actually seen Bitcoin above, or even close to $250. The situation, in our opinion, remains largely unchanged.

On the long-term BTC-e chart, Bitcoin just touched one of the possible trend lines. Is this an important sign? It might become one but we would have to see Bitcoin move above this level and possibly in the direction of $250 (solid green line). The lack of strong move suggests that the steam might be out of the market. Since the trend seems to be down now, it is possible that following the current period of appreciation Bitcoin will resume its move down.

$250 is, in our opinion, the all-important level to observe now. We think that Bitcoin might stagnate now or still move further up but these moves would be followed by more depreciation. At present, we’re still more inclined to view the current situation as bearish but not bearish enough to open speculative positions.

Summing up, in our opinion no speculative positions should be held at this time.

Trading position (short-term, our opinion): no positions.

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.